Land and Buildings Transaction Tax (LBTT) key operational update for agents and tax professionals.

Digital by default

- Revenue Scotland operates a policy of electronic submission of tax returns and payments by taxpayers and agents.

- Revenue Scotland will not accept paper tax returns or cheque payments.

- Revenue Scotland will however continue to discuss submission and payment options with taxpayers requiring enhanced support.

Contact to/from Revenue Scotland

- Agents with a tax specific query should contact Revenue Scotland using the Secure Message Service (SMS) within SETS.

- Revenue Scotland will continue to provide access to the telephone Support Desk. The hours of opening are 10:00 to 12:00 and 14:00 to 16:00, Monday to Friday.

- Opening hours may occasionally vary. Updates are communicated via the Revenue Scotland website.

- Telephone calls made to/by Revenue Scotland are recorded for training, monitoring and quality assurance purposes.

Secure Message Service and Notification of Penalties

- Further guidance on using SMS and notification of penalties via SMS will be issued shortly.

- Late filing and late payment penalty notices are issued to taxpayers in writing. Agents and the agent account administrator are notified of the penalty via SMS within SETS.

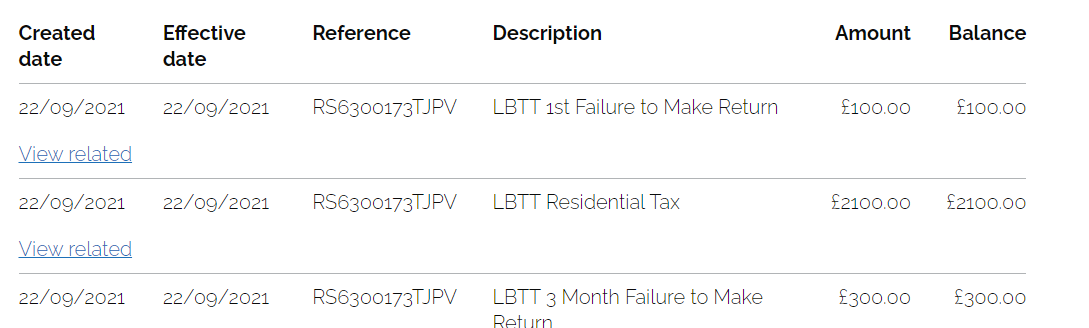

- Agents are encouraged to check their Agent Dashboard for outstanding balances and navigate to the All Transactions screen for more information regarding the late filing and payment penalties (see below). The All Transactions area automatically displays the most recent transactions - the filter option can be used to change this.

Image

Impact of COVID-19

- Where a tax return or tax remains due, this must be submitted / paid on time.

- Revenue Scotland will however take proportionate measures to alleviate the burden on taxpayers potentially facing penalties for late payment/returns incurred during the COVID period or experiencing difficulty paying a tax bill.

- The COVID period is defined as between 23 March 2020 – 31 August 2021.

Taxpayers facing Financial Difficulty

- We encourage anyone in financial difficulty to contact us as soon as possible.

- Further information is available at Difficulties paying a tax bill.

- Please contact rsdebt@revenue.scot to discuss payment options that may include Time to Pay arrangements or a Payment Promise.

3 Yearly Lease review returns

- Please continue to submit 3 yearly lease review returns on time.

- Later in the year an aid will be shared showing common errors we are seeing in relation to this type of tax return.

3 Yearly Lease Reviews – Failures incurred during COVID period

- We are very aware of the impact of COVID-19 on businesses, many of whom were unable to open / access premises during this time.

- In response to these impacts, we have introduced proportionate measures to alleviate the burden on taxpayers potentially facing penalties for late returns or payments.

- During the COVID-19 period for three yearly lease returns only where the tax return has been received (albeit late) the penalty will be remitted to nil. A notice will be issued to the taxpayer confirming this – no further action is required.

- For taxpayers yet to submit tax returns due during this period, please submit this return as soon as possible. Letters will be issued to taxpayers giving 92 days from the date of the penalty notice to submit the tax return. Failure to submit / pay by this deadline will result in the penalty becoming due and payable. We will be writing to affected taxpayers.

- Further information can be found at LBTT Penalties: submitting or paying late.

All other taxpayers – action that can be taken

- The measure noted above does not apply to any other type of return/taxpayer including first time lease transactions and conveyance returns.

- However taxpayers can continue to seek a review within 30 days of receipt of the penalty notice.

- Taxpayers who feel they have been impacted by COVID-19 can contact reviews@revenue.scot providing full details as to why COVID-19 affected the submission of the tax return / payment on time.

- General queries related to penalties should continue to be submitted via SMS on SETS and not sent to the reviews email address.