Introduction

Land and Buildings Transaction Tax (“LBTT”) replaced Stamp Duty Land Tax (“SDLT”) in Scotland from 1 April 2015 (the commencement date). Special transitional rules are set out in The Land and Buildings Transaction Tax (Transitional Provisions) (Scotland) Order 2014 (2014/377) (the “TPO”). The purpose of the TPO (as set out in the Policy Note) is to ensure that different types of land transactions or arrangements involving land transactions in Scotland are not taxed twice (by both SDLT and LBTT) but are subject to one tax or the other where appropriate, rather than no tax at all. As Scottish leases executed prior to 1 December 2003 (within the Stamp Duty (“SD”) regime) fall within the scope of leases subject to SDLT, they are covered by the TPO in certain circumstances, see below for further detail.

This guidance aims to provide additional detail on how Revenue Scotland interprets the legislation. This interpretation is consistent with the HMRC Transitional Guidance, the Revenue Scotland transitional examples and how Revenue Scotland have interpreted the rules since the introduction of LBTT.

The guidance covers the transitional rules that specifically relate to pre-implementation leases (leases granted prior to 1 April 2015). The following rules are contained within the TPO:

- Overlapping leases – Article 10 ensures that the discount in respect of overlapping leases under Paragraph 24, Schedule 19 of the Land and Buildings Transaction Tax (Scotland) Act (“LBTT(S)A”) can apply, even though the lease was entered into prior to the 1 April 2015.

- Assignation of exempt lease granted prior to 1 April 2015 – Article 11 applies where tax reliefs were previously claimed so that the lease was exempt from SDLT and the lease is then assigned to a different tenant after 1 April 2015. Where the new tenant is not entitled to any of those tax reliefs, Article 11 ensures that Paragraph 27, Schedule 19 LBTT(S)A applies so that an assignation of the lease is treated as a new lease for LBTT purposes.

- Variation of lease – Article 12 applies where the lease is varied after the commencement date to increase the amount of rent within the first five years of the grant of the original lease. The variation is treated as a grant of a new lease for LBTT purposes.

- Extension of lease – Article 13 applies where there is an extension of the term or premises of a lease. The variation is treated as a grant of a new lease for LBTT purposes.

Overlapping leases

Rules covering rent for an overlap period in the case of a grant of a further lease are found at LBTT(S)A 2013 Paragraph 24, Schedule 19.

Article 10 of the TPO applies where the old lease has been granted prior to 1 April 2015 (and the rent was taken into account for calculating SDLT), and one of the following has taken place:

- party A renounces an existing lease to party B (the old lease) and in consideration of that renunciation party B grants a lease to party A of the same or substantially the same premises (the new lease);

- on termination of a lease (the head lease) a sub-tenant is granted a lease (the new lease) of the same or substantially the same premises as the tenant’s old lease in pursuance of a contractual entitlement arising in the event of the head lease being terminated; or

- a person who has guaranteed the obligations of a tenant under a lease that has been terminated (the old lease) is granted a lease of the same or substantially the same premises (the new lease) in pursuance of the guarantee.

The overlap period is the period between the date of the grant of the new lease and what would have been the end of the term of the old lease had it not been terminated.

The rent paid during an “overlap period” is treated as paid under the old lease and not the new lease. Under the transitional rules the rent that would have been payable under the old lease is the amount of rent taken into account in determining the tax chargeable under the SDLT rules in respect of the acquisition of the old lease.

The rent payable under the new lease is treated as reduced by the amount of rent that would have been payable during the overlap period under the old lease (but cannot be a negative amount). This is the actual rent during this period even where this is different from the rent which was payable when the old lease was granted.

Assignation of a lease treated as the grant of a lease

In summary, where there is an assignment of a SDLT or SD lease which was previously exempt from charge (due to one of the reliefs listed below), the first assignation of the lease where none of the reliefs are available is treated as the grant of a new lease. The new lease will be for the remaining term of the lease and on the terms agreed to by the assignee.

