Frequently Asked Questions

Will the information I put in to my online return save automatically?

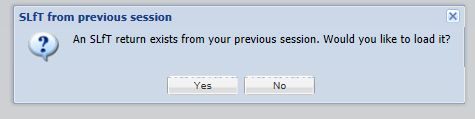

Revenue Scotland have now introduced an AutoSave function that will allow users to retrieve on-going tax returns in the event that the application closes, or an alternative menu is selected prior to the draft being saved. The application will save progress every 2-3 minutes. Where an unsaved draft of a return has been AutoSaved, a message will be displayed when the user tries to create a new tax return.

If you select ‘Yes’ – the return will be opened at the point that the last return had been saved. If ‘No is selected, this AutoSave will be deleted and unable to be retrieved. Once retrieved an AutoSaved version, we would recommend that this is now saved as a draft.

What is secure messaging?

Secure Messaging is a function available within the Revenue Scotland Portal. This allows Revenue Scotland and users of the system to communicate with each other securely. It also provides an electronic contact method where taxpayer information can be sent. The general email inboxes should not be used for taxpayer queries.

Secure Messages can be sent and received via the Secure Messaging tab at the top of the screen. Once accessed, all messages that have been received will be stored in the grid and can be viewed, deleted or replied to from the ‘Actions’. Any sent items will be saved in the ‘Sent Items’ menu, which is located on the left hand section of the screen.

All messages will be sent and received from a group mailbox. To be able to direct your queries appropriately, please provide any relevant reference and appropriate summary in the ‘subject’ line, along with all relevant information in the message.

Attachments are now able to be sent and received via messaging. Most file types are accepted as attachments. Please note that large attachments may take time to upload. For very large attachment, .zip files may be more appropriate. The application limit for attachment is 30MB.

Administrators can add an email address for Revenue Scotland to notify when a secure message has been sent to your account. This will not provide the details of the message, but will advise when this has been received. This can be updated at any time by the administrator of the account. To add or amend this, select the ‘Actions’ menu on the Account Profile section of the ‘My Profile’ tab and select ‘Change Secure Messaging Notification Email’. You are now able to add, change or remove this email address. If there is no email address selected, you will not receive notifications, however the messages will still be received into the inbox.

Last updated