Submitting the return

Submitting a return

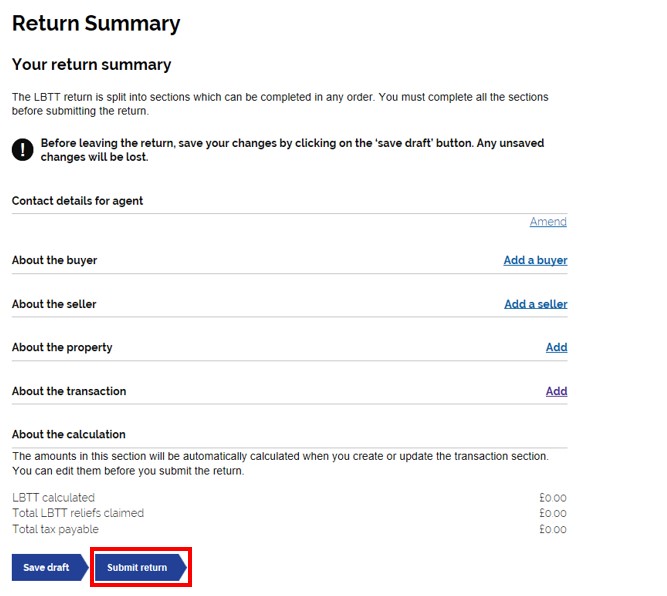

Submit Return Button

When you have completed the LBTT return and are ready to submit it, select ‘Submit return’ at the very bottom of the return summary page.

Note: If you select ‘Submit return’ and an error dialogue box appears, you must correct any relevant errors before you can successfully submit the return.

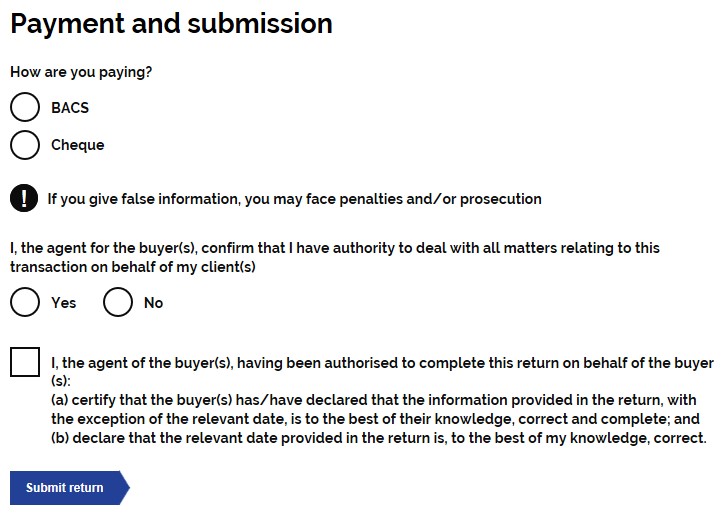

Payment Method

After selecting ‘Submit return’ you will be asked if you are paying by BACS or Cheque. If you have signed up for Direct Debit, this will also show as an option. Use the check box to select your chosen payment method.

Declaration Statements

Under the payment check boxes you will see two declaration statements. The first declaration asks you to confirm, by checking the box, that you, as the agent, have the authority to deal with all matter relating to the transaction on behalf of your client(s).

Use the radio button to select either ‘yes’ or ‘no’.

The second declaration asks you to confirm that;

(a) you certify that the buyer(s) has/have declared that the information provided in the return, with the exception of the relevant date, is to the best of their knowledge, correct and complete; and

(b)declare that the relevant sate provided in the return is, to the best of your knowledge, correct.

Note: You must check the box to confirm you agree with the declaration in order to submit the return.

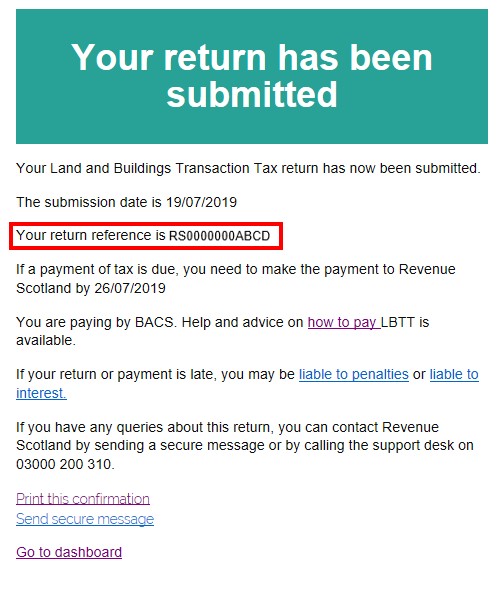

Submission Confirmation

The return will then be submitted to us and given a 13 digit unique transaction reference (RSXXXXXXXABCD) which will be displayed to you on this screen. This number must be quoted when making payments in relation to the transaction or when contacting us about the transaction.

The submission screen will confirm when payment must reach us by. A link to our How to pay guidance is provided. There is also a link to our penalties and interest guidance.

Note: Any tax due is treated as paid on time if arrangements satisfactory to us are made at the same time as the LBTT return and the full payment is received no later than the return filing date.

This return Submission Confirmation notice can be printed by selecting the ‘Print this confirmation’ link at the bottom of the page. From choosing this option, users can also save the receipt locally.

Note: it is not possible to download this Submission Confirmation receipt later, so if the receipt is required, users should ensure that it is printed or saved locally when it is presented on screen.

You can also send a secure message from the submission page. Clicking the ‘send secure message’ button will create a secure message and automatically populate the return reference.

You can then select ‘Go back to dashboard’ to go back to your dashboard.

A summary of the return details will be displayed on your dashboard. At any time you will be able to view or download and print a copy of the return. You will also be able to amend the return if within 12 months of the filing date see General guidance about the LBTT return for further information.