Article 11 applies where the following conditions are met:

- the effective date of the grant of the lease is prior to 1 April 2015;

- paragraph 11(1) of Schedule 17A of the Finance Act 2003 (“FA 2003”) applies as it was previously exempt from charge to SDLT or SD as a result of a claim for one of the following tax reliefs:

- Section 57A (sale and leaseback relief);

- Part 1 or 2 of Schedule 7 (group relief or reconstruction or acquisition relief);

- Part 1 or 2 of Schedule 7A (PAIF seeding relief and COACS seeding relief);

- Section 66 (transfers involving public bodies);

- Schedule 8 (charities relief);

- Paragraphs 6 and 8 of Part 3 of Schedule 61 to the Finance Act 2009 (alternative finance investment bond relief)

- any such regulations as are mentioned in Section 123(3) (regulations reproducing SDLT the effect of enactments providing for exemption under SD).

- this is the first assignation of the lease after 1 April 2015 that is not exempt from charge by virtue of any of the above reliefs occurring (and in relation to which the assignee does not acquire the lease as a bare trustee of the assignor).

This rule does not apply where group relief, reconstruction or acquisition relief, PAIF seeding relief, COACS seeding relief or charities relief applied and is withdrawn as a result of a “disqualifying event” occurring before the effective date of the assignation. A disqualifying event is defined in Paragraph 11(5), Schedule 17A FA 2003.

Further details of the SDLT rules related to Paragraph 11, Schedule 17A FA 2003 can be found in the HMRC SDLT manual at SDLTM17090.

Where Article 11 applies:

- The grant of the lease referred to above shall be treated as the grant of the lease for the purposes of Paragraph 27(1) of Schedule 19 LBTT(S)A;

- the first assignation of a lease referred to above is treated as the first assignation of a lease for the purposes of Paragraph 27(2) of Schedule 19; and

- the provisions in Paragraph 11(3) and (5) of Schedule 17A FA 2003 shall be treated for the purposes of Paragraph 27 of Schedule 19 as if they were the corresponding provisions in Paragraph 27(3) and (5) of Schedule 19.

See LBTT(S)A 2013 Paragraph 27, Schedule 19 for the relevant legislation for cases where the assignation of lease is treated as the grant of a lease. LBTT6026 also provides guidance on the circumstances when the assignation of a lease is treated as the grant of a lease.

Variation or extension of a lease

General principles

Articles 12 and 13 of the TPO provide that certain variations and extensions of leases that were granted prior to 1 April 2015 (“a pre-implementation lease”) are to be treated as the grant of a new lease for LBTT purposes.

The relevant variations or extensions are where, after the 1 April 2015:-

- the pre-implementation lease is varied to increase the amount of rent, within the first five years of the grant of the lease (Article 12); or

- there is an extension of the term or premises of a pre-implementation lease (Article 13)

Therefore, where Schedule 17A FA 2003 would have applied before 1 April 2015 to a relevant variation or extension of a pre-implementation lease (but can no longer apply due to Sections 29(5) of the Scotland Act 2012 disapplying SDLT after 1 April 2015), LBTT applies.

The new lease is an acquisition of a new chargeable interest that is chargeable under Section 4 and Section 6(1)(a) LBTT(S)A. Therefore, all of the rules that follow from the creation of a new lease follow this (such as the availability of the nil rate band).

The subject matter of the lease: The relevant part of the varied lease contract that is treated as a new lease under the LBTT rules is the part related to the variation or extension. The part of the lease contract that was subject to SDLT (the “SDLT lease”) does not enter the LBTT regime.

The effective date: is the date of signature of the variation or, in the less common case, the date of conclusion of the missives which constitutes the variation i.e. where no formal minute of variation will be entered into. This is in accordance with Sections 63 and 64 of the LBTT(S)A.

The rent: As the original lease will already have been subject to SDLT, LBTT will only be liable on the additional rent which results from the variation or extension.

The term: The term of the new lease is the period in which possession of the property or rent in relation to the new terms can be linked. The start date of the new lease is the start date of the relevant term. There may be a number of changes to the lease when it enters this period. The tenant does not have possession under the new LBTT lease until possession is under those terms. The tenant may have possession of the premises during the period between the effective date and the start of the term of the new lease but this possession is linked to the SDLT lease.

