Performance overview

Introduction

This section outlines Revenue Scotland’s purpose and vision, our key activities, organisational structure, strategic objectives, and the key risks we faced during the financial year.

Who we are and what we do

Revenue Scotland was established under the Revenue Scotland and Tax Powers Act 2014 (RSTPA). We are responsible for the collection and management of the fully devolved Scottish taxes: Land and Buildings Transaction Tax (LBTT) and Scottish Landfill Tax (SLfT). We are currently working on the introduction of two new devolved taxes, Scottish Aggregates Tax (SAT) and Scottish Building Safety Levy (SBSL).

As a Non-Ministerial Office and a Crown Body, we are part of the Scottish Administration and we are accountable directly to the Scottish Parliament, ensuring the impartial administration of taxes. We provide policy development support through the provision of advice, data, and information based on our operational experience to the Scottish Government which is responsible for tax policy and the setting of tax rates and bands.

We are also proud to work alongside the Scottish Fiscal Commission (SFC), which is responsible for providing independent forecasts of tax revenue in line with the Fiscal Framework. To aid forecasting work, we provide anonymous, aggregated SLfT and LBTT data to the SFC.

We delegate specific functions for SLfT collection to the Scottish Environment Protection Agency (SEPA) and collaborate with His Majesty’s Revenue and Customs (HMRC) on tax compliance activity. We also actively participate in the British Isles Tax Authorities Forum, working closely with other tax authorities to share knowledge and best practices in tax collection and management. The Devolved Tax Accounts published alongside the Resource Accounts for Revenue Scotland demonstrate the value achieved from the operations of Revenue Scotland in the operation of the Devolved Taxes.

How we are governed

The Revenue Scotland Board is responsible for the strategic direction, oversight, and governance of the organisation. As at the 30 March 2025, the Board comprised seven

members appointed by Scottish Ministers through the Scottish Public Appointments process. Board members provide specialist knowledge in key areas and act as ambassadors for the organisation.

The Board has two committees: the Audit and Risk Committee (ARC) and the Staffing and Equalities Committee (SEC), which provide direction, support and detailed scrutiny of key areas of work and report on these matters to the Board. The Chief Executive is accountable to the Board and acts in a personal capacity as the Accountable Officer for Revenue Scotland.

The ARC supports the Accountable Officer on matters related to risk, control, governance and associated assurance processes. The Committee reports to the Accountable Officer and the Board following each of its meetings, through an annual report on its activities and effectiveness and via additional reports on emerging issues as and when required. The Chief Executive is responsible for the day-to-day leadership and operation of the organisation.

On the 1 July 2025 we welcomed the appointment of two new members to our Board, Gillian Wheeler and Alison Macdonald, following a formal Public Appointments process which had commenced during 2024-25. These appointments will be for an initial period of three years from the 1 July 2025 to 30 June 2028.

Gillian Wheeler is a senior executive, international tax lawyer, and mediator with extensive experience across legal, corporate, and professional services. Gillian brings deep expertise in governance, risk, finance, and organisational change, with a strong track record across sectors including property, healthcare, energy, and finance.

Alison Macdonald is a Chartered Banker with senior experience in financial services, including as Chief Controls Officer at Lloyds Banking Group. She brings expertise in risk, governance, and strategic change, and holds non-executive roles focused on sustainability and inclusion. She is Chair of climate resilience charity Verture and Trustee of Lar Housing Trust.

These appointments follow Martin McEwen’s departure at the end of June 2025 and in anticipation of Jean Lindsay stepping down in June 2026.

We warmly welcome Gillian and Alison, who will bring a wealth of diversity and experience to the Board.

We have also taken action to bolster our Board committees, through the appointment of non-voting, co-opted, members.

Biographies of the new and co-opted members can be found on our website.

Further details about the activities of the Board, committees, and staff can be found in the Accountability Report section of the Annual Report.

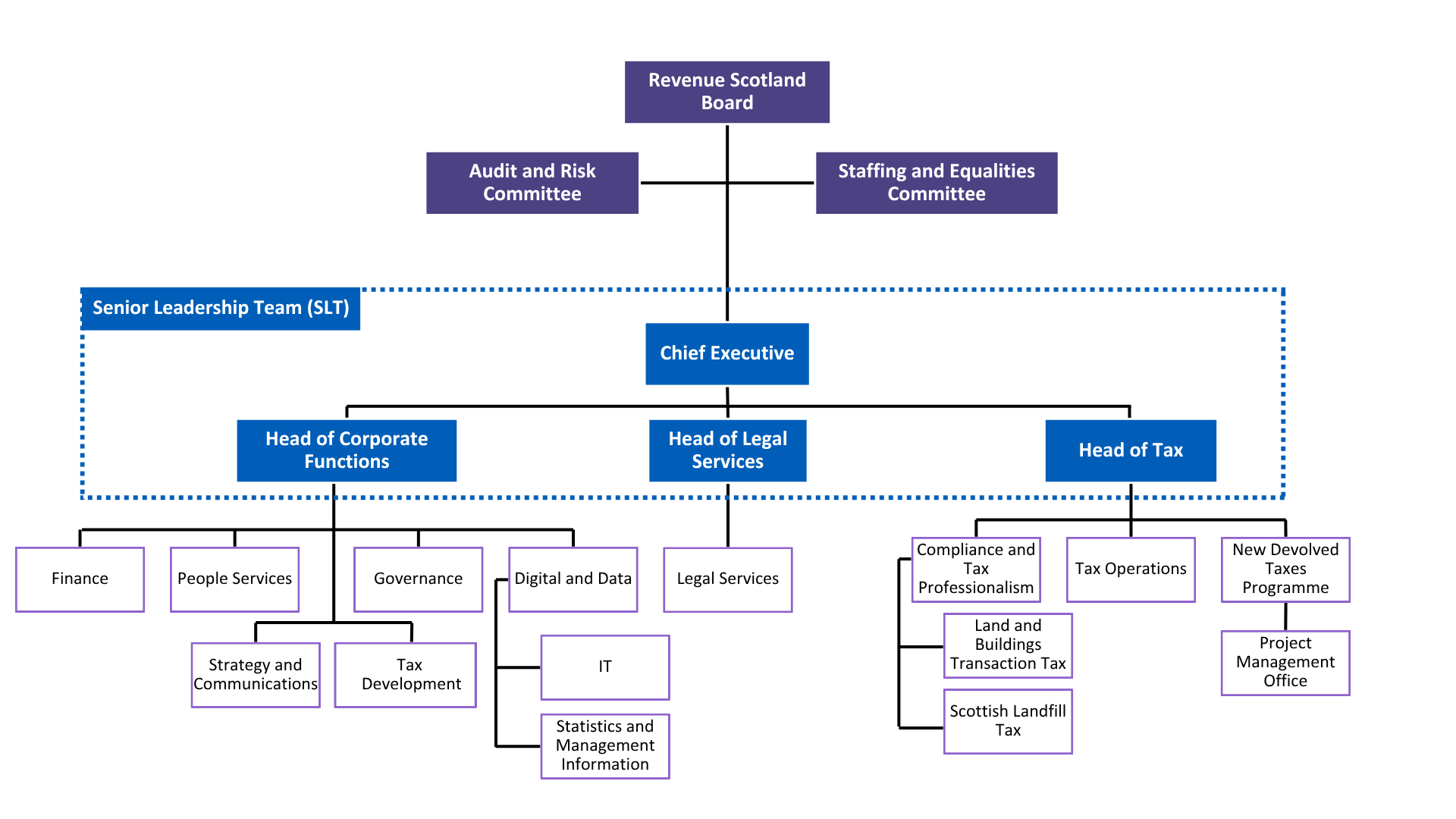

Our organisational structure

Our Senior Leadership Team is led by the Chief Executive and includes the Head of Tax, the Head of Corporate Functions, and the Head of Legal Services. It provides operational leadership, and the direction and coordination of the delivery of our strategic outcomes.

Our organisational and team structure is depicted in the diagram below, providing a visual representation of the Senior Leadership Team’s role within our organisation.

How we are funded

Revenue Scotland is part of the Scottish Administration, and our budget is set by the annual Budget Bill. The Scottish Government liaises with us to identify our budgetary requirements which are then reflected in the Budget Bill which Ministers present to the Scottish Parliament. Where additional funding for major programmes is required, proposals for funding are developed in line with the guidance on business cases in HM Treasury’s ‘The Green Book: appraisal and evaluation in central government’.

