Key points

Annual statistics

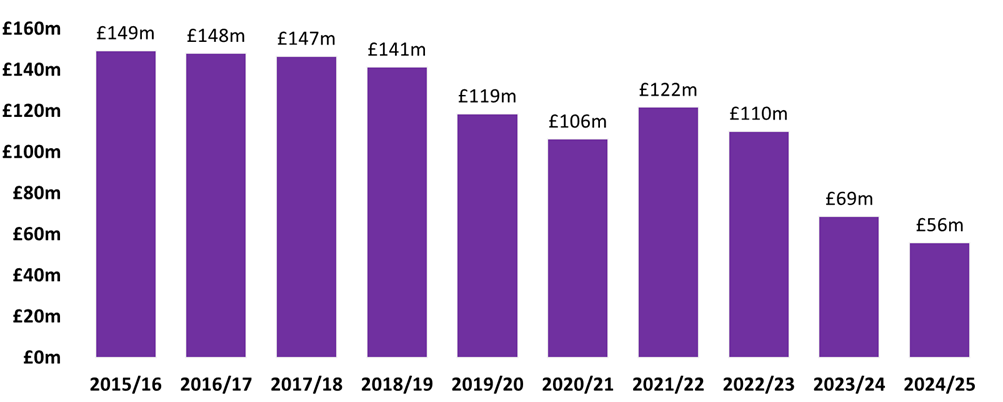

- In 2024/25 net SLfT declared due was £55.9 million, a 19% decrease on the previous year. The long-term decrease in net SLfT, excepting the increase in 2021/22, is mainly due to standard rate disposal tonnages decreasing faster than the standard rate of tax has increased.

- Standard rate disposals account for the vast majority of SLfT due, making up 97% of gross SLfT in 2024/25. The tonnages of standard and lower rate disposals were nearly equal. Standard rate disposals make up most of the SLfT due because the standard tax rate is around 31 times higher than the lower tax rate.

- In 2024/25 around half of SLfT revenue (48.1%) was Mixed municipal waste (EWC code 20 03 01), followed by 27.7% from EWC code 19 12 12 (waste “from the mechanical treatment of waste”).

