How to make an online LBTT lease review return (agents)

Purpose of this guidance

This guidance will help you make an online Land and Buildings Transaction Tax (LBTT) lease review return. Separate guidance is available on using the online portal for submitting a LBTT return, including how to save a draft and amend a return, and ‘How to pay LBTT’, including setting up Direct Debit and BACS/CHAPS payment arrangements.

This is not guidance about the tax itself. LBTT legislation guidance for taxpayers and agents is available separately on our website. Where we refer to further guidance, for example ‘see LBTT1001’, we mean references to that guidance.

Practical guidance about how to complete the return is also available by clicking on the information bubble next to each question.

Further information about using the online portal, including how to save a draft and amend a return, can be found in the ‘General guidance about the online LBTT return’.

It is the tenant’s responsibility to ensure the LBTT return is complete and accurate.

Where an agent is completing and submitting this on behalf of the taxpayer, you must certify, as part of the declaration on the final page, that the tenant(s) have declared that the return is correct and complete, and that the relevant date entered is correct.

Key information you will need to complete this return

To complete this return, you will need the following information:

- The lease agreement, showing information such as the start and end dates of the lease;

- Transaction reference of the LBTT return original LBTT return submitted for the lease;

- Effective date of the LBTT return original LBTT return submitted for the lease;

- A recalculation of the total LBTT payable on the lease. Please consult our guidance on how to calculate tax on a lease review before using the LBTT on Lease Transactions Calculator;

- How much LBTT has already been paid on the lease.

All references in this guidance to:

- LBTT(S)A 2013 means The Land and Buildings Transaction Tax (Scotland) Act 2013 (as amended);

- ‘tenant’ means the buyer as defined in section 7 of the LBTT(S)A 2013;

- ‘landlord’ means the seller as defined in section 7 of the LBTT(S)A 2013;

- ‘we’, ‘us’ or ‘our’ means Revenue Scotland;

- ‘you’ means the person making the LBTT return (either as the tenant or the tenant’s agent);

- ‘original return/transaction’ means the first LBTT return submitted when the lease was granted, or when it became notifiable for the first time.

Protection of information

We will protect and handle any information that you provide us with in your tax return with care. For further information please see our Privacy Policy and guidance on taxpayer information (Chapter 9 of The Revenue Scotland and Tax Powers Act 2014 legislation guidance).

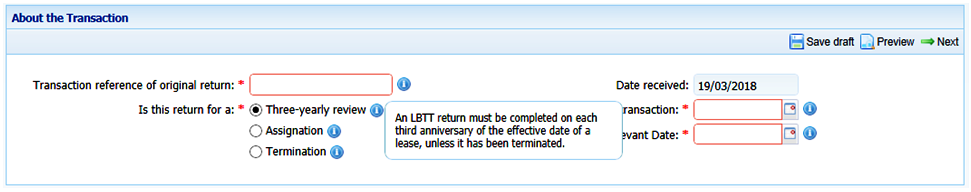

- About your LBTT return

-

Image

You must answer this question.

Select the radio button to indicate that this return is being submitted for a ‘Review of a lease’.

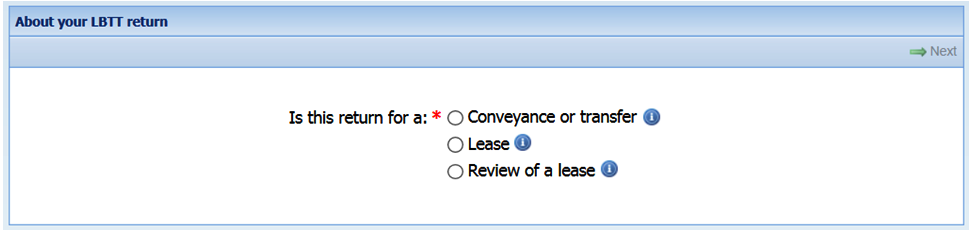

- About the Transaction

-

Image

Transaction reference of the original return

You must answer this question.

