Overview

Land and Buildings Transaction Tax (LBTT) is a charge on land transactions in Scotland. Land transactions must be notified to Revenue Scotland, unless the chargeable consideration is less than £40,000, or the transaction is otherwise exempt.

The Additional Dwelling Supplement (ADS) is an additional charge which applies when the taxpayer is purchasing an additional property and not replacing their main residence. ADS most commonly arises for purchases of a second home or a buy-to-let dwelling.

Chargeable Consideration is defined as anything given in money or money’s worth for the subject-matter of the transaction. For example, the chargeable consideration for a house will be the price paid for the property, land and fittings. For leases, chargeable consideration can include rent payable and any premium paid on the lease.

Table 1: Number of LBTT returns received by type of transaction and year, last 5 years

|

Year

|

Residential conveyance |

Non-residential conveyance |

Lease |

Review of

a lease |

All |

| 2018/19 |

103,750 |

7,160 |

5,130 |

4,220 |

120,250 |

| 2019/20 |

105,110 |

6,440 |

4,920 |

4,570 |

121,040 |

| 2020/21 |

96,850 |

5,930 |

3,500 |

2,900 |

109,170 |

| 2021/22 |

110,120 |

7,080 |

4,540 |

4,580 |

126,330 |

| 2022/23 |

102,610 |

7,040 |

4,620 |

4,720 |

118,980 |

The total number of LBTT returns received in 2022/23 was 6% lower than in the previous year. This decrease was mainly driven by a reduction in residential conveyance returns, while non-residential returns remained fairly steady and there was an increase in both lease and lease review returns.

The fall in residential LBTT returns may be due in part to rising house prices, as well as a cooling off from the previous year, where built up demand resulted in a record high number of returns following the easing of COVID 19 restrictions.

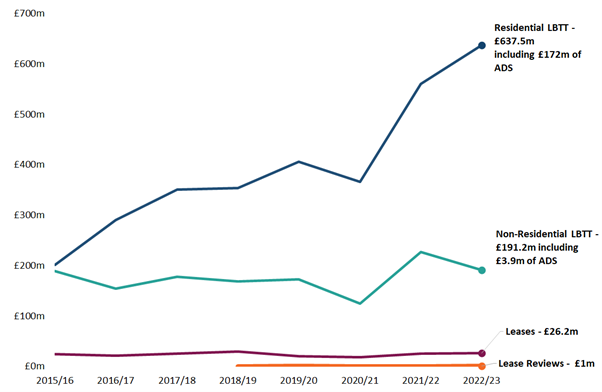

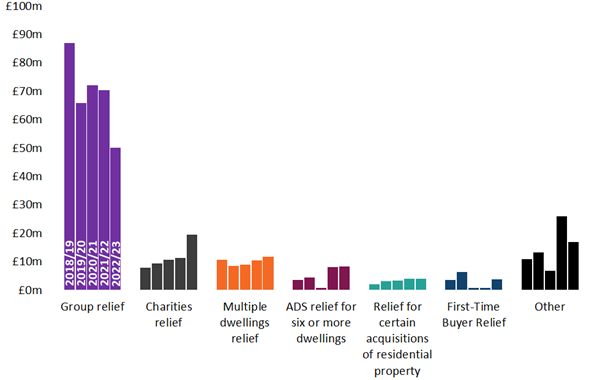

Figure 1: LBTT including net ADS declared due, by year and transaction type

Image

2022/23 saw the highest ever LBTT declared due at £855.9 million. This up 5% on the previous high of £814.0 million recorded in 2021/22. This record-high figure was driven mainly by residential LBTT and net residential ADS, which rose by 12% and 19% respectively, offsetting a decline in non-residential LBTT.

Since the introduction of ADS in April 2016, total residential LBTT revenue has typically been at least twice as high as non-residential LBTT. This remains true in 2022/23 with total residential LBTT (£637.5m) being more than three times the figure for total non-residential LBTT (£191.2m).

Before 2016, figures for residential and non-residential were much closer. The current ratio reflects rising house prices, and the fact that ADS mainly applies to residential conveyances (27% of total residential LBTT was due to ADS in 2022/23). Excluding net ADS, residential LBTT was around 2.5 times the figure for non-residential LBTT.