Quarterly statistics

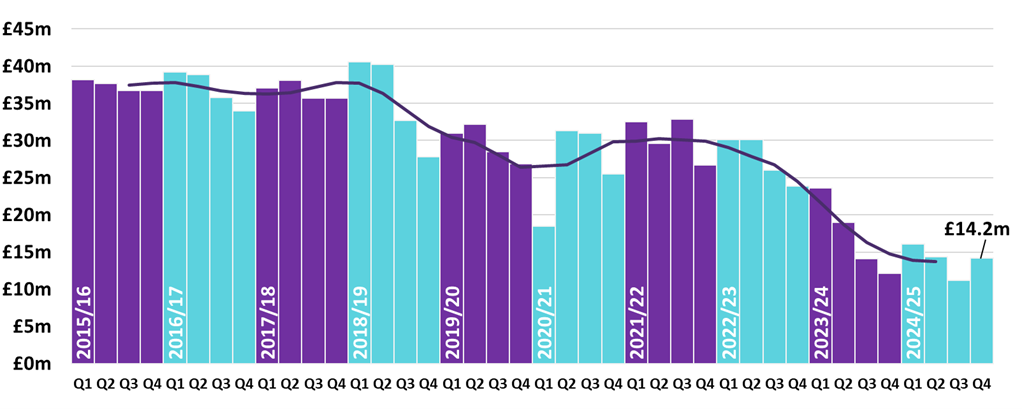

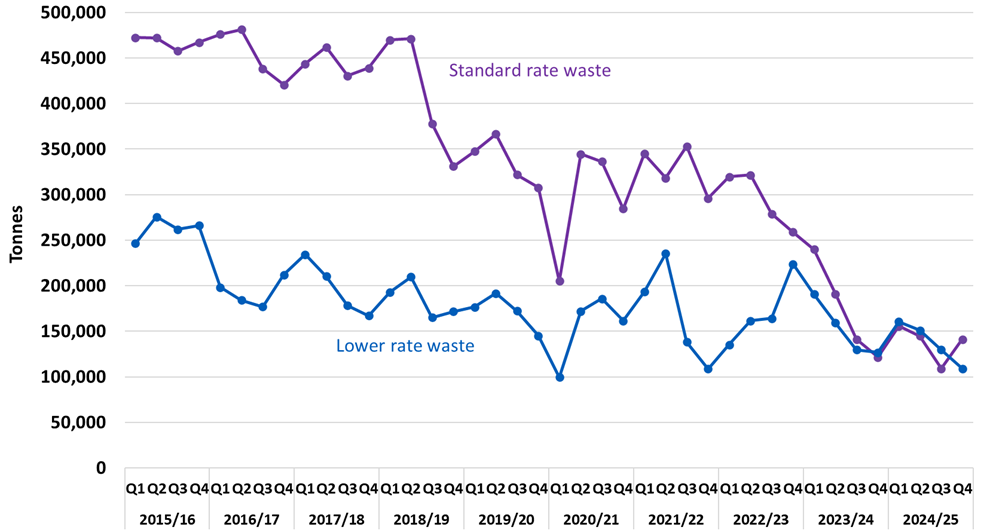

- £14.2 million in Scottish Landfill Tax (SLfT) was declared payable Q4 2024/25 (January to March 2025). Total standard rate tonnage was 141,300 and total lower rate tonnage was 109,000.

- The total SLfT declared due and standard rate waste increased in Q4 compared to Q3, which is inconsistent with the pattern seen in previous years.

- 24 operators provided returns for the latest quarter, covering 43 sites. Note that some sites may submit a nil return for some quarters as operators are liable to submit a return until they are de-registered.

Introduction

This publication is part of a quarterly series of Scottish Landfill Tax (SLfT) statistics, started in April 2015, which provides data on the total number of returns; total number of sites; total tax payable; total contributions to the Scottish Landfill Communities Fund; standard and lower rate waste tonnages, as reported to Revenue Scotland.

We have amended this publication to include annual summary information and additional breakdowns by European Waste Catalogue (EWC) code which were previously only included in our annual statistics publication.

We have published a document covering SLfT background information, including data sources, methodology, quality, revisions policy and corrections.

An official statistics publication for Scotland

These statistics are official statistics. Official statistics are statistics that are produced by crown bodies, those acting on behalf of crown bodies, or those specified in statutory orders, as defined in the Statistics and Registration Service Act 2007.

Revenue Scotland statistics are regulated by the Office for Statistics Regulation (OSR). OSR sets the standards of trustworthiness, quality and value in the code of practice for statistics that all producers of official statistics should adhere to.

Annual statistics

The following annual statistics used to be published in our Annual Summary of Trends in the Devolved Taxes. They are now being published as part of our Q4 quarterly SLfT statistics to improve timeliness of release and more detailed statistics for users. The Annual Statistics Publication will be no longer be published and is being replaced by these annual SLfT statistics and a separate new publication for annual trends in Land and Buildings Transaction Tax (LBTT).

SLfT declared and tonnages by year

SLfT was £55.9 million during 2024/25, 19% lower than the previous year (£68.7m).

Figure 1: Column chart showing SLfT declared by year from 2015/16 to 2024/25, with a decreasing trend after 2021/22.

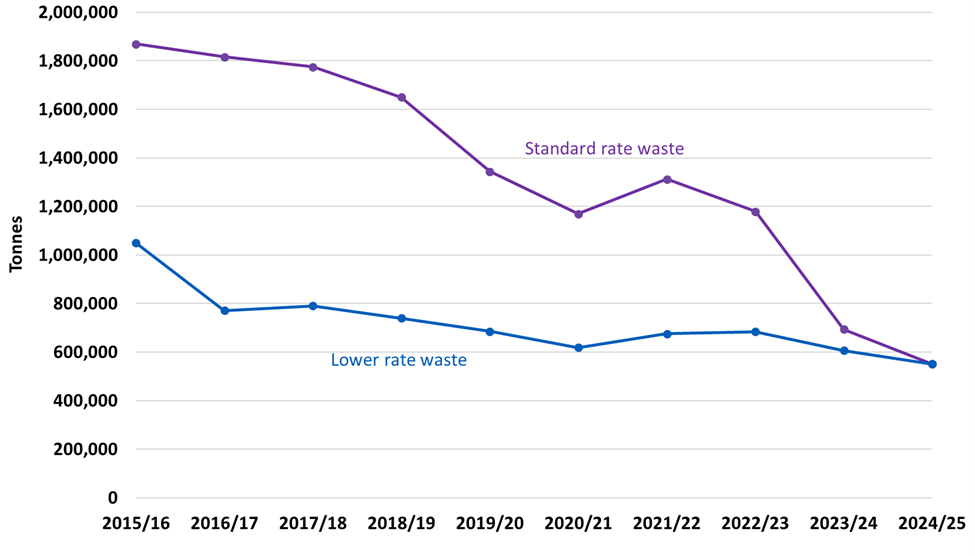

Standard and lower rate tonnage were nearly equal in 2024/25, and both were lower than last year.