Enter the transaction reference of the LBTT return that was originally submitted for this lease. This should be entered in the following format - ‘RSXXXXXXX’.

Is this return for a Three-yearly review, Assignation or Termination

You must answer this question.

Select the radio button to indicate the event for which this return is being completed (see LBTT6014 and LBTT6017).

Effective date of original transaction

You must answer this question.

Enter the effective date of the original transaction, as stated in the LBTT return that was originally submitted for this lease, by using the calendar or manually entering it in ‘DD/MM/YYYY’ format,

Except where the original LBTT return was submitted under any of the following provisions:

- lease continuing after a fixed term causing it to become notifiable (paragraph 20 of schedule 19 - see LBTT6020);

- lease for an indefinite term (paragraph 22 of schedule 19 - see LBTT6021);

- increase in rent or extension of term for a lease causing it to become notifiable (paragraph 30 of schedule 19 - see LBTT6029).

In these cases, the ‘Relevant Date’ of the originally submitted LBTT return should be entered instead of the ‘Effective Date’.

Relevant Date

You must answer this question.

Enter the ‘relevant date’ for the transaction (as defined under section 36(3) of the LBTT(S)A 2013) by using the calendar or manually entering it in ‘DD/MM/YYYY’ format. The ‘relevant date’ in relation to each of the three different provisions under which a LBTT lease review return is required is:

- three yearly review of lease (paragraph 10 of schedule 19 - see LBTT6015) - the review date as defined in paragraph 10(7) of that schedule;

- assignation or termination of a lease (paragraph 11 of schedule 19 - see LBTT6017) - the day on which the lease is assigned or terminated.

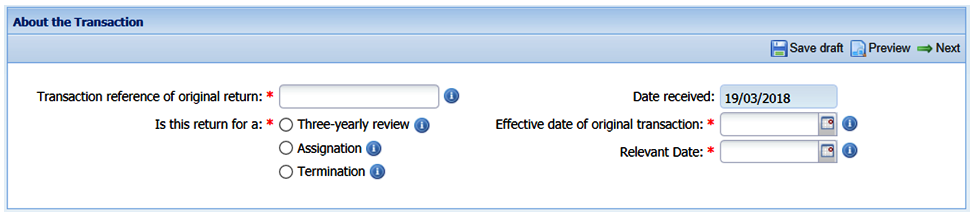

- About the Tenant

-

Image

Note: If there are two or more tenants, go to the ‘List of Additional Tenants’ area near the bottom of the screen and select ‘Add’ each time you need to add an additional tenant (there are no limits to the number of tenants that can be added). You can edit or delete the information about any additional tenants by selecting ‘Edit’ and ‘Delete’ respectively.

This section is divided into three sub-sections:

- Questions for the ‘Private Individuals and Representatives’ sub-section;

- Questions for the ‘Incorporated Bodies’ sub-section;

- Questions for the ‘Agent Details’ sub-section.

Type of Tenant

You must answer this question.

Select the option which is most relevant to the tenant.

Note: For these purposes Private Individuals and Representatives includes partnerships, and Incorporated Bodies includes unincorporated associations, charities and unit trusts. The option you choose will automatically update the return to only display the set of questions relevant to that option. Where there is more than one tenant, you must answer this question each time you use the ‘Add’ option, and you can include a mixture of both ‘Private Individuals and Representatives’ and ‘Incorporated Bodies’ Tenants

-

Questions for the ‘Private Individuals and Representatives’ sub-section

Title

From the drop-down list select the relevant title (if any) of the tenant.

Tenant surname

You must answer this question.

Enter the surname (family name) of the tenant.

Tenant first name(s)

Enter the first and middle name(s) (or non-family name) of the tenant.

Telephone number

Enter a daytime telephone number that can be used to contact the tenant.

National Insurance number (Tenant 1), if you have one (this question is not displayed for additional tenants)

You must answer either the National Insurance Number (NINO) question or the following (non-UK tax reference) question.

Note: If you answer the NINO question, the answer field for the following (non-UK tax reference) question will be greyed out.