We are responsible for managing our budget for each financial year to deliver our statutory functions. We have authority to incur expenditure on individual items, but this is subject to the limits imposed by the budget allocated by the Scottish Parliament and guidance from Scottish Ministers.

Our Framework Document, refreshed during the year as described below, sets out the funding arrangements agreed between Revenue Scotland and Scottish Ministers and the agreed governance, risk, assurance and monitoring arrangements in place.

Corporate Plan 2024-27

Our fourth Corporate Plan, Corporate Plan 2024-27, was laid in Parliament in March 2024 in accordance with the requirements of the Revenue Scotland and Tax Powers Act 2014. This plan builds on the strong foundations of the past while adapting to a rapidly evolving landscape. It defines our purpose, vision, strategic outcomes and success measures, and sets out our priorities for the corporate plan period which guide our work to collect and manage devolved taxes efficiently and effectively in support of Scotland’s public services.

Strategic outcomes

Our Corporate Plan 2024-27 introduces four new strategic outcomes focused on Operational Excellence, Investing in our People, Working with Others, and Expanding Horizons. These outcomes shape our priorities over the next two years, ensuring we continue to deliver a trusted, accessible and well-governed tax administration service that supports Scotland’s people, economy and environment. Further details on the strategic outcomes can be found below.

Overview: How we deliver our purpose and measure our success

Our purpose is delivered through the strategic outcomes in our Corporate Plan, with progress tracked using success measures (see below), milestones related to key project objectives, and internal key performance indicators (KPIs).

Our Business Plan details projects and initiatives supporting these outcomes, guiding team and individual goals. This approach ensures a direct connection between individual work goals and the strategic outcomes defined in the Corporate Plan. Our systematic method of managing performance underpins our ability to track and document progress throughout the organisation.

National Performance Framework and National Outcomes

The National Performance Framework (NPF) underpins the Scottish Government’s vision, setting out National Outcomes to measure progress towards its goals. Our Corporate Plan is aligned with these Outcomes, guiding our efforts to support those relevant to Revenue Scotland’s remit.

Following the recent statutory review of the National Outcomes, and the subsequent Scottish Parliament inquiry, the Scottish Government has committed to a period of reform of the NPF to support the development and implementation of a more strategic and impactful framework for Scotland.

The current 11 National Outcomes are still in operation as is the duty (set out in the Community Empowerment (Scotland) Act 2015) on public bodies to have regard to them. By collecting devolved taxes, we indirectly support all National Outcomes, and directly contribute to six specific areas:

- economy

- environment

- fair work and business

- communities

- human rights

- health

Our approach emphasises investment in our workforce, dedication to equality, diversity, and inclusion, and collaboration with various partners, all underpinned by transparency and accountability.

The delivery of our Corporate Plan 2024-27 involves clearly defined objectives and deliverables, implemented through detailed strategies which include corporate, business and team plans. We track our progress rigorously, with monthly and quarterly performance reviews.

The following table shows which Revenue Scotland strategic outcomes are relevant to the various National Outcomes.

| National Outcomes | Operational Excellence | Investing in our People | Working with Others | Expanding Horizons |

|---|---|---|---|---|

| We grow up loved, safe and respected so that we realise our full potential | ✓ | |||

| We live in communities that are inclusive, empowered, resilient and safe | ✓ | ✓ | ||

| We are creative and our vibrant and diverse cultures are expressed and enjoyed widely | ✓ | ✓ | ||

| We have a globally competitive, entrepreneurial, inclusive and sustainable economy | ✓ | ✓ | ✓ | |

| We are well educated, skilled and able to contribute to society | ✓ | ✓ | ||

| We value, enjoy, protect and enhance our environment | ✓ | ✓ | ||

| We have thriving and innovative businesses, with quality jobs and fair work for everyone | ✓ | ✓ | ||

| We are healthy and active | ✓ | ✓ | ||

| We respect, protect and fulfil human rights and live free from discrimination | ✓ | ✓ | ✓ | |

| We are open, connected and make a positive contribution internationally | ✓ | ✓ | ||

| We tackle poverty by sharing opportunities, wealth and power more equally | ✓ | ✓ | ✓ |

Key Issues and Risks Summary

This corporate risk summary provides an overview of the key risks we have faced, their impact on delivering our strategic outcomes, and emerging risks that may affect our future performance. Further details on these risks are provided in the analysis section.

We have a Risk Management Framework that follows the best practices outlined in the Scottish Public Finance Manual (SPFM) and the Scottish Government’s Risk Management Guidance. This framework guides us in identifying, documenting, and scoring risks. It helps us to assign ownership, determine responses, monitor, and report risk management progress.

Managing and communicating potential threats and opportunities is key for meeting the ambitions in our Corporate Plan. The Audit and Risk Committee, together with staff, undertook a detailed review of our Corporate Risk Register during the year to ensure that our corporate risks accurately reflected the key risks to the achievement of the outcomes we set in our new Corporate Plan for 2024-27.

Before taking any action, we thoroughly assess risks using a combination of the likelihood of the risk occurring and the impact on our activities if it did. The concept of ‘risk appetite’ - the level of risk we are willing to accept to achieve our objectives - helps create a shared understanding across Revenue Scotland and supports confident, risk-based decision-making.

Robust management is in place and our approach to risk management is fully detailed. Full details on all our corporate risks are detailed further in this document. The risks presented below are a summary of our key risks as of 31 March 2025.

Summary of Corporate Risks

| Risk | Risk descriptor |

|---|---|

| Delivery of new taxes |

Recognises our ability to deliver new taxes and our core statutory purpose of collecting and managing Scotland’s devolved taxes. We have a devolved taxes programme in place to manage the introduction of new taxes. Our Senior Leadership Team meetings are structured to provide strategic focus on the delivery of new projects and programmes. |

| Communication and stakeholder engagement |

Recognises our need to have appropriate internal and external engagement to achieve our corporate plan objectives. We have actively participated in a number of high-profile external events in 2024-25 and our engagement has extended into significant areas of public interest. |

| Corporate transformation |

Recognises our need to continuously improve, adapt to change and embed new systems, policies and procedures. We engage regularly with Scottish Government at all levels. |

| Data optimisation |

Allows us to exploit the potential in our data and realise the opportunities to link to other data sets to improve the design of our systems, deliver evidence-based operational efficiencies and identify areas for innovation. We have a Digital and Data strategy overseen by the Data Digital Programme Board |

Key Projects

Performance Summary

Our Business Plan for 2024-25 outlines key programmes of work, and projects aligned with the first year of our new Corporate Plan. These represent significant investments or carry a high-level of importance, playing a vital role in achieving our strategic outcomes. At the end of this period all of our projects either remain on track for delivery or have been successfully completed.

All of our key projects are linked to our Corporate Plan ambitions. We work closely with our stakeholders as part of the development of our projects (Working with Others), and we ensure our staff receive learning and development opportunities to deliver the projects (Investing in our People). Our key projects also deliver our ambitions of Expanding Horizons, and Operational Excellence, by improving our ways of working, and sharing our learning with others.

| Project and scope | Progress | Status |

|---|---|---|

| SAT Programme | The work to implement SAT is progressing in line with our programme plan. Our SAT digital module has been built and tested, with work to deliver wider business readiness on track. We continue to engage closely with the Scottish Government Bill team in finalising legislation, and with stakeholders across the industry as we prepare for the introduction of the tax from 1 April 2026. | On track |

| SBSL Programme | We work closely with the Scottish Government on the development of the SBSL. This project, along with that for SAT, forms our New Devolved Taxes Programme and benefits from a consistency of approach. Initial work has commenced on both digital and business requirements, and we are represented on the Expert Advisory Group which is informing our understanding of the industry and design of the tax. Work is progressing in line with the overall plan as we prepare for the introduction of the tax from 1 April 2027. | On track |

| Data and Digital Programme | A new Digital and Data Programme Board has been established including external representatives from across government to provide oversight and assurance. The programme has made progress against all seven missions in the Strategy. | On track |

| Stakeholder Engagement Programme | We delivered a new Engagement Plan in June 2024 to take a more coordinated approach to stakeholder engagement activity across Revenue Scotland, and deliver our ambitions of acting as a sector connector. The plan supports teams in identifying gaps and areas for improvement, while keeping responsibility for engagement within each business area. Workshops are held every 6 months to identify priorities, capture learning, and identify new or changing stakeholders. We have introduced new tools to support engagement, with further improvements under way | On track |

| Scottish Government Business Transformation Project | In October 2024, the Scottish Government introduced a new digital platform for HR functions. This represented a new shared service for Revenue Scotland. We continue to engage in the improvement and future development of the platform. | Complete |

| Land and Buildings Transaction Tax (LBTT) Lease Improvement Project | We made good progress across all areas of the Lease Improvement Project in 2024-25. Engagement with high-volume tenants is underway, supported by user research. We also completed the design phase for digital and communications improvements. Our data-sharing pilot with local authorities was approved in October 2024 and is progressing well. A targeted communications strategy has been developed, with implementation of improvements due to begin in 2025-26. | On track |

| Legislative Framework Project |

We made significant progress on the Legislative Framework Project in 2024-25, forming a Tax Partnership Board with the Scottish Government to enable joint oversight of a prioritised programme of legislative work on the devolved taxes. A formal programme is now in place, including the LBTT review committed to in the Scottish Budget 2025-26. This review, which also features in Scotland’s Tax Strategy, supports evaluation of key legislative provisions and will inform decisions in the next Parliament. |

