Introduction

This publication covers annual statistics for Land and Buildings Transaction Tax (LBTT), going back to 2015/16. It includes information on tax declared due, numbers of tax returns, revenue foregone to reliefs, and data by local authority. Monthly LBTT statistics are also published on the Revenue Scotland website: Land and Buildings Transaction Tax Statistics | Revenue Scotland

This publication replaces the previous series ‘Annual Summary of Trends in the devolved taxes’ which covered both Land and Buildings Transaction Tax and Scottish Landfill Tax. Annual Scottish Landfill Tax statistics are now published separately alongside Q4 statistics on the Revenue Scotland website: Scottish Landfill Tax Statistics | Revenue Scotland This change was made to bring forward publication dates to make the statistics more timely for our users.

An Official Statistics Publication for Scotland

These statistics are official statistics. Official statistics are statistics that are produced by crown bodies, those acting on behalf of crown bodies, or those specified in statutory orders, as defined in the Statistics and Registration Service Act 2007.

Revenue Scotland statistics are regulated by the Office for Statistics Regulation (OSR). OSR sets the standards of trustworthiness, quality and value in the Code of Practice for Statistics that all producers of official statistics should adhere to.

Land and Buildings Transaction Tax

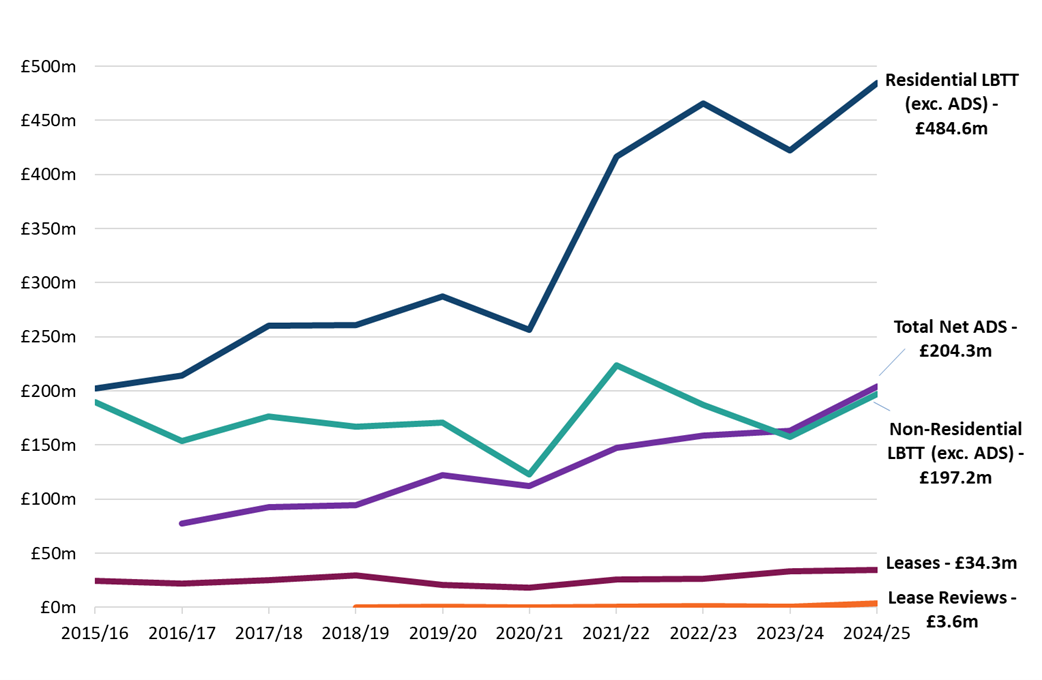

- £924.1m in LBTT revenues were declared due during 2024/25. This is the highest ever annual total and is 10% higher than the next highest figure of £838.6m in 2022/23. The total LBTT revenue includes £204.3m net Additional Dwelling Supplement (ADS) payments, some of which is likely to be reclaimed at a later date, which will reduce the total LBTT amount.