Answer this question if the tenant is an individual. Give the correct NINO for the tenant – we will not accept a temporary NINO. If the tenant does not have a NINO then answer the question below.

If tenant (1) has no UK reference, give a tax reference from the country in which tenant (1) is based (this information is not required for additional tenants)

You must answer either this question or the previous (NINO) question.

Note: If you answer this (non-UK tax reference) question, the answer field for the previous (NINO) question will be greyed out.

If the tenant is based in the UK you should only answer this question if the tenant does not have a NINO.

If you are not able to give a non-UK tax reference for a non-UK based tenant or a NINO number for a UK-based tenant we will accept the following:

- Passport Number;

- Driving Licence Number; or

- another recognised ID reference e.g. Child Benefit Number (if the tenant is aged under 16).

Country where ID was issued (this question is not displayed for additional tenants)

If you answered the (non-UK tax reference) previous question then you must answer this question.

Note: The answer field for this question will be greyed out until you have entered details for the previous (non-UK tax reference) question.

Enter the name of the country where the non-UK tax reference, Passport Number, Driving Licence Number or other recognised ID was issued.

Is the Tenant acting as a private individual?

You must answer this question.

Answer ‘Yes’ if the tenant is acting in an individual capacity and not acting on behalf of any group of individuals, for example a trust, partnership or a company.

Note: If you answer ‘No’, you must answer the ‘Is the Tenant acting as a trustee?’ and ‘Is the Tenant acting as representative partner?’ questions below.

Address

You must answer this question.

Enter the address of the tenant after the effective date of the land transaction, including the house (or office) name and number and postcode.You must also enter the name of the country to which the address relates. This is the address we will use if we need to correspond with the tenant involved in this transaction.

Is the Tenant acting as a trustee?

You must answer this question if you answered ‘No’ to the ‘Is the Tenant acting as a private individual?’ question.

Answer ‘Yes’ if the tenant is acting as a trustee (see LBTT8001).

Is the Tenant acting as representative partner?

You must answer this question if you answered ‘No’ to the ‘Is the Tenant acting as a private individual?’ question.

Answer ‘Yes’ if the tenant is acting on behalf of a partnership, is the representative partner as defined in paragraph 9 of schedule 17 to the LBTT(S)A 2013 and notice of the nomination has been given to us (see LBTT7004).

Name of Partnership or Trust

If you have answered ‘Yes’ to either the ‘Is the Tenant acting as a trustee?’ or ‘Is the Tenant acting as representative partner?’ questions then enter the name of the relevant trust or partnership.

Are the Tenant(s) and Landlord(s) connected?

You must answer this question for all tenants.

Enter ‘Yes’ if the tenant and landlord are connected persons as defined under section 58 of the LBTT(S)A 2013. Connected persons include:

- a spouse or civil partner;

- relatives and their spouse or civil partner;

- relatives of a spouse’s or civil partner’s relatives and their spouse or civil partner;

- if the tenant or landlord are in business in a partnership, the business partners and their spouses or civil partners and their relatives;

- a company that the tenant or landlord controls, either by themself or with any of the persons listed above; or

- the trustees of a settlement of which the tenant or landlord is a settlor, or of which a person who is still alive and who is connected with them as a settlor.

‘Relative’ in this context means brother, sister, ancestor or lineal descendant.

A company is connected with another company:

- if the same person has control of both companies, or a person has control of one and persons connected with him (or he and persons connected with him) have control of the other; or

- if a group of two or more persons have control of each company, and the groups either consist of the same persons or could be regarded as consisting of the same persons by treating (in one or more cases) a member of either group as replaced by a person with whom he is connected.

Note: For these purposes a company includes a body corporate or unincorporated association.

-

Questions for the ‘Incorporated Bodies’ sub-section

Legal Name

You must answer this question.

Enter the registered legal name of the tenant.

Trading Name (if different)

If the trading name of the tenant is different from the ‘Legal Name’, enter the trading name of the tenant.

Company Number

You must answer either this question or the following ‘Charity Number’ question. Only one of these questions can be answered - if you answer the latter, this question will be greyed out.

