Contingent consideration - Section 18 LBTT(S)A

Where some or all of the chargeable consideration to be paid is contingent on an uncertain future event and this amount is known, then the amount of consideration used in the LBTT return is determined on the assumption that the contingency will be resolved so that the consideration is payable or, as the case may be, does not cease to be payable.

Contingent means that it is an amount that is to be paid only if some uncertain future event occurs or that it ceases to be payable if some uncertain future event occurs.

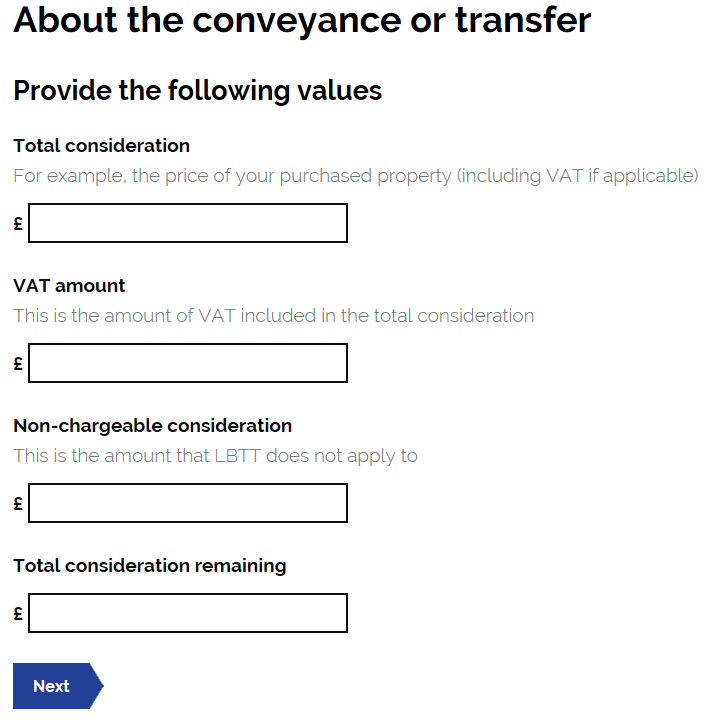

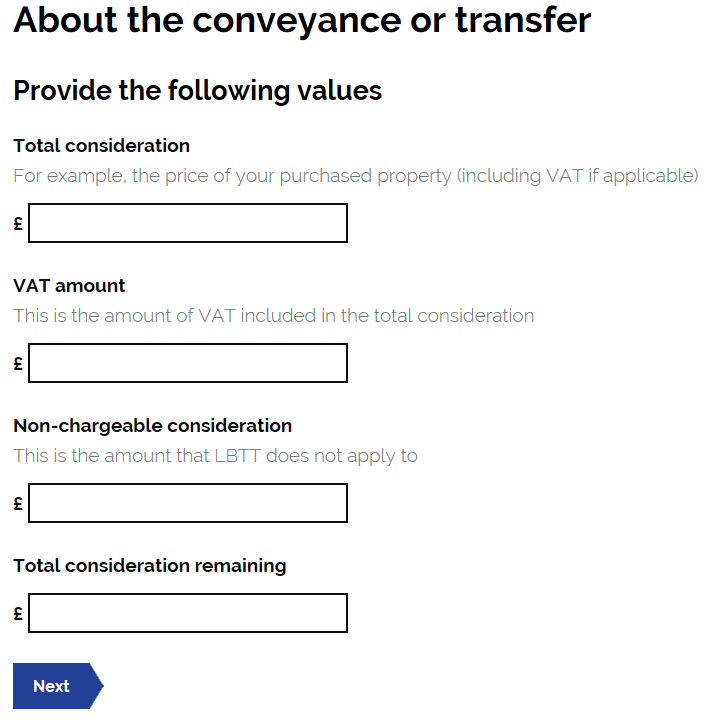

The full amount of chargeable consideration (both the non-contingent and contingent elements) should be included in the ‘total consideration’ field of the return, as can be seen below.

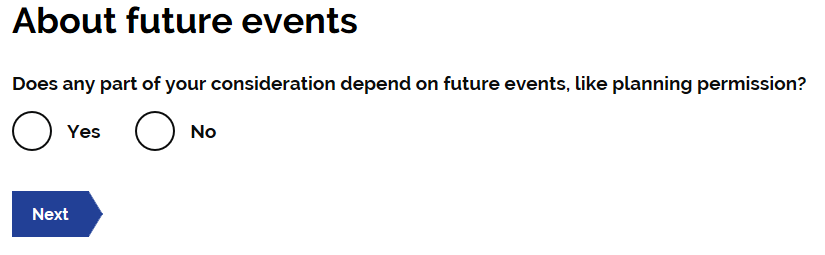

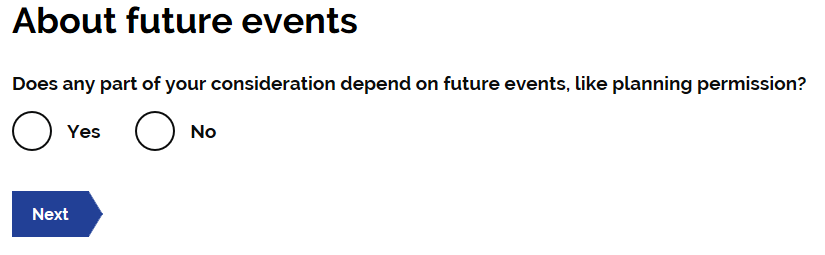

When asked ‘Does any part of your consideration depend on future events, like planning permission?’ please select ‘yes’. You will then be asked ‘Have you applied to pay on a deferred basis?’. Please select the appropriate box.

It may be possible to seek a deferral on the contingent amount if certain criteria has been met. Please see the guidance on deferrals here: LBTT4016 - Application to defer payment of LBTT | Revenue Scotland

Uncertain or unascertained consideration - Section 19 LBTT(S)A

Where some or all of the chargeable consideration to be paid is uncertain or unascertained because it depends on future events, then a reasonable estimate of the amount of consideration should be provided in the LBTT return.

Uncertain means its amount or value depends on uncertain future event(s). Unascertained means its amount or value depends on certain future event(s).

Where consideration is ascertainable, the LBTT return should be completed on the basis of a best estimate of the chargeable consideration and a deferral cannot be sought. This is different from unascertainable consideration.

The full amount of chargeable consideration (both the non-contingent and estimated contingent elements) should be included in the ‘total consideration’ field of the return, as can be seen below.

When asked ‘Does any part of your consideration depend on future events, like planning permission?’ please select ‘yes’. You will then be asked ‘Have you applied to pay on a deferred basis?’. Please select the appropriate box.

It may be possible to seek a deferral on the uncertain amount if the appropriate criteria has been met. Please see the guidance on deferrals here: LBTT4016 - Application to defer payment of LBTT | Revenue Scotland

Section 20 LBTT(S)A

Where the contingency ceases or the consideration is ascertained, please see the guidance at: LBTT4021 - LBTT return where contingency ceases or consideration ascertained | Revenue Scotland