On track |

| People Strategy Action Plan | The People Strategy was developed in consultation with staff, the Senior Leadership Team, and the Staffing and Equalities Committee. The People Strategy, and supporting action plan, was submitted to the Board for approval in May 2025. | On track |

| New Staff Intranet Project | We successfully launched the platform for a new staff intranet. It offers improved usability, search functionality, and content management. A new approach for updating and refreshing the content on our intranet is underway | Complete |

Success Measures

The Corporate Plan 2024-27 outlines our key success measures which track our progress and alignment with strategic outcomes. These success measures are detailed in the Performance Analysis section of this Annual Report.

The success measures assess our progress in delivering our four strategic outcomes: Operational Excellence, Investing in our People, Working with Others, and Expanding Horizons. They provide a clear framework for evaluating our effectiveness in areas such as tax collection performance, service user satisfaction, and workforce diversity. These measures demonstrate our commitment to continuous improvement, enhancing digital capabilities, and supporting the development of new and existing taxes in collaboration with stakeholders.

| Success measure | 2024-25 | 2023.24 | Status | More info |

|---|---|---|---|---|

| A tax collection rate (i.e. tax collected as a proportion of tax declared) of 99% or more | 99% | 99% | Achieved | More info |

| A cost of collection ratio of 1% or less | 0.93% | 0.87% | Achieved | More info |

| A service user satisfaction score of 75% or higher | 76% | 76% | Achieved | More info |

| An annual People Survey Score in the top 25% of Civil Service organisations | Combined rank of 8 out of 103, within the top 25% | Combined rank of 8 out of 103, within the top 25% | Achieved | More info |

| Evidence Revenue Scotland has taken action to expand the diversity of the workforce and Board, to advance equality of opportunity | Green | N/A | Achieved | More info |

| Case studies will provide evidence Revenue Scotland is actively engaging with national and local authorities to share tax knowledge | Green | N/A | Achieved | More info |

| Case studies will provide evidence Revenue Scotland is actively engaging with the Scottish Government and other public bodies to support Scotland’s Public Service Reform ambitions | Green | N/A | Achieved | More info |

| Evidence Revenue Scotland has actively worked in partnership with the Scottish Government to develop and deliver new devolved taxes will be reported each year in the Annual Report and Accounts | Green | N/A | Achieved | More info |

| Evidence Revenue Scotland has contributed knowledge and supported the development of new and existing local taxes will be reported each year in the Annual Report and Accounts. | Green | N/A | Achieved | More info |

Footnote:

RAG Status Definitions:

Red: Significant concerns; the measure is off track and unlikely to meet targets without

immediate intervention.

Amber: Some concerns; the measure is at risk but can recover with corrective action.

Green: The measure is on track to achieve its target.

Financial Performance – Resource Accounts

The figures given below are the final budget (revenue and capital) after adjustment in the Spring Budget review.

| Net Expenditure against Resource Budget |

Budget - Resource and Non Cash £000 |

Total Actual - Resource and Non Cash £000 |

|---|---|---|

| 2024-25 | 9,100 | 8,694 |

| 2023-24 | 7,872 | 7,832 |

| Expenditure against Capital Budget |

Budget - Capital £000 |

Total Actual Capital £000 |

|---|---|---|

| 2024-25 | 1,200 | 1,252 |

| 2023-24 | 500 | 500 |

In 2024-25 revenue expenditure was £406,000 (5%) less than budget. This underspend was primarily due to delays in filling vacancies across several business areas, as well as a targeted review of discretionary spending and capitalising of bulk laptop purchases. These measures were implemented to support the Scottish Government’s wider programme of savings and efficiency improvements.

£52,000 capital spend variance (4% of the capital budget) is due to the bulk purchase of laptops in-year costing £60,548. This was provided for within the Resource budget, however the bulk purchase of laptops are capitalised as per accounting standards.

Financial Performance - Devolved Taxes Accounts

The LBTT revenue collected is dependent on performance of both the residential and non-residential property markets within Scotland. The SLfT revenue collected is dependent upon categories and tonnage of waste deposited in landfill sites within Scotland.

Independent forecasts of LBTT and SLfT revenue are published by the Scottish Fiscal Commission (SFC). The SFC publishes forecast evaluation reports comparing outturn figures to Budget Act estimates, detailing the reasons for any differences observed.

| Revenue net of repayment, excluding interest payable and revenue losses |

2024-25 Tax, penalties and interest receivable £000 |

2024-25 Budget Act Estimates £000 |

2023-24 Tax, penalties and interest receivable Total £'000 |

|---|---|---|---|

| LBTT | 899,162 | 730,000 | 784,372 |

| SLfT | 55,938 | 58,000 | 68,372 |

| Penalties and interest | 6,457 | 0 | 2,714 |

| Total | 961,557 | 788,000 | 855,458 |

The values in the above table are for tax returns and amendments submitted during 2024-25. They are adjusted for the value of LBTT and SLfT returns received during April and May 2025, which relate to the period up to March 2025.

The tax returns submitted during 2024-25 may include adjustments to returns originally submitted in previous financial years.

However, unless these adjustments were received in April or May of the relevant financial period and therefore accrued into the financial statements of that year, these are accounted for in the year of receipt.

A summary of the tax revenue and our resource spend over the period 2019-24 is shown below and this forms part of our Performance Report.

Performance analysis

Introduction

The purpose of the performance analysis section is to provide a detailed analysis of our performance in 2024-25.

At the beginning of 2024-25 we published our new Corporate Plan 2024-27. The Corporate Plan has four strategic outcomes:

- Operational Excellence

- Investing in our People

- Working with Others

- Expanding Horizons

Each of our strategic outcomes are evaluated by corporate success measures. At the beginning of this corporate plan period, we developed a three year business plan to enable us to deliver the strategic outcomes. Sections 3-7, below, discuss our performance in relation to each of the strategic outcomes. Section 8 discusses our wider corporate performance.

Operational Excellence

Introduction

At the heart of Revenue Scotland’s work is our commitment to delivering reliable, efficient, and user-friendly digital tax services that support compliance and trust in the tax system. Our ambition is to be a digital and data-informed organisation with robust systems for both stakeholders and staff. This supports the accurate and efficient collection of tax and ensures high quality user experience.

To achieve this strategic outcome, our Corporate Plan 2024-27 sets out four key priority areas, each one of which is discussed in the remainder of this section:

Improving the guidance available to taxpayers

Work with taxpayers to improve guidance, webinars, and systems designed to enable taxpayers to comply with their obligations.

Optimising our digital architecture

Create a single end-to-end digital tax service, which is modular by design to provide resilience and flexibility to make better use of data and administer additional taxes.

Increasing our use of automated processes and reporting

Improve our efficiency and effectiveness of our processes, enhance reporting capability and enable our staff to spend more time on fulfilling work.

Designing user-centric systems

Collaborate with users of our systems to gather insights, ensuring they have an excellent experience as they engage with us and our systems.

Improving the guidance available to taxpayers

We have an ongoing programme to update and improve our guidance pages, and we also regularly review any service user feedback on our website guidance, and take appropriate action where necessary.

In 2024-25 we made updates to our technical guidance pages, improvements to the worked examples, and the calculators provided on our website. These changes provide additional clarity, explain legislative changes, and reflect decisions arising from Tribunal cases. Examples of these improvements include:

How to claim a repayment of Additional Dwelling Supplement (ADS): We updated our guidance presenting it in clearer, plain English, and to reflect legislative changes. We also created a step-by-step ‘How to’ video to support service users through the process.