Enter the company registration number (CRN) if the company is registered at Companies House.

Enter the Local Authority number, or N/A for other public bodies.

Charity Number

You must answer either this question or the preceding ‘Company Number’ question (note: if you are claiming charities relief you must answer this question). Only one of these questions can be answered - if you answer the latter, this question will be greyed out. Enter the charity number if the tenant is a registered charity.

Governing Law / Jurisdiction

Enter the name of the country where the company is registered.

Is the Tenant acting as a trustee?

You must answer this question if you answered ‘No’ to the ‘Is the Tenant acting as a private individual?’ question.

Answer ‘Yes’ if the tenant is acting as a trustee.

Are the Tenant(s) and Landlord(s) connected?

You must answer this question.

Enter ‘Yes’ if the tenant and landlord are connected persons as defined under section 58 of the LBTT(S)A 2013.

A company is connected with another company:

- if the same person has control of both, or a person has control of one and persons connected with him (or he and persons connected with him) have control of the other; or

- if a group of two or more persons have control of each company, and the groups either consist of the same persons or could be regarded as consisting of the same persons by treating (in one or more cases) a member of either group as replaced by a person with whom he is connected.

Note: For these purposes a company includes a body corporate or unincorporated association.

Connected persons include:

- a spouse or civil partner;

- relatives and their spouse or civil partner;

- relatives of a spouse’s or civil partner’s relatives and their spouse or civil partner;

- if the tenant or landlord are in business in a partnership, the business partners and their spouses or civil partners and their relatives;

- a company that the tenant or landlord controls, either by themself or with any of the persons listed above; or

- the trustees of a settlement of which the tenant or landlord is a settlor, or of which a person who is still alive and who is connected with them as a settlor.

‘Relative’ in this context means brother, sister, ancestor or lineal descendant.

Address

You must answer this question.

Enter the address of the tenant after the effective date of the land transaction, including the house (or office) name and number and postcode. You must also enter the name of the country to which the address relates. This is the address we will use if we need to correspond with the tenant(s) involved in this transaction.

-

Questions for the ‘Agent Details’ sub-section

This sub-section should only be completed if an agent is completing and submitting the form on behalf of the tenant. The ‘Agent Details’ sub-section of the ‘About the Tenant’ section is accessed by selecting ‘Agent Details’.

If any information is entered in this sub-section, the ‘Agent Name’ and declaration questions become mandatory, as well as one of the ‘Agent’s DX number and exchange’ or ‘Address’ questions.

If the user of the portal has signed up as an agent, the agent details will be pre-populated on all LBTT returns with the information provided as part of the sign up process. The information that has been pre-populated can be edited if required on each return.

The Agent Authorisation question must be answered for each return.

Please remember if there are updates to the registration, this must be updated on the account - for details of how to do this, please see the relevant section of the ‘how to’ guidance.

Agent Name

You must answer this question if you intend to enter any information in the ‘Agent Details’ sub-section of the ‘About the Tenant’ section of the return. Enter the full business name of the tenant’s agent.

Agent’s DX number and exchange

You must answer one or both of this question and the ‘Address’ field if you intend to enter any information in the ‘Agent Details’ sub-section of the ‘About the Tenant’ section of the return. Enter the DX or Legal Post Number of the tenant’s agent.

Agent’s telephone number

Enter the full telephone number of the tenant’s agent (direct dial where available).

Agent’s email

Enter the email address of the tenant’s agent.

Agent’s reference

Enter a reference meaningful to the tenant’s agent.

Address

You must answer one or both of this question and the ‘Agent’s DX number and exchange’ question if you intend to enter any information in the ‘Agent Details’ sub-section of the ‘About the Tenant’ section of the return.

Enter the postal address of the tenant’s agent, including where applicable the postcode and country to which the address relates.

I, agent for the tenant(s), confirm that I have authority to deal with all matters relating to this transaction on behalf of my client(s).

You must answer this question. It will not be pre-populated as it will be specific to each client.