- In 2024/25, LBTT from residential conveyances accounted for just over half(52% or £484.6m) of total LBTT declared due. LBTT from non-residential conveyances accounted for 21% (£197.2m). ADS accounted for 22% (£204.3m). Leases accounted for 4% (£34.3 million) and reviews of a lease accounted for less than 0.4% (£3.6m).

- The total number of LBTT returns received was 123,900 in 2024/25. Residential conveyance returns increased by 8,050 (9%) compared to 2023/24, non residential conveyance returns increased by 950 (15%),lease returns increased by 20 (<1%) and the number of lease reviews submitted increased by 4,080 (74%). This was a combined increase of 9,020 returns (8%) compared to the previous year.

Figure 1: LBTT declared due by type of transaction and year

Residential Conveyances

- £484.6m in LBTT revenues from residential conveyances was recorded in 2024/25, excluding ADS. This is 15% higher than in 2023/24 (£422.1m) and the highest annual total since the introduction of LBTT in 2015/16.

- The number of residential conveyance returns received (102,100) in 2024/25 was up 9% from 2023/24 (94,050) and was slightly below average compared to previous years.

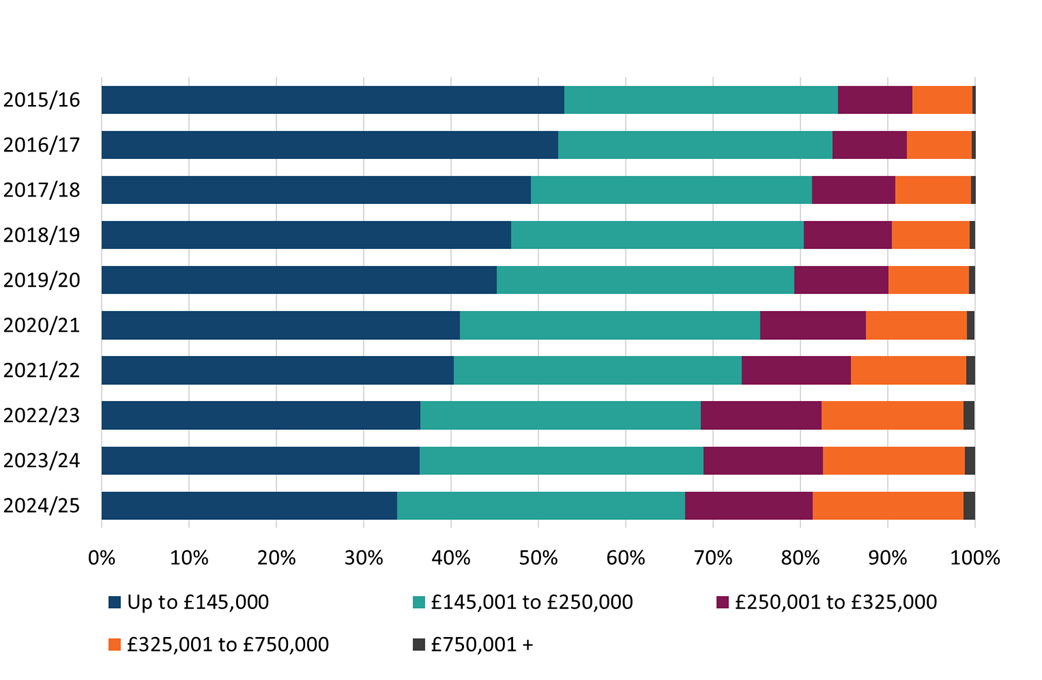

- Residential LBTT revenue excluding ADS is dominated by transactions in the £325,000 to £750,000 band, which made up 61% of residential revenue in 2024/25 while making up 17% of residential returns.