Green Freeport Relief: We added new sections to our guidance covering the introduction of Green Freeports LBTT relief and the designation of Green Freeport sites.

SETS and Secure Messaging Support: We revised our help guides for the Scottish Electronic Tax System (SETS) and published a dedicated guidance page for using our Secure Messaging Service (SMS).

We published our Approach to Tax Compliance, setting out the principles which underpin the way we undertake and focus our compliance activities.

Land and Buildings Transaction Tax (LBTT) Lease Improvement Project

Tenants of non-residential property in Scotland who have paid LBTT on their lease are required to submit further tax returns every three years throughout the duration of their lease in order to achieve the correct tax position should the terms of their lease change. Helping taxpayers to comply with their tax obligations has continued to be priority for Revenue Scotland.

During 2024-25 we developed a new lease strategy with the overarching aim of raising taxpayer awareness of their obligations and increasing the compliance rates for three-yearly lease reviews.

The data workstream within the project is currently focused on working with tenants who have a high volume of leases to gain insight and identify opportunities for improvement. We also engaged with key stakeholders to further support our aim of improving return rates by raising awareness of taxpayer obligations. Engagement has included delivering webinars, advertising through social media platforms and utilising business support organisations and local authority websites to share access to the LBTT guidance. We have received positive responses from taxpayers, agents and wider stakeholders who have praised our approach in supporting taxpayers to improve their processes to meet their tax obligations. Relevant stakeholders have also worked with us to post information on their organisations' websites to promote three yearly obligations.

We are the first organisation to gain approval from the newly created Scotland Debt and Fraud Data Sharing Review Board for data sharing under the Digital Economy Act (DEA) 2017. The DEA allows public bodies to share data if it can be used to identify and recover debt owed to the public sector or to combat fraud.

We identified that Non-Domestic Rates data held by Scottish local authorities could be used to highlight non-compliance with certain lease review return obligations. In 2024 we launched a pilot using the DEA debt provisions to facilitate a data share with three Scottish local authorities:

- Fife

- Falkirk

- Perth & Kinross

If successful, we would seek to reach agreement with other local authorities to extend the pilot. Collaborating with local authorities for this pilot has also led to further discussions, exploring mutual compliance benefits that could be obtained.

To better understand the needs of taxpayers with lease agreements, we have conducted a range of other activities designed to gather valuable user insights. Examples of this are a review of the user journey to identify areas for improvement in our guidance and correspondence. We have also conducted meetings with users to gain feedback on their interactions with us, and to better understand any challenges they have and how we might overcome them. Based on the insights gathered, we have proposed changes to our digital platforms to increase filing accuracy and developed additional communications for our taxpayers and their agents to help to reduce non-compliance.

We have enhanced our approach to communications and engagement by introducing a social media advertising campaign to reach smaller businesses with leases. We have also been expanding our reach by engaging with business support organisations, and worked in partnership with local authorities and Scottish Government to raise awareness of three-yearly lease reviews by adding information and guidance links to their websites. The evidence gathered from the various activities highlighted above has helped to inform the LBTT review.

Optimising our Digital Architecture: the Digital and Data Programme

In 2024-25 we began the implementation of the Digital and Data Strategy, which supports the Corporate Plan 2024-27 to ensure we achieve our digital vision:

‘To transform the way that people experience and engage with Scotland’s taxes and related public services, by delivering an end-to-end digital service which maximises the potential of our data and positions us as a leader in the public administration tax environment.’

The Public Sector Cyber Resilience Framework was published in December 2024 and this programme and strategy follow the best practices noted there including for cyber-security, business continuity planning and in terms of improving our cyber resilience.

To provide appropriate governance and oversight of the delivery of the programme, we have established the Digital Data and Technology Programme Board which includes representatives from Registers of Scotland and Scottish Government. We are grateful to both for their time and insights which have helped to guide our activities.

The Strategy has seven themes, or ‘missions’, to track the progress of delivery:

Mission 1: Building a new digital team

As our digital services mature and we look to make better use of our data and other data sources. We have created a Digital, Data and Technology (DDaT) function as part of Corporate Functions, consisting of the existing Statistics and Management Information team, IT team and the creation of a new Product and Design team. This team has been created to develop our in-house capability in business analysis and user-centred design. This will improve our ability to prioritise enhancements to our digital systems and customer experience.

Mission 2: Developing our digital tax architecture

We have redesigned our continuous improvement programme for the SETS system to ensure we are focusing on thematic strategic improvements which will bring the most value for tax administration and our users.

Mission 3: Supporting the development of new taxes and Continuous Improvement

The DDaT team has continued to support the New Devolved Taxes programme to implement SAT and SBSL in SETS. In addition, the team continues to build improvements to our current systems through a continuous improvement project.

Mission 4: Building a new data platform

We have worked with colleagues within Scottish Government to specify and design a new data platform to allow us to improve our analytics capability and exploitation of data.

Mission 5: Focusing on data quality and standards

All of the improvements to our digital services are dependent upon having high quality, standardised data. We have put into place a programme to tackle data quality issues, both on new data entry and retrospectively correcting our historical data.

Mission 6: Developing our capability in property and geospatial data

Most of the data we hold has some geographical element to it, whether a residential address or the location of a landfill site, and so we are developing our expertise in using this data. We are working closely with Ordnance Survey to support this capability building, and have set up a special interest group for other Scottish public sector organisations to share knowledge and best practice.

Mission 7: Building our digital and data literacy

Building our digital capability needs to be accompanied by ensuring our staff have the knowledge and confidence to make the best use of data and digital technology. We have begun planning a programme of work for 2025-26 that will align with the Scottish Tax Education Programme (STEP) syllabus and provide expert support to Revenue Scotland staff in using data and digital tools, including the use of AI.

Increasing our use of automated processes and reporting: the Continuous Improvement Project

Over the past year, the DDaT Programme has continued to advance the functionality and performance of our core tax system (SETS) through the Continuous Improvement Project (CIMP). This initiative is central to improving operational efficiency, accuracy, and user experience across the end-to-end tax journey. By addressing pain points and modernising our digital infrastructure, CIMP ensures that SETS remains responsive to the evolving needs of taxpayers, internal users, and legislative demands.

Operational Enhancements

This year we extended the streamlining of our core back-office services through investment in our tax collection system SETS. This capability balances efficiency with human decision making at the appropriate stages.

Using experience gained from the introduction of standardised letters in 2023-24, we established a multi-disciplinary team to ensure internal service users’ needs were met. End users were actively involved in documenting business requirements and conducting user testing. This approach enabled a seamless integration into operational delivery.

In 2024-25 we expanded our range of system generated letters. Data from the tax system is now integrated into letters and financial transactions are provided to Revenue Scotland officers for quality assurance checking. This approach increased the efficiency of decision making and reduced the risk of human error. In May 2024, in response to external stakeholder feedback, we introduced functionality in SETS which automatically issued copies of conveyance and lease penalty notices via Secure Messaging System SMS to authorised agents.

To help lease taxpayers to avoid incurring penalties during the daily penalty period, we introduced automated generation of correspondence which issues reminders to taxpayers to submit their outstanding three-yearly lease review return.

We also introduced a digital link between SETS and our third-party print/post supplier for selected correspondence. This enhancement delivered efficiency savings by automatically updating SETS.

During the remainder of our new Corporate Plan period, we will be working on expanding letter functionality to other types of correspondence.

User-Centric Services

Consumer Duty

Revenue Scotland is now subject to the Consumer Duty, which came into effect on 1 April 2024. It requires us, when making decisions of a ‘strategic’ nature about how to exercise our functions, to have regard to the impact of those decisions on consumers in Scotland, and the desirability of reducing harm to them.

To comply with the duty in a proportionate and streamlined way, we developed an Integrated Impact Assessment tool, which brings together the requirements of the Consumer Duty, equalities duties and the Fairer Scotland Duty. This ensures when we are approaching strategic decisions, all these duties are considered early and in the round. It is supported by the roll out of guidance and materials. We intend that this integrated process will enable us to perform these duties in a way that genuinely influences the strategic decisions under consideration.

Acting on User Research

Putting users at the centre of our services remains a core priority for us. We actively seek and value feedback, and we are committed to delivering a high-quality experience for all users. Over the past financial year, we focused on understanding and improving services where taxpayers interact with us most directly.