Answer ‘Yes’ to this question if you, as an agent, have been given authority from your client (the tenant) to act on their behalf in relation to this transaction. This may lead to us contacting you, as an agent for this matter, in subsequent dealings with this transaction. You must have authority from your client in order to answer ‘Yes’ to this question and we may ask for you to provide evidence of this in the future.

If you do not have authority from your client – answer “No”, we will correspond directly with your client in the address provided on the “About the Tenant” tab.

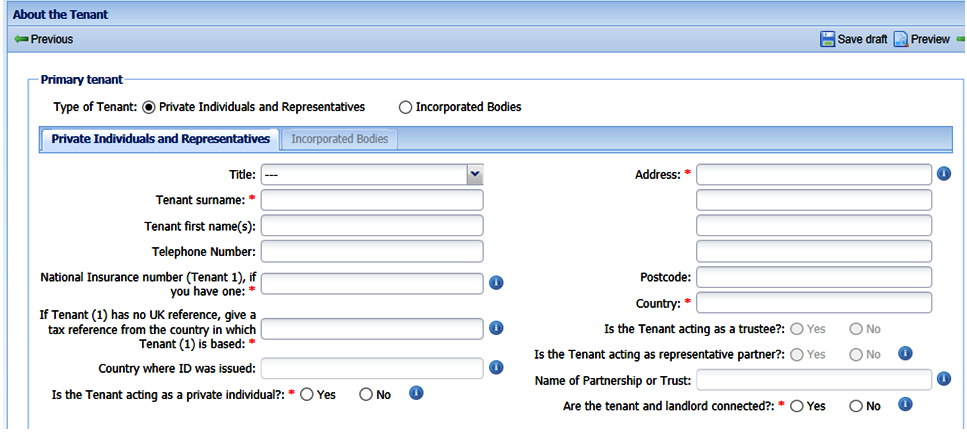

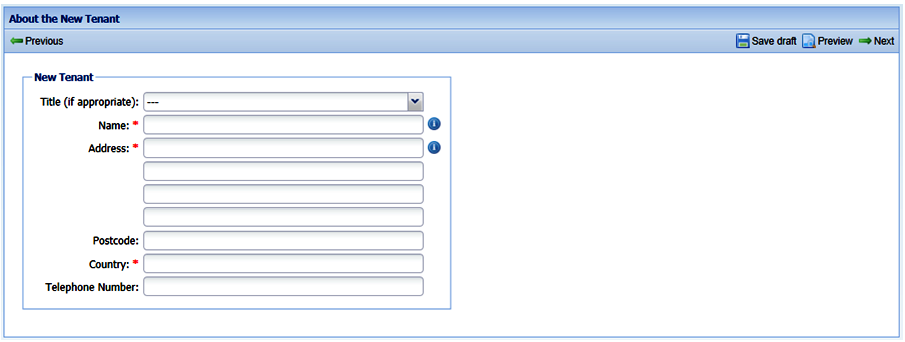

- About the New Tenant

-

The section will only enabled if you have a have selected ‘Assignation’ on the ‘About the Transaction’ section of the return.

Image

Title

From the drop-down list select the relevant title (if any) of the tenant.

Name

You must answer this question.

If the new tenant is a private individual enter their first name and surname.

If the new tenant is not a private individual, enter the name of the business, charity, trust, etc.

Address

You must answer this question.

Enter the address of the new tenant after the effective date of the land transaction, including the house (or office) name and number and postcode. You must also enter the name of the country to which the address relates. This is the address we will use if we need to correspond with the new tenant who the lease has been assigned to.

Telephone number

Enter a daytime telephone number that can be used to contact the new tenant.