The relevant date: is usually the effective date as per LBTT6002 - Effective date for lease transactions | Revenue Scotland

Article 12 - variation of a lease

The term of the deemed new lease is the term over which the rent has been increased.

It is important to note that the variation is treated as a new LBTT lease and it is not treated as a variation of an existing LBTT lease.

Note: If the lease is varied after the 1 April 2015 to increase the amount of rent after the first five years of the grant of the lease then the lease will not enter the LBTT regime (unless one of the other TPO provisions apply). Therefore, there should be no new deemed LBTT leases created by Article 12 from 31 March 2020.

Article 13 - extension of a lease

Where a lease is varied by an extension to its term, the “term” for the purposes of the new LBTT lease is the period by which the lease contract has been extended. The new lease starts when the original term ends.

If the new deemed LBTT lease is a result of an extension to the premises let, the tenant cannot substantially perform the contract before they are in possession of those premises. If there is a prior contract before the minute of variation, and the variation relates wholly or partly to an extension to the premises let, then if the tenant takes possession of the extended area, the effective date will occur as at that date and the term of the lease will start from that date.

Where the tenant does not take possession of the additional premises in advance of the minute of variation the effective date is the date the minute of variation is signed. The start of the new lease is the start date agreed in the minute of variation and it runs until the end of the lease contract.

The additional rent is the full rent related to the extended period or the additional premises.

Where both Articles 12 and 13 apply

If the rent is varied within the first five years of the lease and a minute of variation also extends the lease this is likely to give rise to two deemed leases under the TPO.

The successive linked lease provisions in LBTT(S)A 2013 Paragraph 23, Schedule 19 apply to the two leases.

Therefore the two new leases are treated as the grant of a single lease, at the time of the grant of the first deemed lease, for a term equal to the aggregate of the terms of both of the leases and in consideration of the rent payable under both of the leases.

Net Present Value (NPV) calculation

NPV of the rent payable over the term of a lease is calculated by applying the following formula -

where -

r is the rent payable in respect of year i,

i is the first, second, third etc. year of the term of the lease,

n is the term of the lease, and

T is the temporal discount rate.

As set out above, the term where Articles 12 or 13 of the TPO apply is the duration of the new LBTT lease. The lease starts when there is possession under the new LBTT lease and so may be different from the effective date. As highlighted above, the tenant may have possession of the premises during the period between the effective date and the start of the term of the new lease but this possession is linked to the SDLT lease.

Rent will be rent under the new LBTT lease i.e. the additional rent payable over and above that due under the SDLT lease.

See the transitional lease examples below.

Three-year lease reviews

The three-year LBTT review returns will inform Revenue Scotland of any changes that have occurred since the effective date or last review date. These start from the effective date, which is usually the date of variation. This allows Revenue Scotland to review the amount of tax chargeable on the lease and take account of those changes.

This would only take account of changes to the LBTT lease and not those related to the “SDLT lease”. There may be one or more three-year lease review returns due before the extended lease period actually begins.

Reviews will be required until the termination of the lease contract.

Increases in rent

Where there is an increase in rent as a result of a periodic rent review or where the rent increase takes place after 5 years from the grant of the lease, LBTT is not chargeable on the SDLT lease.

If the rent increase applies to the extended period, the full rent in this period is taken into account for LBTT. Any increase in rent in relation to this period will be taken into account in the next 3 year review.

If the rent increase applies to an extension in the premises to which Article 13 of the TPO applied, then the rent increase must be apportioned as between the SDLT lease and the LBTT lease. This increase will be taken into account in the next 3 year review of the lease and this should be done on a just and reasonable basis under Paragraph 4, Schedule 2 LBTT(S)A. What is just and reasonable for any particular lease will be fact dependent.

Stamp Duty leases

The purpose of the TPO (as set out in the Policy Note) is to ensure that different types of land transactions or arrangements involving land transactions in Scotland are not taxed more than once but are subject to one tax or the other where appropriate, rather than no tax at all. Therefore, the purpose of the Order is to ensure those transactions that would have been chargeable under SDLT are chargeable to LBTT after the 1 April 2015. It ensures that existing Scottish leases do not fall out of tax when they move between the different regimes.

