Hear from the Chair of our board

Download the Candidate Pack

Our candidate pack is available for download in PDF format, allowing for easy access and review at your convenience.

Introduction

Dear Applicant,

I am delighted that you are interested in finding out more about the position for Chief Executive Officer for Revenue Scotland.

This is an exciting time for Revenue Scotland as we celebrate 10 years of tax collection and continue to implement new tax powers. We will be adding the Scottish Aggregates Tax (SAT) and Scottish Building Safety Levy (SBSL) to the suite of devolved taxes that we administer. Revenue Scotland is seeking an experienced, inspiring, people-focused leader to be its next Chief Executive, with the drive and ambition to lead the organisation through its next exciting period of consolidation and development.

This role is at the forefront of digital-led tax administration and collection, and is well positioned to contribute to the evolving Scottish tax system. Revenue Scotland prides itself in its operational expertise and collaboration with key partners in Scotland.

I welcome applications from those both internal and external to the Civil Service. If you believe you have the relevant skills, experience and passion and are excited about this opportunity, I look forward to hearing from you.

Aidan O'Carroll

Chair, Revenue Scotland Board

Who we are?

Revenue Scotland is Scotland’s tax authority, established under the Revenue Scotland and Tax Powers Act 2014.

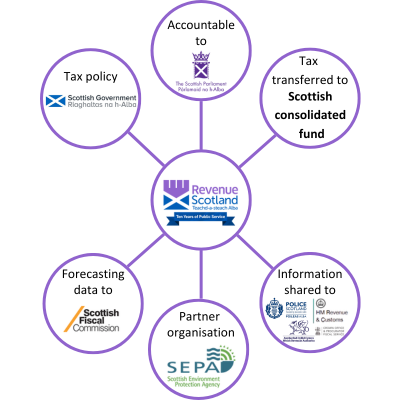

Revenue Scotland was established as a non-ministerial Office on 1 January 2015 and is accountable to the Scottish Parliament for our performance. Our staff are civil servants, and we sit within the Scottish Administration but remain separate from the Scottish Government. We work in partnership with the Scottish Government on matters of tax policy, and as a public body and employer.

Since 2015, Revenue Scotland has developed to being a highly effective digital organisation, with outstanding operational performance and a reputation for being a great employer. Since we began, we have been responsible for collecting £8 billion from devolved taxes, all of which stays in Scotland to help fund vital public services.

We are efficient, keeping costs low because of our use of technology and have a highly engaged workforce, with nine professions working in a collaborative way to deliver public services to the highest standards.

We are a highly professional organisation, with a strong reputation for the transparent way in which we undertake our work and utilise our powers. In addition to processing over 120,000 tax returns a year, we are undertaking increasingly complex investigatory work in order to ensure revenues are protected.

We are leading the way in data sharing pilots with other parts of the public sector to support our work. In the case of Scottish Landfill Tax, this includes multi agency working to tackle waste crime.

The data we publish on tax revenues carries official statistics status and is relied upon by the Scottish Fiscal Commission and Scottish Government for forecasting tax revenues for the budget each year.

You can find out more about the organisation in our Corporate Plan, Annual Report and Accounts and on the Revenue Scotland website.

Our Purpose, Vision and our Structure

Our purpose

To efficiently and effectively collect and manage the devolved taxes which fund public services for the benefit of the people of Scotland.

Our vision

To be:

- an exemplar in providing an excellent service to our taxpayers

- trusted by our partners to deliver innovative digital revenue services and support the development of policy

- a progressive public body

- an employer of choice

Our Structure

Why Revenue Scotland?

We are an organisation with an inclusive culture and highly motivated teams.

Revenue Scotland is ranked 15th highest across the civil service for its employee engagement score and within the top seven highest for all the other themes.

- Second highest for learning and development and inclusion and fair treatment in the Civil Service People Survey 2024

- £855 million total tax revenue

- 76% user satisfaction with our service

- £35.3 million secured through compliance activity

What our staff say

“Revenue Scotland is the most motivational and inspiring organisation that I have worked for in my 34 years as a civil servant - best career move ever!”