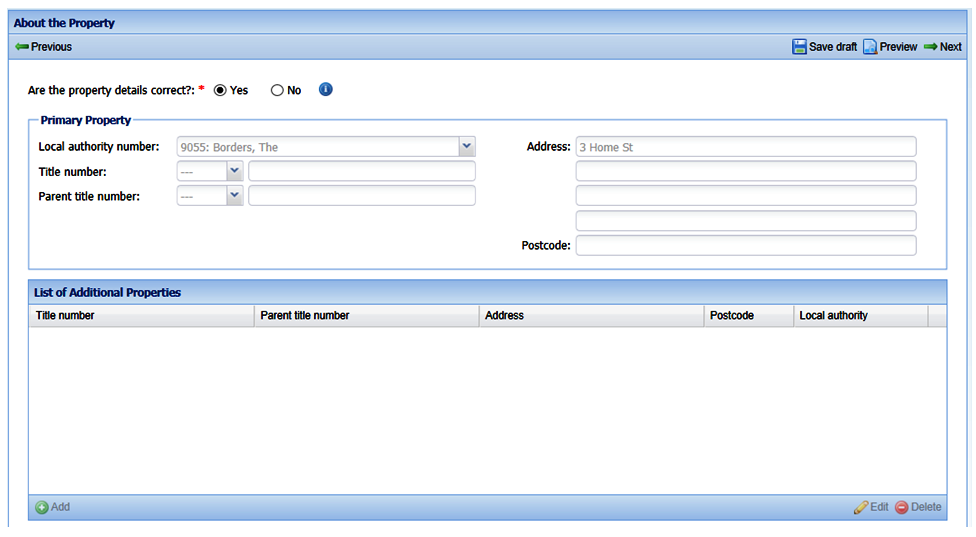

- About the Property

-

Note: This section will be prepopulated with the property details entered on the original LBTT return.

Image

Are the property details correct?

You must answer this question.

Select the radio button to indicate whether the property details pre-populated in the fields below are correct and complete:

- If the property details are correct you can proceed to the next section of the return.

- If the property details are not correct you must enter the correct details following the guidance below.

Note: If the land transaction involves two or more properties, go to the ‘List of Additional Properties’ area near the bottom of the screen and select ‘Add’ each time you need to add an additional property (there are no limits to the number of properties that can be added). You can edit or delete the information about any additional properties by selecting ‘Edit’ and ‘Delete’ respectively.

Local authority number

You must answer this question.

From the drop-down list select the local authority in whose area the property in the transaction is situated. If a property straddles a local authority boundary enter the code for the local authority in which most of the property falls.

Title Number

Note: Only complete this question if you know the full title number.

Firstly, from the drop-down list select the appropriate county code for the property’s title number e.g. for Aberdeen select ‘ABN’.

Secondly, in the free-text field to the right of the county code enter the property’s title number (if known).

Parent Title Number

Note: Only complete this question if you know the full parent title number.

If you do not know the title number of the property it is possible that it forms part of a larger area. Where this is the case, firstly select from the drop-down list the appropriate county code for the property’s parent title number e.g. for Aberdeen select ‘ABN’.

Secondly, in the free-text field to the right of the county code enter the parent title number(s) to which the property relates.

Address

You must answer this question.

Enter the full postal address of the property, including where possible the house (or office) name, the house (or office) number and the postcode. Where there is no recognised postal address, enter a description of the property.

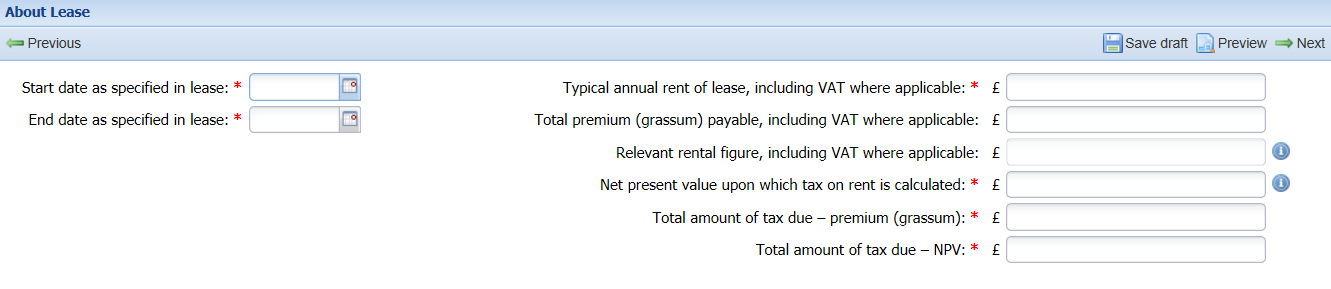

- About the Lease

-

Image

Start date as specified in lease

You must answer this question.