One example is our review of the current process for submitting LBTT lease transactions and three-yearly lease reviews. To guide this work, we engaged directly with taxpayers to better understand their experiences and identify opportunities for improvement. These insights shaped a series of planned enhancements, which we have included in our roadmap for 2025-26. This initiative supports our strategic outcome of delivering accessible, transparent, digital services that meet user needs. We also recognise that agents and tax professionals, who frequently submit returns on behalf of taxpayers, are among our most active service users. It’s essential that we continue to meet their needs effectively.

A second example is the introduction of a major change to how we manage correspondence: all tax-related communication with registered SETS users is now delivered through our Secure Messaging Service (SMS) on the SETS portal. To ensure this change delivered value, we conducted targeted user research and worked closely with agents to gather feedback. Based on this, we improved SMS by enhancing search functionality, refining the file upload process, and publishing comprehensive guidance to help users get the most from the service.

We also improved the design and usability of our website by aligning it with the Scottish Government Design System (SGDS). This redesign brought several benefits, including:

- a consistent look and feel across our digital platforms - both revenue.scot and SETS now use the same design approach

- inclusive and accessible layouts that follow best practice design standards

- reusable components that support faster development and ongoing improvements

These changes contribute to our broader commitment under the Consumer Duty obligations to ensure our services are transparent, accessible, and designed to support well-informed decision-making.

Looking ahead, we will deepen our understanding of user needs and behaviours through expanded user research and greater use of behavioural and data insights. This will help us design services which are efficient, intuitive, and meet the evolving expectations of taxpayers, agents, and other stakeholders.

Tax Compliance Activity

Our tax compliance work has three key elements, all of which contribute to our work to deliver user-centric services:

Enabling: We help taxpayers to understand and comply with their tax obligations through the services we provide. This includes the publication of clear, informative guidance; a user-friendly online system; our support desk; providing tax opinions; and engaging with and upskilling stakeholders, for example, by presenting technical webinars.

Assurance: We use our resources and statutory powers to ensure the tax system is performing as expected and to help taxpayers to get to the right tax position. This includes checking returns to ensure they are complete, accurate, and that the correct amount of tax has been paid; carrying out landfill inspections; sharing intelligence with other tax authorities; and the use of investigatory powers, statutory enquiries and assessments.

Resolution: We seek to resolve disputes and pursue non-compliance by using our powers proportionately and applying penalties where required.

In 2024-25 we published our Approach to Tax Compliance which outlines the concepts underpinning our compliance work. This document sits alongside our Settlement and Litigation Principles which details the way in which we resolve tax disputes. Along with our guidance, these proactively inform taxpayers about our approach to dispute resolution. See below for details of litigation over the year.

We continue to work closely with other UK tax authorities, sharing information, intelligence and knowledge with HMRC and the Welsh Revenue Authority (WRA). We do this through legislative gateways and through our formal Information sharing agreements.

In addition, we regularly discuss areas of potential legislative change in partnership with Scottish Government policy colleagues. We also frequently meet with bodies such as the Association of Tax Technicians (ATT), the Chartered Institute of Taxation (CIOT), the Convention of Scottish Local Authorities (COSLA), the Institute of Chartered Accountants of Scotland (ICAS), and the Law Society of Scotland (LSS), as well as other industry bodies.

Our data-led approach to identifying tax risks helps to ensure that we maximise our compliance resource. This provides us with an excellent level of assurance of the tax system whilst also targeting the most significant risks.

Our compliance activities secured £3m in tax during the 2024-25 fiscal year. This includes both additional tax identified and ‘tax protected’; for example, where repayment claims were declined because they were found to be unwarranted, directly as a result of our compliance efforts.

This figure represents a strong performance, and whilst lower than the results seen in 2022-23 and 2023-24 it is important to recognise that those years saw exceptional figures reported as a consequence of the culmination of a number of long-running, high value disputes, reflecting compliance work that had spanned a number of years.

The figure does not include the impacts of upstream assurance and compliance activity, such as improving guidance or systems to assist taxpayers to comply with their obligations.

Tax Disputes: Reviews and Appeals

Introduction

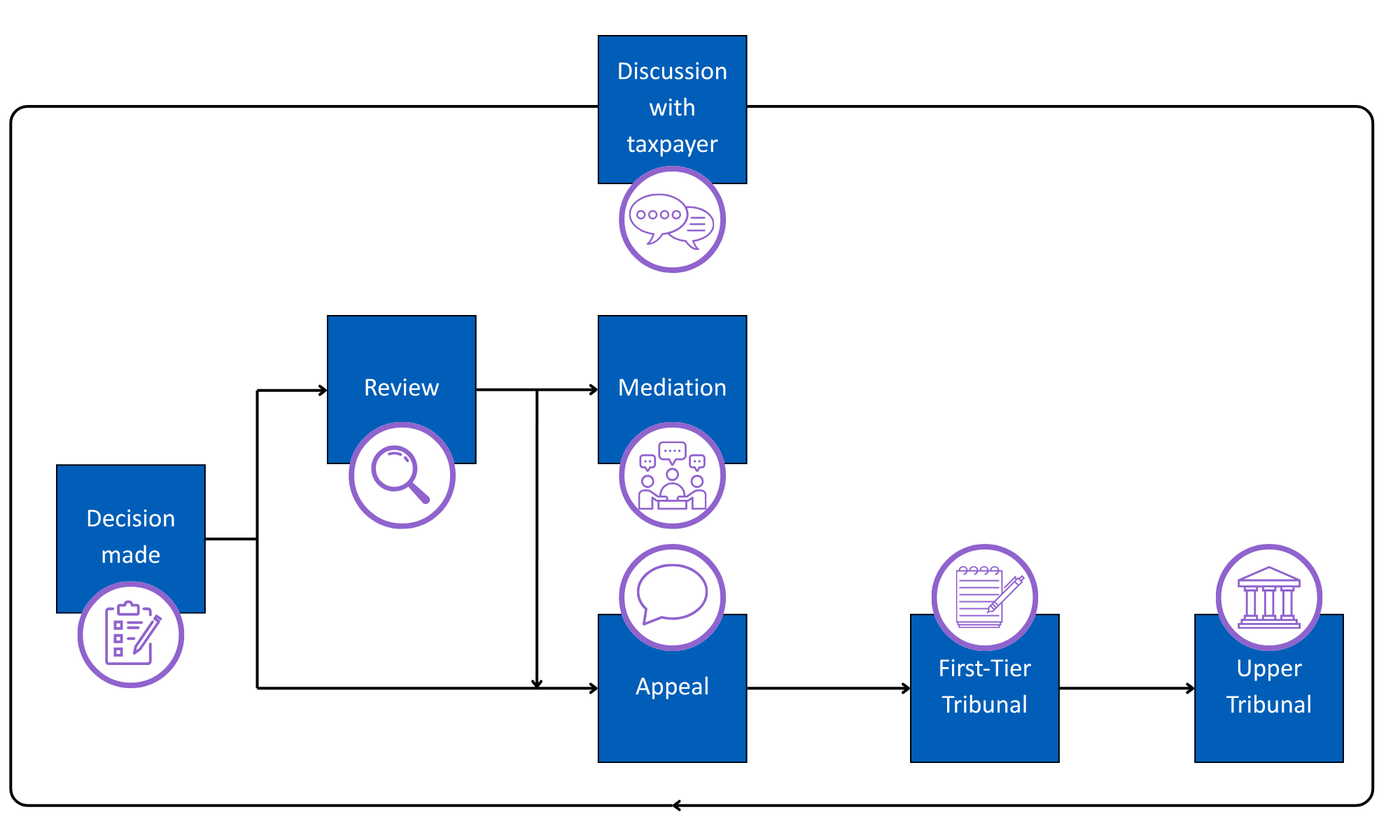

We aim to minimise tax disputes by providing clear information and guidance to taxpayers, and by having robust decision-making processes in place. In the event of a dispute, a taxpayer may request an internal review of a decision, request or agree to mediation, or appeal a decision to the Tax Chamber of the First-Tier Tribunal for Scotland (FTTS).

Taxpayers and their agents have the right to request us to review any decision which affects whether a person is liable to pay tax, the amount of tax due, the date the tax is due and payable and the imposition of a penalty or interest. An independent review of the decision will be carried out by someone who was not involved in making the decision being reviewed. The Revenue Scotland and Tax Powers Act 2014 (RSTPA) sets out the decisions which are reviewable and appealable. An appeal may be made regardless of whether or not a review has been sought or mediation entered into. The FTTS decides appeals against Revenue Scotland decisions, and the Upper Tribunal for Scotland (UTS) decides appeals on a point of law from decisions of the FTTS.