The modern approach to statutory construction is to have regard to the purpose of a particular provision and interpret its language, so far as possible, in a way which best gives effect to that purpose. This approach applies as much to a taxing statute as any other. In seeking the purpose of a statutory provision, the interpreter is not confined to a literal interpretation of the words, but must have regard to the context and scheme of the relevant Act as a whole.

FA 2003 introduced SDLT where a land transaction has an effective date of 1 December 2003 or later (the implementation date). There are also special provisions for land transactions effected in pursuance of a contract entered into on or before the date of Royal Assent of the FA03 – 10 July 2003. Generally, Scottish leases granted prior to 1 December 2003 fell within the SD regime.

For SDLT purposes, the extension and/or variation of a Scottish lease granted prior to 1 December 2003 would have been treated as the grant of a new lease (see the archived HMRC SDLT guidance for Scottish leases) for the purposes of Schedule 17A FA03.

Applying a purposive interpretation to the wording at Articles 12 and 13 of the TPO that state that they apply to leases “which the provisions of Schedule 17A to the 2003 Act apply” would, in Revenue Scotland’s view, include leases granted prior to the introduction of SDLT.

Revenue Scotland’s LBTT Technical Bulletin 1 dated 16 October 2016 explained that the provisions of Schedule 17A FA 2003 can be considered to apply to Scottish leases varied after July 2003. Variations from April 2015 would have been subject to SDLT but for the introduction of LBTT (even if these were not previously varied by March 2015). Although Article 12 of the Transitional Provisions Order does not bring variations of rent alone in a Stamp Duty lease into charge for LBTT (because of the five year rule), variations within the scope of Article 13 are potentially chargeable, depending on the terms of the lease, to LBTT on the additional amount of rent.

The SDLT rules at Schedule 17A FA 2003 were generally accepted to apply to SD leases surrendered and re-granted; assigned where previously exempt; or varied to extend the premises or period prior to 1 April 2015. The guidance above in relation to those circumstances therefore applies to SD leases.

Examples

A 15 year lease with an annual rent of £50,000 was executed on 1 September 2014. An SDLT return was submitted and resultant tax paid.

On 1 September 2015, a minute of variation was executed to increase the rent from £50,000 to £75,000 per annum from the date of execution of the minute. The rent increase was not pursuant to a rent review clause in the original lease. Under the SDLT rules (Paragraph 13(1), Schedule 17A FA 2003), an increase in rent within the first five years of the grant of the lease would have been treated as a grant of a new lease. As this applies in this case, the increase in rent is treated as the grant of a new lease under Article 12 of TPO.

The effective date will be the date the minute of variation was executed, 1 September 2015. An LBTT return is required by the filing date of 1 October 2015.

The effective date is used to determine when the three yearly review return will be due. This will be based on the third anniversary of the effective date and every three years thereafter. The third anniversary of the effective date of the transaction is 1 September 2018. The three yearly review return must be made by the filing date of 1 October 2018.

The chargeable consideration will be all of the additional rent payable in the remaining years of the lease. If the rent had already been increased within the terms of the original lease, the additional rent is the difference between the rent established by the variation and the rent immediately before the variation is put into effect – sometimes called the “passing rent”.

The NPV is calculated using the additional £25,000 payable in each of the 14 remaining years. This results in a NPV of £273,013.01.

Using the rates and band for leases, the total tax chargeable would be:

(£150,000 x 0%)+(£123,013.01 x 1%) = £1,230

Note: Where a lease granted prior to 1 April 2015 is only varied to increase rent later than 5 years from the grant of the lease this is not treated as creating a new lease under Article 12 of the of the TPO.