“There is a great welcome and feel to Revenue Scotland, when joining I soon felt like part of one big team. The inclusive and people focused culture is evident as being part of our core values.”

We are an organisation that places equality, diversity and inclusion at its heart.

We seek to create a culture where we truly celebrate our diversity, embrace our inclusivity, and achieve better equality for everyone. Our Equality Mainstreaming Revenue Report for 2024-2028 Our mainstreaming outcomes for 2024-2028, aligned with our Corporate Plan for 2024-2027, will serve as a guide and goal for us over the next four years and will ensure that Revenue Scotland continues to work hard to ensure that we meet the needs of all the people we serve.

“Diwali is the Hindu festival of lights and symbolises the spiritual victory of light over darkness, good over evil and knowledge over ignorance. I wished to introduce my colleagues to this festival, using it as an opportunity to educate them about my cultural background through festivities and culinary traditions.

My faith is extremely important to me and, having been a civil servant for nearly 25 years, it wasn’t until I joined Revenue Scotland in October 2018 that I felt I could be myself and have a sense of belonging. I am proud to be working for an organisation that promotes EDI and ensures it is at the heart of everything it does bringing people from various cultures and backgrounds together."

The Role

The Chief Executive of Revenue Scotland is responsible for delivering exceptional organisational performance for the Scottish taxpayer, with a culture of continuous improvement and public service at its heart. In addition they are responsible for:

- Leading Revenue Scotland to deliver our Corporate Plan 2024-2027 priorities and our vision of being a trusted and valued partner in the delivery of revenue services informed by data, with a high performing and engaged workforce.

- Ensuring delivery of the collection and management of tax revenues in line with Scottish Fiscal Commission forecasts, circa £1 billion per annum, including taking decisions on handling cases of strategic importance (for instance those of high value or ones that could influence interpretation of tax legislation).

- Ensuring the successful implementation, administration and collection of new devolved taxes and responsibilities.

- Ensuring successful procurement, design and launch on Revenue Scotland’s tax future collection system

- Acting as an ambassador for Revenue Scotland by engaging with stakeholders across the tax system in Scotland, the UK and overseas.

- Providing leadership and strategic direction, in line with Ministerial priorities, to ensure Revenue Scotland meets its key performance indicators and operates in an efficient, effective and digitally focused manner. This includes ensuring that Revenue Scotland is high performing, with a culture of inclusivity, well-being and innovation at its heart.

- Taking a leadership role, working closely with senior leaders, Revenue Scotland’s Board and Chief Executives across the public sector to drive improvement in Scottish public services, including by setting a leading example in digital and data solutions.

- Collaborating with the Scottish Government on setting and delivering Scotland’s tax vision and strategy, including drawing on Revenue Scotland operational expertise to input into future tax design.

- Acting as Accountable Officer for the management of Revenue Scotland’s operating budget (circa £12 million in the current financial year) and devolved tax revenues of circa £1 billion per annum and ensuring that all relevant financial considerations and Scottish Government guidance, including issues of propriety, regularity, efficiency and value for money, are applied in delivering Revenue Scotland’s business.

Person Specification

Please refer to the Operational Delivery Framework for the core capabilities for SCS roles. It is essential that you can provide evidence in your application of the professional experience and skills required for this role (as set out in the five criteria below). In addition, candidates applying for roles are assessed in line with the behaviours listed below as outlined in the Success Profiles framework.

The successful candidate will be able to demonstrate the following:

- Significant senior leadership experience, demonstrating the ability to lead and manage resilient operational delivery within an organisation at the size, scale and scope of Revenue Scotland, with evidence of leading organisational change and transformation, including complex technical, analytical, and service programmes, ensuring operational resilience, and maximising the value of data.

- Strong understanding of organisational governance, risk and financial acumen and experience of managing a budget to drive efficiencies and resources effectively.

- Highly effective strategic leadership with a proven capacity for strategic foresight and horizon scanning displaying excellent judgement and demonstrating astute political sensitivity.