Enter the contractual start date of the lease as stated in the lease.

End date as specified in lease

You must answer this question.

Enter the contractual end date of the lease as stated in the lease.

If you are completing the lease review return upon termination of the lease, please enter the date the lease ended.

Typical annual rent of lease, including VAT where applicable

You must answer this question.

Enter the average annual rent (ignoring any rent-free periods) in pounds sterling under the terms of the lease, including any VAT payable on the rent.

Total premium (grassum) payable, including VAT where applicable

Enter the amount of any premium paid on the grant of the lease, plus any additional premiums paid, or to be paid, since the last return was submitted.

Relevant rental figure, including VAT where applicable

Enter the relevant rental figure under the terms of the lease. This is the annual rent in relation to the transaction in question or, if that transaction is one of a number of linked transactions for which the chargeable consideration consists of or includes rent, it is the total of the annual rents in relation to all of those transactions. See paragraph 9 of schedule 19 to the LBTT(S)A 2013 and LBTT6012.

Net present value upon which tax on rent is calculated

You must answer this question.

Enter the Net Present Value (NPV). To calculate the NPV apply the formula in paragraph 6 of schedule 19 to the LBTT(S)A 2013 or see LBTT6011. Our website also has an online tax calculator to help you work this figure out.

To calculate the NPV on a lease review return, you should use:

- The actual amount of rent paid in each of the years preceding the review date; and

- The actual amount of rent payable for each year in the remaining term. If the amount of rent to be paid varies in accordance with the provisions of the lease (for example, where there are rent reviews or in turnover leases), then a reasonable estimate should be provided (see LBTT6005).

Total tax already paid

You must answer this question.

Enter the total amount of LBTT already paid on this lease to date, taking account of any adjustments made on previously submitted review returns.

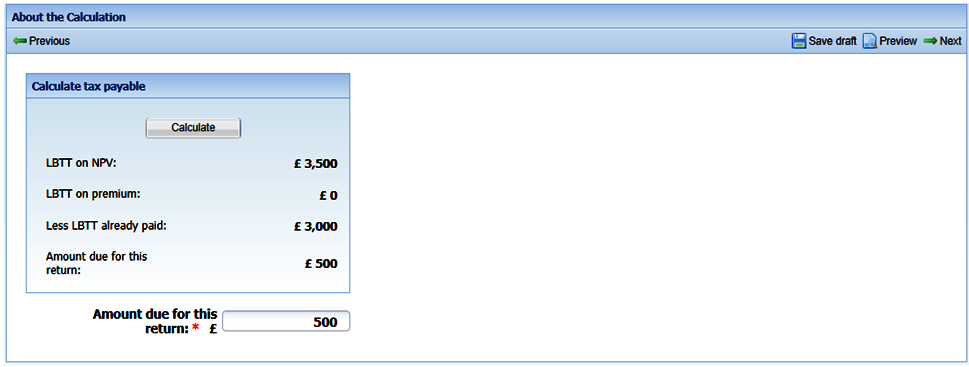

- About the Calculation

-

Image

Assistance with the calculation can be found by selecting ‘Calculate’ in the ‘Calculate tax payable’ box which will display the total tax payable based on the information you have entered elsewhere in the LBTT return. Please note however that because LBTT is a self-assessed tax the tenant is ultimately responsible for the amount entered against this question. While we have provided the ‘calculate tax payable’ function for your assistance, we take no responsibility for your use of it in answering this question

Amount due for this return

This field will be pre-populated but the figure is editable. This figure should equal the amount of LBTT payable on the lease after deducting any reliefs claimed and tax already paid.