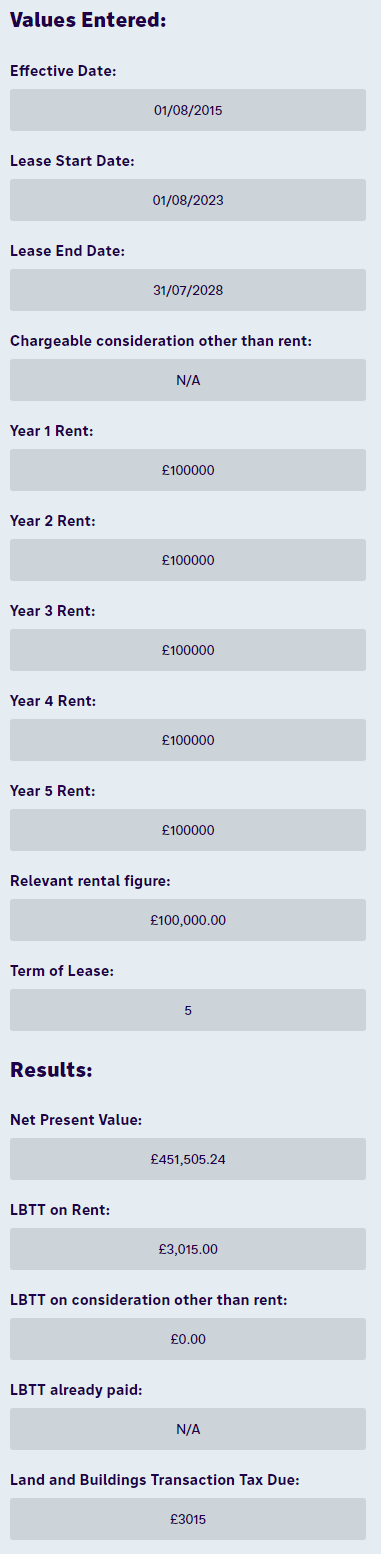

A ten year lease with an annual rent of £100,000 was executed on 1 August 2013. An SDLT return was submitted and resultant tax paid.

On 1 August 2015, a minute of variation was executed to extend the lease for a further 5 years. This is treated for LBTT purposes as the grant of a new lease under Article 13 of the TPO.

The effective date will be the date the minute of variation was executed, 1 August 2015. An LBTT return is required by the filing date of 31 August 2015. Although the effective date is 1 August 2015, the term of the lease will not start until the tenant takes possession of the premises under the new lease, which will be under the extended term starting on 1 August 2023.

The effective date is used to determine when the three yearly review return will be due. This will be based on the third anniversary of the effective date and every three years thereafter. The third anniversary of the effective date of the transaction is 1 August 2018. The three yearly review return must be made by the filing date of 31 August 2018. There will be further three yearly review returns due in August 2021, August 2024, August 2027 and then a termination return due when the lease expires on 31 July 2028. Under LBTT rules, no termination return will be required at the end of the original SDLT lease, but only on expiry of the LBTT lease.

The chargeable consideration will be all of the additional rent payable under the term of the lease. As stated above, the term of the new LBTT lease is the extended five year period (1 August 2023 – 31 July 2028).

You therefore need to input the term of the lease as 1 August 2023 – 31 July 2028 on the return and enter £100,000 each year for the 5-year lease. You do not put the start date of the lease as the effective date and enter 0’s into the return.

The NPV is calculated using the £100,000 payable in each of the five extended years. This results in a NPV of £451,505.24. The start date of the LBTT lease is 1 August 2023.

Using the rates and band for leases at the effective date, the total tax chargeable would be:

(£150,000 x 0%)+(£301,505.24 x 1%) = £3,015

The calculations will be as follows on the lease transactions calculator:

A ten year lease with an annual rent of £100,000 was executed on 1 May 2012. An SDLT return was submitted and resultant tax paid.

On 1 May 2015, a minute of variation was executed to extend the lease for a further 10 years and increase the annual rent from the effective date by £20,000. Each variation is treated as a grant of a new lease, for LBTT purposes, under Articles 12 and 13 of the TPO. The LBTT leases are part of a single arrangement, therefore they are successive linked leases. They would be treated as a single lease for LBTT purposes.

The effective date will be the date the minute of variation was executed, 1 May 2015. An LBTT return is required by the filing date of 31 May 2015.

The effective date is used to determine when the three yearly review return will be due. This will be based on the third anniversary of the effective date and every three years thereafter. The third anniversary of the effective date of the transaction is 1 May 2018. The three yearly review return must be made by the filing date of 31 May 2018.

