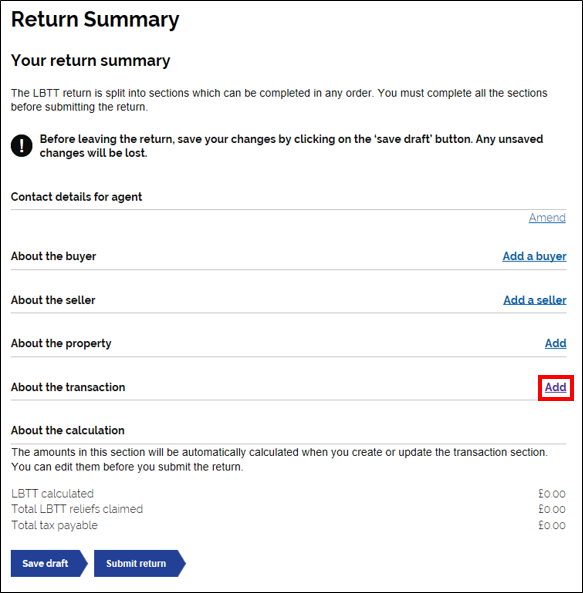

You can add details about the transaction by selecting the ‘add’ button on the right hand side of the ‘About the transaction’ section.

About the transaction

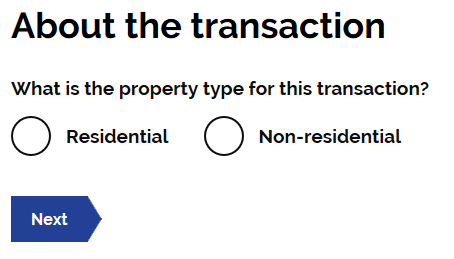

You will then be asked ‘what is the property type for this transaction?’. Use the radio buttons to select the appropriate answer.

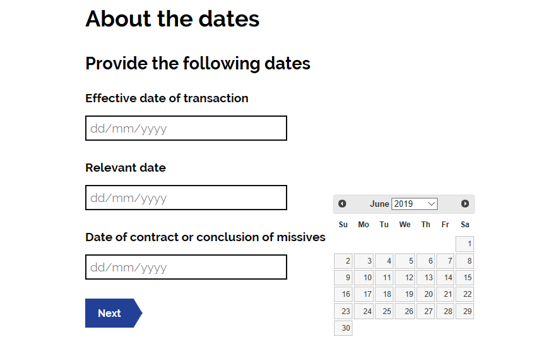

You will be asked to complete the following dates;

- Effective date of transaction

- Relevant date

- Date of contract of conclusion of missives (where this is unavailable, please use the effective date)

Clicking on the box will produce a calendar. You can use this to select the appropriate dates. You can also type into the box, without having to use the calendar.

Conditional contracts

If the contract is conditional (i.e. subject to suspensive conditions), the contract date will usually still be taken as the date that the conditional contract was entered into/signed. This is because a binding contract has been entered into at this point. Where we believe this rule may have been abused, we will make contact with the relevant parties to ascertain if the return needs to be amended and any additional tax paid.

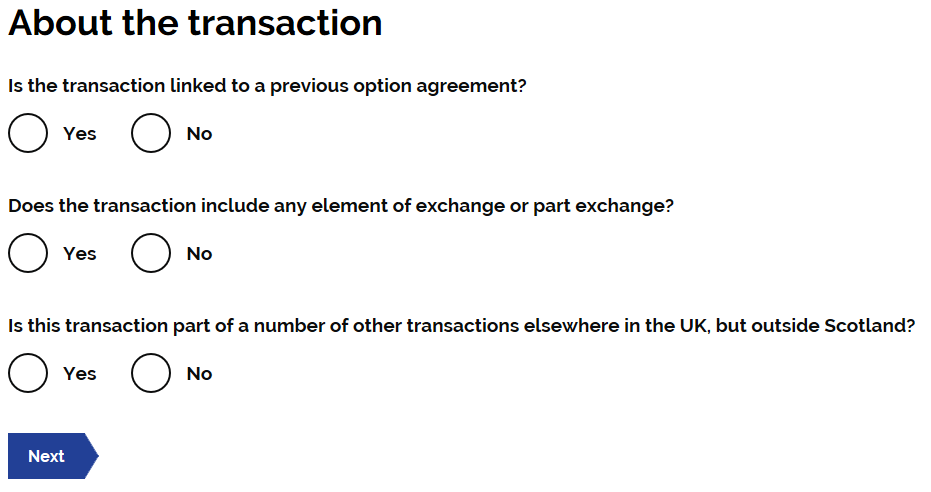

You will be asked the following questions;

- Is the transaction linked to a previous option agreement?

- Does the transaction include any element of exchange or part exchange?

- Is this transaction part of a number of other transactions elsewhere in the UK, but outside Scotland?

Use the radio buttons to choose the appropriate answer to each question.

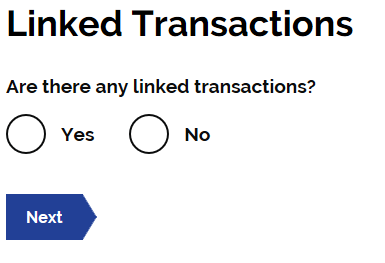

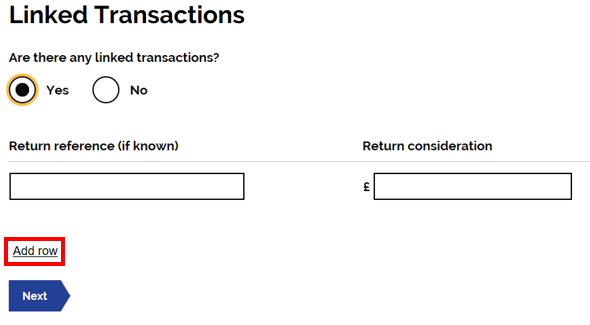

Linked Transactions

You will be asked if this transaction is linked to any other transactions. Guidance on linked transactions can be found at LBTT2008.