- 34% (34,470) of residential conveyance returns received in 2024/25 were in the nil rate (£0 to £145,000) tax band, the lowest proportion on record. This is down from 36% in 2023/24 and continuing the year-on-year decrease from 53% in 2015/16.

Figure 2: Distribution of residential conveyance returns received by residential LBTT band and year

Additional Dwelling Supplement

- £251.5m gross ADS was declared due in 2024/25, a 7% increase on the previous year. The number of returns with ADS declared due was 21,170, a slight increase on the previous year (21,080). ADS was declared due on 21% of all residential conveyances in 2024/25, down from 22% in the previous year.

- The ADS rate increased from 6% to 8% on the 5th December 2024. This increased rate is likely to be partially responsible for the increase in gross ADS declared for 2024/25 compared to 2023/24.

- In 80% of residential ADS returns submitted in 2024/25, the taxpayer stated they did not intend to reclaim the ADS declared due, which is down slightly from 84% in the previous year.

Non-Residential Conveyances

- £197.2m LBTT was declared due for non-residential conveyances in 2024/25, excluding ADS. This is a 25% decrease from 2023/24.

- The number of non-residential conveyance returns received (7,470) in 2024/25 was 15% higher than in the previous year (6,520).

- Almost three quarters (74% or £146.3m) of LBTT declared due for non-residential conveyances in 2024/25 came from just the top 5% of highest value transactions (those with the most LBTT due). This is just slightly above the average figure of the six previous years, where the highest percentage was 75.4% in 2021/22 and the lowest was 71.7% in 2018/19.

Leases and lease reviews

- Leases contributed £34 million LBTT revenue in 2024/25, slightly higher than 2023/24 (£33.6 million). The number of returns received in 2024/25 (4,770) was also similar to the previous year (4,750).

- Reviews of a lease accounted for approximately £3.6m of LBTT declared due in 2024/25. This is more than triple the amount in any previous year. The number of reviews received (9,570) was also much higher than in previous years (for example, 5,490 in 2023/24).

- The significant increase in the number of review-type returns submitted in 2024/25 compared to previous years is likely due to a combination of factors. These include (ii) nine-year lease reviews being due for the first time in 2024/25. (ii) an increase in compliance activities carried out by Revenue Scotland in 2024/25 which led to the submission of some late reviews.

Sub-Scotland

- Transactions in the City of Edinburgh accounted for £134.8 million in residential LBTT revenues (excluding ADS) in 2024/25, 28% of the total. The local authority area with the second largest revenue was Glasgow City, accounting for £37.0 million (8%). However, the two local authorities accounted for a similar proportion of residential returns (City of Edinburgh 12%, Glasgow City 11%).

- The proportion of residential conveyance returns in which the taxpayer declared ADS due, but did not intend to reclaim it, was highest in Dundee City (26%) and lowest in East Lothian (10%). These figures can be used as a proxy for the percentage of returns which were for second home or rental property purchases.

- In East Renfrewshire, 42% of all residential conveyances were in the top two tax bands (transactions over £325,000). This was the highest of any local authority.

Reliefs

- £188.7 million of LBTT revenue was foregone to reliefs in 2024/25, 3% higher than in 2023/24. Around 21,250 returns received relief, 20% more than in 2023/24.

- Within this, ADS foregone to relief increased by 60%, while LBTT excluding ADS foregone to relief fell by 7%. 50% more returns had some ADS foregone to relief, and 20% more returns had LBTT excluding ADS foregone to relief.

- Non-residential transactions accounted for the 68% of revenue forgone to reliefs in 2024/25.

- Group relief accounted for over half of revenue foregone to reliefs (£95.7 million, 51%). Group relief fell slightly compared to 2023/24 (£105.2 million).

- A new relief was introduced on 01 April 2024, Relief for certain acquisitions by local authorities, which accounted for £17.6m in LBTT foregone to reliefs in 2024/25. Information on this, and all other reliefs, is available on the tax reliefs section of the Revenue Scotland website.