The term of the new LBTT lease is 1 May 2015 – 30 April 2032.

The chargeable consideration will be the increased rent during the term of the LBTT lease. That is, £20,000 per annum from May 2015 to April 2022 and £120,000 from May 2022 to April 2032.

The NPV is calculated from 7 years’ annual rent of £20,000 and 10 years’ annual rent payable of £120,000. This results in a NPV of £906,704.

Using the rates and bands for leases, the total tax chargeable would be:

(£150,000 x 0%) + (£756704 x 1%) = £7567

Note: Where a lease granted prior to 1 April 2015 is varied to increase rent later than 5 years from the grant of the lease this variation is not treated as creating a new lease under Article 12 of the TPO.

A ten year lease with an annual rent of £100,000 was executed on 1 May 2009. An SDLT return was submitted and resultant tax paid.

On 1 May 2015, a minute of variation was executed to extend the lease for a further 10 years and increase the annual rent by £20,000 with immediate effect.

This is to be treated as the grant of a new lease under Article 13 of the TPO.

The effective date will be the date the minute of variation was executed, 1 May 2015. An LBTT return is required by the filing date of 31 May 2015. Although the effective date is 1 May 2015, the term of the lease will not start until the tenant takes possession of the premises under the new lease, which will be under the extended term starting on 1 May 2019.

The effective date is used to determine when the three yearly review return will be due. This will be based on the third anniversary of the effective date and every three years thereafter. The third anniversary of the effective date of the transaction is 1 May 2018. The three yearly review return must be made by the filing date of 31 May 2018. There will be further three yearly review returns due in May 2021, May 2024, May 2027 and then a termination return due when the lease expires on 30 April 2029. Under LBTT rules, no termination return will be required at the end of the original SDLT lease, but only on expiry of the LBTT lease.

The term of the new LBTT lease is 1 May 2019 – 30 April 2029.

The chargeable consideration will be all of the rent payable under the term of the new LBTT lease. That is, £120,000 per annum from 2019 until 2029.

The NPV is calculated using the £120,000 payable in each of the ten years extended. This results in a NPV of £997,992.64.

Using the rates and bands for leases, the total tax chargeable would be :

(£150,000 x 0%) + (£847,992.64 x 1%) = £8,479

In February 2015, parties agree in principle that they will enter into a 10 year lease with an annual rent of £100,000 starting on the date of entry. They aim to sign the formal lease on 1 May 2015. The agreement is substantially performed on 1 March 2015 by the tenant taking entry to the property.

The substantial performance of the agreement will give rise to a charge to SDLT.

The lease is subsequently signed off on 1 May 2015 under the terms proposed.

As there was substantial performance under SDLT on 1 March 2015, Article 4 of the TPO (‘Contracts entered into after 1st May 2012 but before the commencement date’) is engaged. The contract was substantially performed without having been completed, therefore the contract is treated as if it were itself the transaction provided for in the contract. In this case the effective date of the transaction is when the contract is substantially performed. Where the contract is subsequently completed by a conveyance, both the contract and the transaction effected on completion are notifiable transactions.

The completion on 1 May 2015 is the first LBTT event so a return is due under Section 29 of LBTT(S)A. Article 4 is engaged for the calculation of tax. In this case the SDLT return and tax liabilities have been met. Where SDLT has already been charged and paid, LBTT is due only on any additional tax amount compared to the amount of SDLT already paid. Any changes or variations made to the lease will be captured in the three yearly review return and any subsequent LBTT would be paid at that time.

The effective date is used to determine when the three yearly review return will be due. This will be based on the third anniversary of the effective date and every three years thereafter. The third anniversary of the effective date of the transaction is 1 March 2018. The three yearly review return must be made by the filing date of 31 March 2018.

The SDLT calculation provides for a NPV of £831,659 and tax due and paid of £6,816 based on the annual rent of a £100,000 for this 10 year lease.

The LBTT calculation produces the same NPV and LBTT due. Accordingly there will be no LBTT payable.

Please see LBTT6002 - Effective date for lease transactions | Revenue Scotland for further guidance on substantial performance.