Figure 2: Line chart showing standard and lower rate tonnages by quarter. Standard rate shows a decreasing trend through time.

In 2024/25 net SLfT declared due was £55.9 million, a 19% decrease on the previous year. The long-term decrease in net SLfT, with the exception of 2021/22, is mainly due to standard rate disposal tonnages decreasing faster than the standard rate of tax has increased.

Standard rate disposals account for the vast majority of SLfT due, making up 97% of gross SLfT in 2024/25. The tonnages of standard and lower rate disposals were nearly equal. Standard rate disposals make up most of the SLfT due because the standard tax rate is around 31 times higher than the lower tax rate.

European Waste Catalogue (EWC) codes by year

European Waste Catalogue (EWC) codes are a coding system used to describe and categorise waste. More information on the waste codes can be found in SEPA’s guidance on using the European Waste Catalogue (EWC) to code waste document.

Mixed municipal waste (EWC code 20 03 01) is the most prevalent waste type, contributing around half of SLfT revenue in 2024/25 (48.1%). A further 27.7% was attributable to disposals of EWC code 19 12 12, which constitutes waste “from the mechanical treatment of waste” (meaning it will contain other waste EWC codes waste types that have then been mechanically treated). Disposals of these two waste streams have accounted for the majority of gross SLfT declared due each year.

Mixed municipal waste has accounted for over 7.7 million tonnes of taxable disposals since 2015/16, nearly all of which was subject to the standard rate of SLfT. Total tonnages of this waste code have been falling over time, reaching the lowest level to date in 2024/25 (273,400 tonnes).

EWC code 19 12 12 has accounted for over 6.2 million tonnes of taxable disposals since 2015/16. The total tonnage of this waste code increased from 2015/16 to 2022/23, but has decreased over the last two years reaching the lowest level to date in 2024/25 (423,500 tonnes). The proportion of EWC code 19 12 12 tonnage taxed at the lower rate has increased over time.

The composition of standard and lower rate waste is different. Standard rate waste is predominantly EWC code 20 03 01 (49.6% of standard rate gross SLfT in 2024/25), followed by EWC code 19 12 12 (27.0%). Lower rate waste is predominantly EWC code 19 12 12 (49.9% of lower rate gross SLfT in 2024/25) followed by EWC codes 17 05 04 (soil and stones other than those mentioned in 17 05 03, 14.1%) and 19 12 09 (minerals for example sand, stones, 11.3%).

Quarterly statistics

SLfT declared by quarter

SLfT was £14.2 million during the last quarter, 27% higher than the previous quarter (£11.2m).

Figure 3: Column chart showing SLfT declared by quarter from 2015/16 to 2024/25, with a decreasing trend through time. An additional line shows the 4 quarter moving average for SLfT declared due.

The total SLfT declared due and standard rate waste increased in Q4 2024/25 compared to Q3 2024/25. This is inconsistent with the pattern in most years, where total SLfT declared due in Q4 is usually the lowest of the year. As the overall tonnages of waste decrease, the patterns in tonnages and SLfT declared due may become more variable and more heavily influenced by the activities of small numbers of sites.

Tonnage by quarter

Standard rate tonnage was 29% higher than the previous quarter and lower rate tonnage was 16% lower.

Figure 4: Line chart showing standard and lower rate tonnages by quarter.

Standard rate tonnage in Q4 of 2024/25 was 141,300, which is relatively low compared to most previous years but higher than Q4 2023/24. Lower rate tonnage was 109,000, which is the second lowest for any Q4 and lower than Q4 2023/24.

Background to SLfT

Scottish Landfill Tax (SLfT) is a tax on the disposal or unauthorised disposal of waste to landfill and is charged by weight. SLfT is a devolved tax, replacing UK landfill tax in Scotland only from 1 April 2015.

We have published a document covering SLfT background information, including data sources, methodology, quality, revisions policy and corrections.

Our website contains further information about Scottish Landfill Tax and the Scottish Landfill Communities Fund.

Tell us what you think

We are always interested to hear from our users about how our statistics are used, and how they can be improved.

Enquiries

For enquiries about this publication please contact:

statistics@revenue.scot