If you answer ‘yes’ to ‘Are there any linked transactions?’ a further field will be populated. Here you will asked to complete the ‘Return reference (if known)’ and the ‘Return consideration’ of the linked transaction.

There is the option to ‘Add row’ if there are multiple linked transactions.

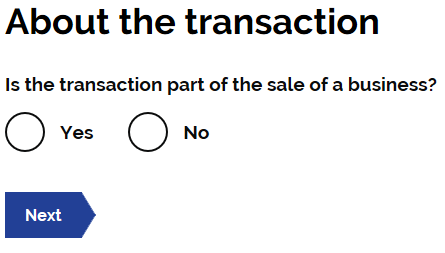

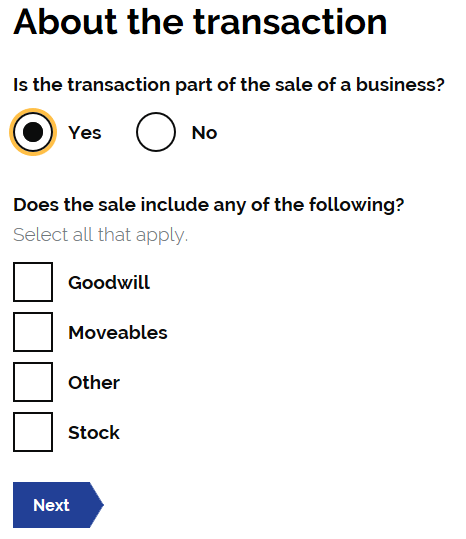

Sale of a business

You will be asked ‘is the transaction part of the sale of a business?’. Use the radio buttons to select the appropriate answer.

If you select ‘yes’ to ‘Is the transaction part of the sale of a business?’ a further field will be populated. You will be asked if the sale includes any of the following;

- Goodwill

- Moveables

- Other

- Stock

Used the check boxes to select the which is applicable.

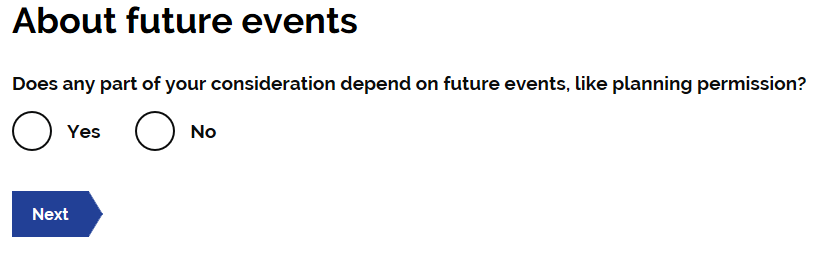

Future events and deferred payments

You will be asked ‘Does any part of your consideration depend on future events, like planning permission?’. Use the radio buttons to select the appropriate answer. Guidance on Contingent, uncertain and unascertained consideration can be found at LBTT 2005.

If you select ‘Yes’ to this question, a further field will populate to ask you ‘Have you applied to pay on a deferred basis?’.

‘If you select ‘yes’ to ‘Have you applied to pay on a deferred basis?’. A further field will populate asking you to state your Revenue Scotland deferral reference. Guidance on deferrals can be found at LBTT4016.

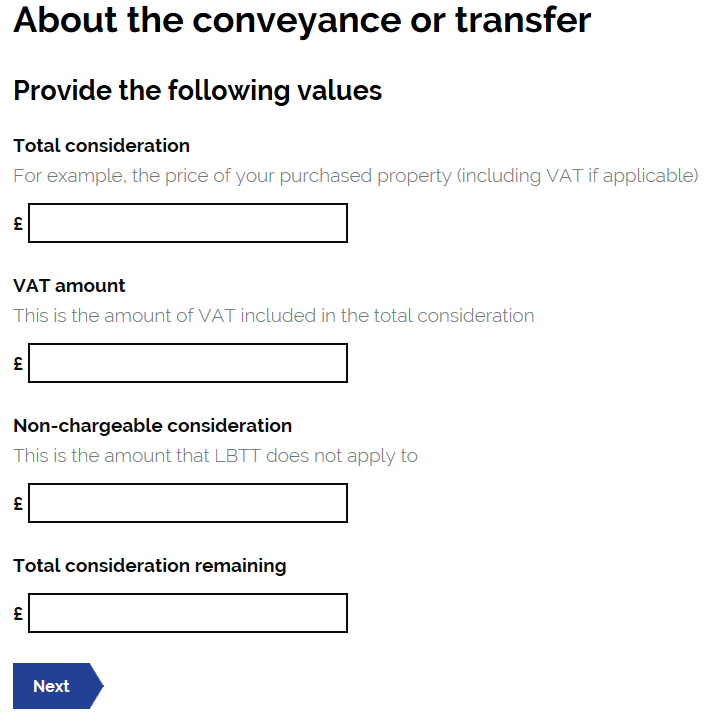

About the Conveyance

You will be asked to complete the following boxes with the appropriate values;

- Total Consideration – the consideration of the transaction

- VAT amount – and VAT included in the consideration

- Non-Chargeable consideration – any amount that LBTT does not apply to

- Total consideration remaining – the remaining chargeable consideration for the transaction once any non-chargeable consideration has been deducted

Once these fields have been completed, the figures will be pulled through to the ‘About the calculation’ section. The ‘About the calculation’ section can then be edited if necessary.