Reviews

In 2024-25, we received 596 requests for a review of decisions made. Of those concluded, we upheld the original decision in 364 cases. In 136 cases, we overturned the original decision, for example due to new information received from taxpayers during the review. We varied 13 decisions, and the taxpayer withdrew one review. The remaining cases were live as at 31 March 2025.

Appeals

We have collected data on appeals since Revenue Scotland was established in 2015. The data shows consistent trends of higher volumes of LBTT appeals compared to SLfT appeals and of the FTTS upholding our decisions in ADS and penalties appeals.

| Appeals | 2024-25 | 2023-24 | 2022-23 |

|---|---|---|---|

| New cases initiated | 29 | 23 | 13 |

| Cases decided | 12 | 6 | 7 |

| Cases settled | 13 | 8 | 11 |

| Cases dismissed | 1 | 2 | 0 |

‘Settled’ covers a range of outcomes including agreement between the parties or withdrawal of the appeal by either Revenue Scotland or the taxpayer. ‘Dismissed’ covers appeals which have been dismissed due to procedural defects e.g. appeals raised in error.

During 2024-25, 29 appeals were initiated in the FTTS, all of which related to LBTT. This is the highest number of appeals initiated in one year. An increase in penalties issued for failure to make an LBTT return for three-yearly lease reviews gave rise to an increase in the number of appeals received. We expect to see a reduction in ADS appeals following legislative changes introduced from 1 April 2024. More information about the changes can be found on our website.

Of those 29 appeals, 23 had been preceded by a review. 24 of them were raised by an unrepresented taxpayer. If requested, we provide guidance to assist taxpayers to understand their obligations.

A taxpayer can opt to have a hearing before the FTTS, either in person or virtually. If they do not want to attend a hearing, then their appeal may be decided on the papers submitted by the parties. Of the appeals received during 2024-25, 11 taxpayers requested hearing. Appeals decided by the FTTS on the papers take an average of 18 weeks to conclude, whilst the average for an appeal involving a hearing is 35 weeks.

During 2024-25, we participated in 8 hearings took place before the FTTS, 1 of which was conducted virtually. We instructed counsel in 3 of these appeals due to the complex nature of the dispute.

The FTTS upheld our original decision in all 12 cases decided in 2024-25. 9 of those appeals had been preceded by a review. We carefully consider our position before entering or continuing litigation, as shown by the 13 appeals settled in 2024-25.

We received approximately 124,000 returns in 2024-25. When considered in relation to that volume of returns, the above illustrates the very low number of disputes per year. This reflects the support and guidance we provide to taxpayers to help them understand and comply with their obligations. For those taxpayers who dispute our decisions and where it is appropriate to do so, we also proactively share examples of reported FTTS case law on similar grounds, to assist taxpayers to understand the rationale for our decision. It also shows we are prepared to vary our decisions where that is justified and that we litigate responsibly.

Finance and Human Resources Business Transformation

In 2024-25, the Scottish Government undertook a significant step in its Corporate Transformation journey with the implementation of Oracle Cloud, a modern, integrated Human Resources (HR) and Finance platform. Delivered by the Scottish Government’s Shared Services Programme Team, this initiative replaced multiple legacy systems, consolidating them into a single solution designed to streamline operations, enhance efficiency, and support data-driven decision-making.

The implementation of Oracle Cloud in October 2024 marked a pivotal moment in the Scottish Government’s ambition to become a digitally enabled, collaborative organisation. Developed in close collaboration with colleagues across the wider Scottish Government family, the programme was underpinned by a shared commitment to modernising back-office functions and improving corporate services. The new system provides real-time access to accurate workforce and financial data, enabling better planning, improved user experiences, and more informed outcomes.

A key feature of the transformation was the introduction of professions aligned with the wider Civil Service, supporting improved workforce planning. The Scottish Government identified 21 professions across its main bargaining unit, including Tax, led by 'Revenue Scotland's Head of Tax. Revenue Scotland’s workforce spans nine of these professions, such as HR, Legal, Tax, Statistics, Digital Data and Technology, Operational Delivery, Finance, Communications, and Project Management.

To support this transformation, several people-related policies were also enhanced. These changes reduced reliance on HR back-office functions and increased accountability among staff and line managers through a self-service model. A comprehensive communication and training plan ensured staff were well-prepared and confident in using the new system. The Scottish Government pay award 2023-25 included the reduction in working week from 37 to 35 hours with effect from October 2025. The transformation included a complete overhaul of recruitment processes. Revenue Scotland successfully delivered this significant programme of change with minimal disruption. Encouragingly, a recent pulse survey showed that 86% of respondents reported being able to consistently work a 35-hour week without any negative impact on their workload.

Throughout the transition, regular communications, focus groups, and training resources played a vital role in supporting staff. These resources continue to be available post-implementation, reinforcing the Scottish Government’s commitment to continuous improvement and user support.

Investing in Our People

Introduction

Our success is built on the skills, commitment, and wellbeing of our people. We aim to be a high-performing, inclusive and supportive workplace where individuals feel valued, empowered, and able to thrive. Our ambition is to be known as an employer of choice, where people are trusted, supported to grow and proud to contribute to the delivery of high-quality public services.

To achieve this strategic outcome, we are focusing on four key priority areas:

I. Developing our capabilities: Ensuring all our staff have the right skills to succeed with a focus on leadership skills, deepening tax knowledge, and digital and data literacy.

II. Creating personalised career development plans: Ensuring everyone can succeed in their role and supporting them in their career ambitions. Seeking opportunities for secondments, both outgoing and incoming.

III. Prioritising equalities, diversity and inclusion: Attracting diverse talent into our inclusive organisation, where everyone can bring their whole self to work.

IV. Empowering our people: Giving our staff autonomy, the tools for a healthy work-life balance, being transparent, and showing recognition.

Together, these actions aim to build an engaged, diverse, and skilled workforce capable of adapting to change and continuously improving the way we work. We assess our performance against this strategic outcome using the following Success Measures:

- An annual People Survey score in the top 25% of Civil Service organisations.

- Evidence Revenue Scotland has taken action to expand the diversity of the workforce and Board, to advance equality of opportunity.

The People Strategy is made up of four themes: Leading and Managing Change, Building Capability, Talent Acquisition and Growth and Resilience and Wellbeing. The action plan will seek to deliver the priorities under these pillars to support delivery of the Corporate Plan strategic outcomes under Investing in our People.

People Survey

Our People Survey performance over the past four years has improved every year. Our response rate in 2024-25 was 98%, the second highest across the Civil Service. This high response rate ensures our results are truly representative of our organisation.

In 2024-25, our People Survey results placed us in the top seven Civil Service organisations across all themes, achieving our aim of ranking within the top 25% across the UK. This reflects high levels of staff engagement and confidence in our leadership. We also strengthened the diversity of our governance by co-opting additional members to our Board committees and sub-committees. In addition, we continued to promote equality of opportunity across our workforce by actively engaging a diverse range of stakeholders in our recruitment campaigns. Our results also rank us second highest in Learning and Development, Inclusion and Fair Treatment, and 15th for engagement.

Revenue Scotland Performance Ranking Across Civil Service

A lower rank indicates better performance relative to the rest of the participating organisations.

| Theme | 2021 | 2022 | 2023 | 2024 |

|---|---|---|---|---|

| My manager | 9 | 2 | 2 | 2 |

| Learning and development | 28 | 5 | 2 | 2 |

| Inclusion and fair treatment | 25 | 4 | 2 | 2 |

| Leadership and managing change | 10 | 4 | 3 | 3 |

| Pay and benefits | 4 | 3 | 3 | 4 |

| My work | 51 | 6 | 6 | 5 |

| My team | 2 | 1 | 6 | 5 |

| Organisational objectives and purpose | 11 | 8 | 4 | 7 |

| Resources and workload | 56 | 14 | 4 | 7 |

| Engagement index | 55 | 16 | 11 | 15 |

We scored 19% on the Proxy Stress Index - the fourth lowest score - which measures factors contributing to workplace stress, including workload demands, control over work, support, relationships, role clarity, and change. A lower score indicates lower stress levels and is therefore desirable.

On the PERMA Index, which assesses positive emotion, engagement, relationships, meaning, and accomplishment, we ranked 11th highest, with a score of 78%, reflecting the extent to which our staff are flourishing at work.