- Declaration

-

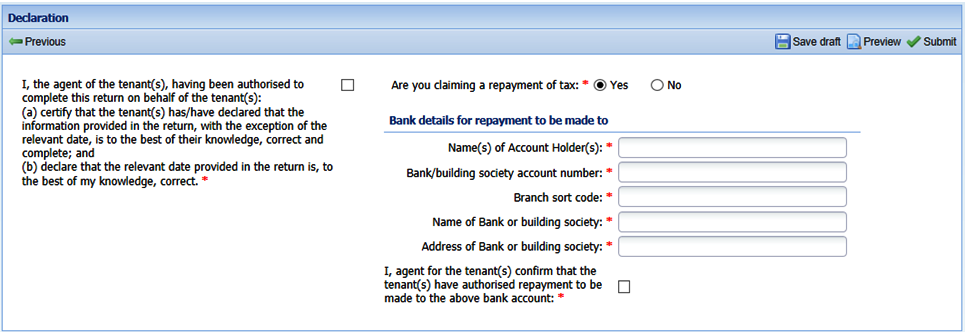

If after having read the declaration statement you are content to give your agreement to it, you must declare this by selecting the check-box beside the statement.

You cannot submit and make an LBTT return without completing the declaration statement.

Note: For the avoidance of doubt, where an agent is completing and submitting this return on behalf of a taxpayer, we will assume that the declaration is made by the agent specified in the ‘Agent Details’ sub-section of the ‘About the Tenant’ section of the return.

Where legislation requires more than one person to make the declaration, you must do this by making a paper LBTT return.

Once you have completed the declaration statement, you will be presented with one of three options:

Additional tax payable

You must now select an appropriate ‘Payment method’ from the drop-down list.

Note:

- if you have not already set up arrangements to pay by Direct Debit then that option will not be visible and only ‘Cheque’ and ‘BACS/CHAPS’ will be available;

- we accept Faster Payments. If you wish to use this option, select the ‘BACS/CHAPS’ option.

See the separate ‘How to pay LBTT’ guidance on our website for more information on payment options and methods.

Depending on which ‘Payment method’ option you selected, the latest “Payment Date for arrangements satisfactory” field will automatically update in accordance with the payment date rules covered in the separate ‘How to pay LBTT’ guidance on our website.

Note: Any tax due is treated as paid on time if arrangements satisfactory to us are made at the same time as the LBTT return and the full payment is received no later than the return filing date.

Less tax payable

Image

Are you claiming a repayment of tax?

You must answer this question.

Select the radio button to tell Revenue Scotland whether you intend to claim repayment of the tax overpaid.

If the answer to the previous question is ‘Yes’, the following mandatory fields will be enabled:

- Name(s) of Account Holder(s);

- Bank/building society account number;

- Branch sort code;

- Name of Bank or building society;

- Address of Bank or building society.

Please check that the bank details are correct before completing the declaration confirming that the tenant(s) have authorised repayment to be made to that bank account.

Once you are satisfied that all the details are correct you can submit the return.

Interest is due on a repayment of LBTT and we will include this in the sum that we repay.

We aim to deal with all repayment claims for which we have full information within 10 working days of receiving them.We will contact you if we need further information to enable us to make the repayment.

No further tax payable

Once you are satisfied that all the details are correct you can submit the return.

- Submitting the return

-

Assuming your system Administrator has given you the relevant permission to do so, when you have completed the LBTT return and are ready to submit it, select ‘Submit’ on the far right side of the ‘Declaration’ page. If you select ‘Submit’ and an error dialogue box appears, you must correct any relevant errors before you can successfully submit the return.

The return will then be submitted electronically to Revenue Scotland and given a unique transaction reference which will be displayed to you on the screen. This number must be quoted when making payments in relation to the same transaction or when contacting us about the transaction.

A summary of the return details will be displayed both on the ‘Overview’ page under the ‘Tax Returns’ tab and in the ‘Dashboard’ tab, and at any time you will be able to view or download (and then print) a copy of the return, as well as being able to amend the return if within 12 months of the filing date (see ‘General guidance about the LBTT return’).