About the Seller

About the Seller

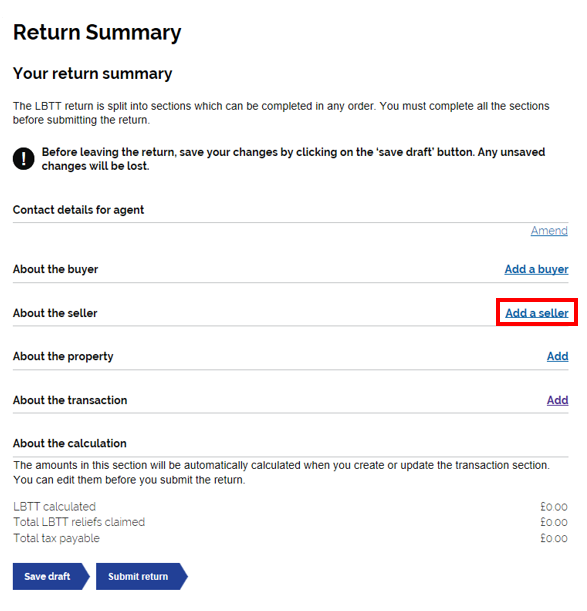

You can add a seller by selecting the ‘add a seller’ button on the right hand side of the ‘About the seller’ section.

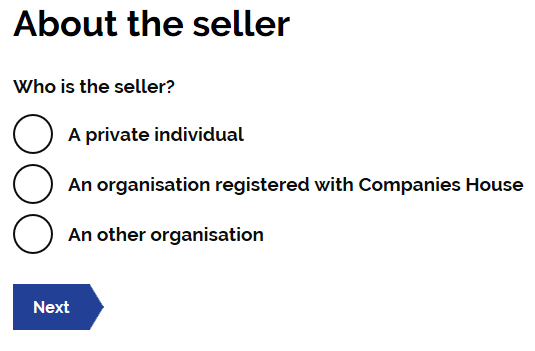

Who is the seller

Select the option which is most relevant to the seller.

Note: For these purposes, ‘An other organistaion’ includes the option of Partnership, Trust, Charity, Club, Other and Company (Not registered with Companies house).

Depending on the type of seller you chose, you will be asked for different information.

Seller type – Private Individual

You will be asked to complete the following details for the seller;

· Title

· First name

· Last name

· Address

Note: All these fields, except Title, are mandatory.

Seller type - Organisation registered with companies house

Registered company details

You will be asked to enter the registered company number. This will populate the Company Name and Address. These can be edited if necessary.

Seller type – An other organisation

Type of organisation

Here you can select which type of organisation the seller is.

Note: When ‘other’ is selected, a box will appear to prompt an explanation of the type of organisation the seller is. If ‘charity’ is selected then you will be asked to provide the charity number.

When you have selected the organisation type you will then be asked to provide the following information;

· Name of the organisation

· Address of the organisation

· The country’s law which governs the organisation i.e. where the organisation is registered

Note: Once complete, you can add additional sellers if necessary. This is done by selecting the ‘Add a seller’ button.