Understanding and maintaining our results remains a priority. We engage staff at all levels to help us understand what is working well, what we need to stop and areas for improvement. This feedback helps us ensure that we continue to focus on the right areas. These include learning and development, team collaboration, workload and resources, employee wellbeing and quality feedback. Actions to support these areas have been integrated into our People Strategy action plan under our four people themes.

Developing our Capabilities (Learning and Development)

Revenue Scotland’s internal Capability and Skills Audit plays a key role in shaping our workforce development. It gathers information from staff about their current knowledge and skills, as well as the core capabilities the organisation needs now and in the future. This data informs our workforce planning and learning and development offer, supporting the delivery of our Corporate Plan. The audit will be conducted annually and outcomes reported to our Staffing and Equalities committee.

In line with both our People Strategy and Corporate Plans, our priority is to build a capable and diverse workforce that values continuous development. By understanding our organisational strengths and skills gaps, we can provide targeted training and development opportunities, enabling greater workforce flexibility. This also empowers staff to explore and develop the core skills that are essential to Revenue Scotland’s success.

The audit informed our Data and Digital Strategy. Its findings supported our mission to build data literacy, a priority for 2025-26, to establish a common foundation level. The audit identified subject matter experts to support the mission to build our data literacy. The audit also enabled subject matter experts to be identified to support peer learning to coach colleagues and build capabilities. In addition to the audit, we conduct an annual talent assessment. Both tools help inform our succession planning and individual learning and development plans. Our approach to learning and development has supported us to achieve the second highest score for learning and development in the annual Civil Service People survey for the second year running, a significant achievement.

Induction builds the foundations for building our capabilities. Our induction programme captures core learning and job specific learning with employee and line manager monitoring progress to agree successful completion of induction. This programme not only focuses on team learning but wider organisational learning and connecting with organisational purpose. Our Scottish Tax Education Programme (STEP) is the foundation for building our knowledge. This learning is delivered virtually, and this year has evolved to test a blended learning approach supported by action learning sets. One hundred percent of respondents to the evaluation survey reported they had learned something new from the STEP session. And 96% of respondents rating the session 4 or above on a scale of one to five (one being lowest and five highest).

Career Development Plans

The Corporate Plan 2024-27 outlines our ambition to have an informed, highly skilled, and diverse staff and Board, able to perform to the best of their ability, delivering success for the organisation. We will achieve this by ensuring staff have the right skills to thrive, with a focus on leadership development, tax expertise, and data literacy. Strengthening leadership capability remains a priority at all levels. Our leadership development programme brings together staff from higher B Band and C Band, featured training in systems thinking and a deep dive into our 10-year organisational journey to foster shared understanding.

Our weekly leadership meetings include monthly reflection on our contributions to the Corporate Plan 2024-27 strategic outcomes, along with deep dives into team priorities to enhance collaboration and alignment. In preparation for the introduction of new devolved taxes, we conducted an organisational scan to assess our priorities, capabilities, and capacity to deliver on our ambitions.

Leadership capabilities are further enhanced through line manager support from People Services to build capability and confidence to support our staff in line with our people policies. The annual talent assessment, monthly conversations, mid-year and end of year process all feature review of learning and development goals and review of plans to achieve these goals. Investment in learning and development is a priority to ensure we continue to build our professional capabilities. We have supported development of professional qualifications in Digital, Data, Finance, Health and Safety, Project Management, HR, Governance, and Legal.

Increasing our focus on tax development has enabled us to reach out and connect with colleagues across Public Sector to share best practice. This has involved engaging with COSLA, Visit Scotland and local authorities on Visitor Levy. Our guest speaker at the New Year Gathering from Visit Scotland commended our staff on their thinking and support in helping them plan for the collection of the levy. This approach continued in our collaboration with Scottish Government colleagues to share best practices supporting the development of legislation for the SAT. To share knowledge, the New Year Gathering hosted a session on Tax Development, which all attendees reported being either satisfied or very satisfied with. Our Tax Design lead has hosted information sessions with tax colleagues to support preparation for user testing and guidance design.

Prioritising Equality, Diversity, and Inclusion

Our Corporate Plan 2024-27 sets out our commitment to prioritise equalities, diversity and inclusion (EDI) by attracting diverse talent into our inclusive organisation, where everyone can bring their whole self to work. Revenue Scotland were the second highest across the Civil Service in the 2024 People Survey for Inclusion and Fair treatment. This is based on response to the following questions:

- I am treated with respect by the people I work with

- I am treated fairly at work

- I think my organisation respects individual differences (cultures, working styles, backgrounds, ideas, etc)

- I feel valued for the work I do

Our Equalities Mainstreaming Report, published on 31 March 2024, set our mainstreaming outcomes for 2024-28. Along with our Corporate Plan for 2024-27, these will serve as our guide to ensure that we meet the needs of the people we serve. The mainstreaming outcomes are:

- Revenue Scotland will actively promote equality, diversity and inclusion in designing and delivering our services.

- Revenue Scotland will embed a celebratory culture of equality, diversity and inclusion within our organisation, to have a workforce which reflects the people we serve.

We developed an EDI strategy and action plan, both of which were approved by our Staff and Equalities Committee. They were influenced by principles including – providing

a single vision for an EDI roadmap, high level deliverables, serving and navigating the intersection between the Corporate Plan 2024-27 and Equalities Mainstreaming Report, complementing our People Strategy and keeping a people focus.

The actions for Equalities Mainstreaming Outcome 1 centre around engaging with service users and stakeholders on the accessibility of our services, the design of our products, projects and communications to consider impacts on protected characteristics, and improving our data collection to consider the equalities impact of the devolved taxes. This will involve analysis of the sources of data already available to us and dovetailing into the development of wider plans to expand what can be gathered. Our work in this area is supported by a steering group and overseen by the Staffing and Equalities Committee.

Our Equalities Mainstreaming Outcomes are supported by an Equalities Strategy and Action Plan. As part of this, ensuring we develop inclusive recruitment practice is a priority. Our approach includes use of inclusive language, interview questions issued to candidates 24 hours in advance, and interviews either taking place in our Edinburgh office or via Microsoft Teams. Candidate evaluation feedback tells us 97% of respondents considered having the questions in advance helped improve their performance at interview and 93% of respondents to panel evaluation responded positively when asked whether having the interview questions in advance aided candidates to give a good account of their skills and experiences.

Revenue Scotland introduced the Employee Passport in 2022, and we continue to promote adoption of the passport to support staff and managers. The passport covers adjustments needed for health reasons, caring responsibilities, and personal circumstances to provide reasonable adjustments to enable staff to remain at work.

Recruitment: Board, Co-option, and Workforce

Over the last year we have taken action to strengthen diversity of thought and experience on our Board and its committees. This was informed by our annual Board skills assessment, which identifies any skills gaps and therefore the recruitment process.

We have recruited three new co-opted, non-voting members, to our Board Committees. These appointments will be for an initial period of 18 months running from 3 February 2025. Two of the new members have joined our Audit and Risk Committee and one new member has joined our Staffing and Equalities Committee. Details of the new co-opted members can be found on our website. These new members bring a wealth of expertise and new perspectives to our Board committees and will support our Committee members in providing assurance to our Accountable Officer and our Board.

We are also delighted to have two new Board members appointed through the Public Appointments process: this increases our Board to eight members. These appointments strengthen our Board’s diversity (a commitment by our Chair in our Equalities Mainstreaming Report 2024-2028) and bring additional skills, expertise, and experience to complement those of our existing members. This will support us in setting the strategic direction of the organisation and delivering our Corporate Plan ambitions.

Our commitment to the Fairer Scotland Duty is demonstrated through our ongoing support for Modern Apprenticeships and the Going Forward into Employment initiative, which are embedded in our recruitment strategies.

Empowering Our People

Hybrid operating model

Our Hybrid Operating Model was launched in April. This sets out the activities staff are required to attend the office for and the frequency, offering staff flexibility as to when they attend. 96% of staff report that when working from home colleagues are good at keeping in touch formally and informally.

All Staff Gatherings

We bring our staff together in person twice yearly to connect with our organisational objectives and purpose. This is integral to our Hybrid Operating Model.

The Summer Gathering was themed on our Corporate Plan strategic priorities: Operational Excellence, Investing in our People, Working with others, and Expanding Horizons. We were joined by guests from the Scottish Government, Visit Scotland, and NEC, who shared their insights on how we are delivering against our strategic objectives. We also heard from our Board member Robert MacIntosh, who shared his insights on leading and managing change.