- Thought leadership by demonstrating ‘big picture’ knowledge, creating, and presenting a compelling vision and clear direction as well as a passion for leading people through change, role modelling positive behaviours illustrating an ability to inspire and engage inclusive, high performing teams.

- Persuasive, diplomatic and skilled at building strong internal and external stakeholder relationships at all levels, demonstrating an ability to navigate politically sensitive issues, foster collaboration, and drive consensus.

These criteria are underpinned by a number of behaviours (Level 6)

- Changing and Improving

- Managing a Quality Service

- Seeing the Bigger Picture

- Developing Self and Others

- Leadership

How to apply

Apply online, providing a CV accompanied by a Supporting Statement of no more than 1500 words which provides evidence in the form of specific examples of how you meet each of the five criteria listed in the person specification above, underpinned by the relevant behaviours.

Chief Executive of Revenue Scotland - Job Advert

If you wish to find out more information about the role, please contact Elaine Lorimer at chiefexecutive@revenue.scot

If you are shortlisted, you will be provided with full details of the next stages of the selection and assessment process.

- membership of the Civil Service Pension Scheme

- six weeks annual leave and 11.5 days public and privilege holiday allowance

- access to our Employee Assistance provider who offers 24/7 advice and support

- flexibility through hybrid working

- access to wide range of diversity networks

Visit the careers section of our website to find out more.

Recruitment process

- Vacancy live - 29 April 2025

- Information webinar - Date tbc

- Closing date - 23:59 on Tuesday 27 May 2025

- Shortlisting - 2 June 2025

- Assessments - Between 9 and 20 June 2025

- Interviews - 24 and 26 June 2025

- Final outcomes

Apply online, providing a CV and Supporting Statement (of no more than 1500 words) which provides evidence in the form of specific examples of how you meet each of the skills, experience and behaviours listed in the person specification above. If you wish to find out more information about the role, please contact Elaine Lorimer at chiefexecutive@revenue.scot

If successful, you would be expected to take up post around the beginning of November 2025 to allow time for a handover period with the current Chief Executive, Elaine Lorimer.

External candidates from outside the civil service would be subject to a nine month probation period.

Assessments

The selection process consists of the following assessments:

- Psychometric assessment

- Staff and stakeholder engagement exercises

- Presentation (tbc)

- Interview

The final interview panel will include:

Paul Gray (Chair) - Civil Service Commissioner

Paul joined the civil service in 1979 holding a number of roles including Head of the Digital Profession, Director of Technology, Director General for Rural Affairs, Environment and Services, Director General for Governance and Communities, and Chief Executive of NHS Scotland and Director General for Health and Social Care. He left the civil service in 2019 and became a Civil Service Commissioner in 2021.

Aidan O’Carroll - Chair of Revenue Scotland Board

Aidan O’Carroll has been Chair of Revenue Scotland since August 2021. Aidan is a former senior partner at EY, which he left in July 2020 after 35 years. Aidan is both a Chartered Accountant and Chartered Director, and a former Scottish Chair of Institute of Directors and Member of UK Council.

Alyson Stafford - DG Scottish Exchequer, Scottish Government

Alyson joined Scottish Government in 2005, first as Director of Finance, then becoming DG Finance in 2010, before setting up and leading the Scottish Exchequer since 2017 as Director General, responsible for the overall Scottish Budget including tax, spending and measuring performance. Alyson is countersigning officer for the Chief Executive of Revenue Scotland.

Jennifer Henderson - Chief Executive of Registers of Scotland

Jennifer is the Chief Executive Officer of Registers of Scotland and has been the Keeper of the Registers of Scotland since 2018. She is also a member of the Accounts Commission for Scotland. Jennifer joined the civil service in 1994, with roles including Deputy Director at the Ministry of Housing, Communities and Local Government and operations and transformation director at the Defence Science and Technology Laboratory.

Thank you for your interest in this position.

If you have any questions, please get in touch:

Aidan O’Carroll

Chair, Revenue Scotland Board

Elaine Lorimer

Chief Executive, Revenue Scotland

Webinars

To find out more about our information webinars relating to this post, please visit the events section of our website.