The afternoon sessions were focused on the Investing in our People theme and drew on the outputs from our Capability and Skills audit, covering a range of topics. In one session, we heard from another Board member, Idong Usoro, about our digital future. The energy and engagement throughout the day was testament to our culture. Board members especially enjoyed interacting with our staff throughout the day.

New Year is a time for reflection and a forward look, and this is no different for us at Revenue Scotland. Approaching the 10th anniversary year of Revenue Scotland, our New Year Gathering offered an opportunity to reflect on our journey over the years, the progress we have made, a look to the coming year and our readiness for delivering two new devolved taxes: SAT and SBSL. The event also provided an opportunity for staff to contribute to the development of our People Strategy. Their input helped shape our vision and priorities for the People Strategy to support the delivery of the Investing in our People priorities in the Corporate Plan 2024-27. This year several new staff joined our organisation bringing many new skills and experience. Maintaining connection as one organisation is key to help us deliver our period of significant change which moves us from delivering efficient collection of two taxes to four taxes. Team building and readiness for change was the theme of the morning.

Volunteering

Revenue Scotland supports staff to take up to six days special leave each year. In this report period, staff have reported 181 hours volunteering. This ranges from supporting Boards and Committees, Children’s Panels, and local charities. During national volunteering week, our Health and Wellbeing group supported Merry-Go-Round, a community enterprise helping families grow up green. In addition, they supported Empty Kitchens Full Hearts, a charity which seeks to relieve poverty in Edinburgh by providing meals made using surplus food to support people across the city free of charge.

The Health and Wellbeing Group also supported MacMillan Cancer Support by hosting a coffee morning raising £302, and Charity for Civil Servants by hosting Christmas Jumper Day raising £111.

This year we made a pledge as part of Communities Channel Scotland to challenge ourselves to increase the positive impact we make on our local community.

We pledged that we will:

- proactively support the use of volunteering days by our staff to support the community and charity projects in the areas they live

- support and encourage our staff to organise and engage with charities and support events and fundraising efforts for these

- strengthen our ties with other public sector bodies and networks to raise our awareness of socio-economic issues

Working With Others

Introduction

Working with others through collaboration and partnership is essential to how we continue to deliver our functions and contribute to wider improvements in public service delivery in Scotland. We aim to build on existing strong relationships with national and local partners and create new ones, sharing what we learn from administering devolved taxes, and play an active role in supporting public service reform. This is why in our Corporate Plan 2024-27, under the strategic outcome of Working with Others, we commit to supporting the Public Service Reform agenda to share our experience of efficiently and effectively delivering public services; and, we will establish new connections with others working in new and local existing taxes.

To achieve this strategic outcome, we are focusing on three key areas of work:

- Sharing learning on devolved taxation: Through building our partnerships and networks we will continue to collaborate and work together on shared goals

- Playing a ‘sector connector’ role: We will establish new connections, bringing people together, offering new opportunities for collaborative working in tax across the UK and beyond

- Leading the way in Public Service Reform: We will embrace change, supporting others by sharing our learning and showcasing our digital services and Shared-Service Model.

Together, these actions aim to ensure we remain an agile, engaged and outward-looking public body, contributing our knowledge and insights to support the public body landscape in Scotland, and further afield. We assess our performance against this strategic outcome using the following Success Measures:

- Case studies will provide evidence Revenue Scotland is actively engaging with national and local authorities to share tax knowledge

- Case studies will provide evidence Revenue Scotland is actively engaging with the Scottish Government and other public bodies to support Scotland’s Public Service Reform ambitions

Stakeholder Engagement Plan

To address the priorities of the Working with Others theme, in 2024-25, we prepared a new stakeholder engagement plan aligned to the Corporate Plan 2024-27. The plan acknowledges that the expertise and responsibility for undertaking engagement remains within the areas of Revenue Scotland where it is performed, and provides support from the Engagement Team to work together with the teams in identifying where gaps and step changes are required. The plan recognises our role as a sector connector, and ensures that we are well positioned to make connections and build networks.

We have delivered a range of tools to support stakeholder engagement, such as standard lines to take for engagement, where a full briefing is not required. Improvements are ongoing in this area, while we finesse the process. Learning from our regular reviews allows us to improve and tailor our approaches to distinct audience groups.

Below are a series of short case studies, which demonstrate how we work with others. These examples also meet a range of our Corporate Plan Outcomes, including Expanding Horizons, however, we are discussing them in this section to highlight how we achieve our ambitions through closely working with others.

Sharing learning on devolved taxation

We worked with SEPA, the Scottish Government, and local authorities to support the transition away from landfill in preparation for the biodegradable municipal waste ban (BMW ban) (see below). We contributed to the design and implementation of new taxes such as the Visitor Levy and SBSL.

We also built new relationships by joining the Institute of Revenues, Ratings and Valuation (IRRV) monthly forums and engaged directly with local authorities on tax-related matters including data sharing, automation, and litigation.

We also held strategic discussions with the Convention of Scottish Local Authorities (COSLA), and the Society of Local Authority Chief Executives (SOLACE) to explore new opportunities.

Biodegradable Municipal Waste Ban

From 1 January 2026, biodegradable municipal waste (BMW) can no longer be accepted for disposal at landfill sites across Scotland. This will significantly reduce the amount of waste that can be sent to landfill, and will heavily impact the industry and the revenues of landfill companies.

Despite the ban, landfill will still be required and there is a risk that the shrinking industry means that the sites that have the funds or practices to stay open may not offer Scotland as a whole the coverage and capacity for waste that still needs to go to landfill. There is also the risk that sites will close as revenues decrease, which could result in sites abandoned without aftercare and maintenance.

To prepare for this, we have been working closely with SEPA colleagues and Environmental Policy colleagues in Scottish Government. Initially, we coordinated a strategy group considering the future of landfill. During these discussions we were able to identify shared objectives across the organisations and flag up risks and attribute ownership.

Following these initial discussions, we now meet individually with each organisation to ensure that we continue to understand the shared risks of the ban and are prepared for it, including financial concerns and compliance risks that will be present when the ban is implemented.

We will continue to work with partners to address concerns in waste compliance, specifically working with SEPA, HMRC, the Welsh Revenue Authority (WRA) and the Joint Unit for Waste Crime, as well as other partners.

Scottish Landfill Communities Fund changes

The Scottish Landfill Communities Fund (SLCF) is a tax credit fund that Scottish Landfill Tax (SLfT) operators can contribute to. Currently, operators can contribute up to 5.6% of their SLfT tax liability for each year, and they benefit from a tax credit of 90% of any amount that they contribute.

SLfT is an environmental tax which aims to encourage the prevention, reuse and recycling of waste by making landfill a relatively expensive option. A long-term trend of decreasing SLfT revenues reflects the success of efforts to encourage diversion of waste from landfill, driven by the SLfT and the introduction of the BMW ban.

However, as the volume of waste disposed of via landfill reduces, so too will operators’ tax liabilities and as a result, contributions that can be made to the fund. This means that from April 2026, the fund will be likely to be running at a deficit and no longer able to sustain itself.

To help manage this transition, we have been working closely with colleagues from the Scottish Government’s Tax Policy team and the SEPA SLCF team, which holds delegated responsibility for monitoring the fund’s compliance. Our collaboration has included supporting drafting the public consultation for the fund, which closed in June 2025. Additionally, we have engaged with the Approved Bodies, organisations that receive contributions from operators, and would be most directly affected should the fund be discontinued.

We will continue to work closely with internal and external stakeholders as decisions on the fund are made following the consultation.

Sharing Learning with National and Local Authorities

Over the course of the last year, we have shared our knowledge of managing self-assessed taxes with Scottish Government, industry and local government in cases where we will not be the collecting agency. An example of this work is the forthcoming Visitor Levy. Since the Visitor Levy (Scotland) Act 2024 was passed, we have continued engaging with stakeholders to provide views on technical tax matters emerging through the design of the levy. We supported the drafting of guidance through our membership on the Visitor Levy Expert Group.

We have also shared our expertise on the management of devolved taxes through specific forums focusing on tax and revenues. This has paved the way for the creation of new working relationships, allowing us to support and learn from others. This work actively contributes to the Public Service Reform agenda and supports our Working with Others strategic outcome to work collaboratively on shared goals.

We continue to work closely with other UK tax authorities, sharing information, intelligence and knowledge through legislative gateways and formal Information Sharing Agreements.

Playing a ‘sector connector’ role