LBTT rates and bands for residential transactions as of 1 April 2021:

| Purchase price |

LBTT rate |

| Up to £145,000 |

0% |

| £145,001 to £250,000 |

2% |

| £250,001 to £325,000 |

5% |

| £325,001 to £750,000 |

10% |

| Over £750,000 |

12% |

Table 2: LBTT declared due, excluding ADS, and number of returns for residential conveyances

| Year |

LBTT excluding ADS

(£ millions) |

Annual percentage change in LBTT excluding ADS |

LBTT returns received |

Annual percentage change in LBTT returns received |

LBTT excluding ADS per return received (rounded to nearest £100) |

| 2018/19 |

261.0 |

0.3% |

103,750 |

-0.2% |

2,500 |

| 2019/20 |

287.1 |

10.0% |

105,110 |

1.3% |

2,700 |

| 2020/21 |

256.4 |

-10.6% |

96,850 |

-7.8% |

2,600 |

| 2021/22 |

416.5 |

62.3% |

110,120 |

13.7% |

3,800 |

| 2022/23 |

465.5 |

11.8% |

102,610 |

-6.8% |

4,500 |

Residential LBTT declared due, excluding ADS, hit a record high of £465.5 million in 2022/23, which is 12% up from the previous high set in 2021/22. The number of residential LBTT returns received was down 7% from 2021/22.

The average amount of LBTT paid per return for residential conveyances had not varied much in the 3 years prior to 2021/22, with the figure ranging between £2,500 and £2,700. In 2021/22 this figure rose significantly, jumping 46% on the year before to an average of £3,800 paid per return. In 2022/23 this figure rose again by another 18%. This rise is driven by an increase in the proportion of conveyances in the higher LBTT bands, which reflects rising property prices.

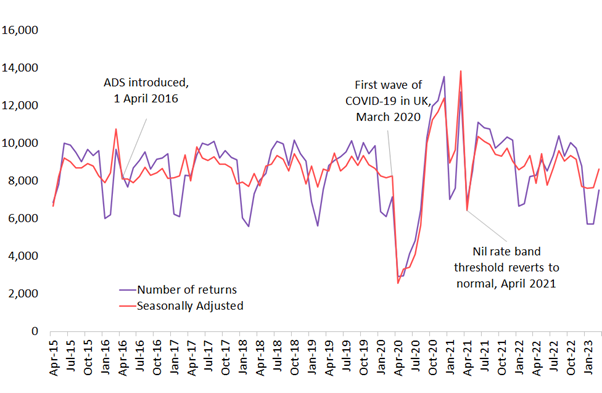

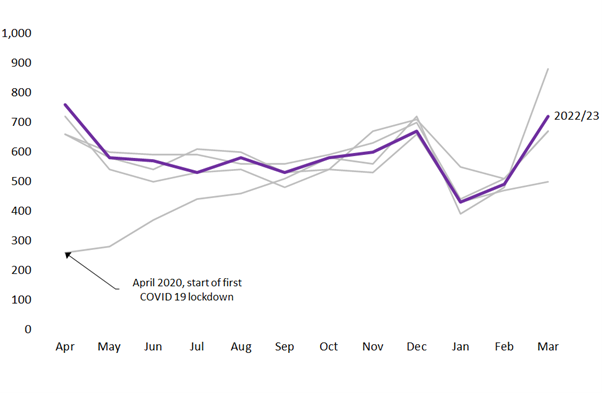

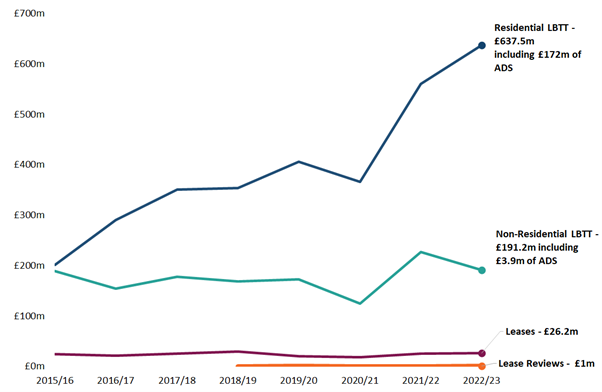

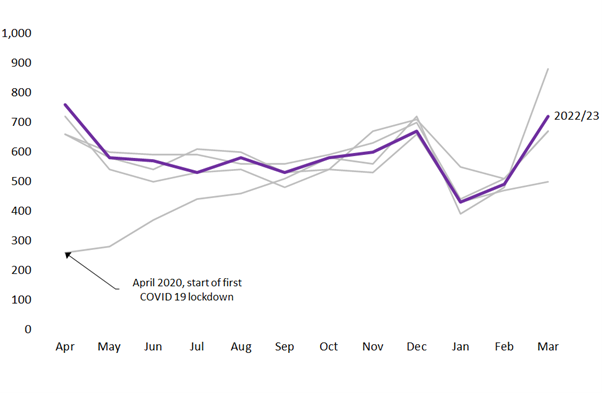

Figure 2: Number of residential conveyance returns received by month

Image

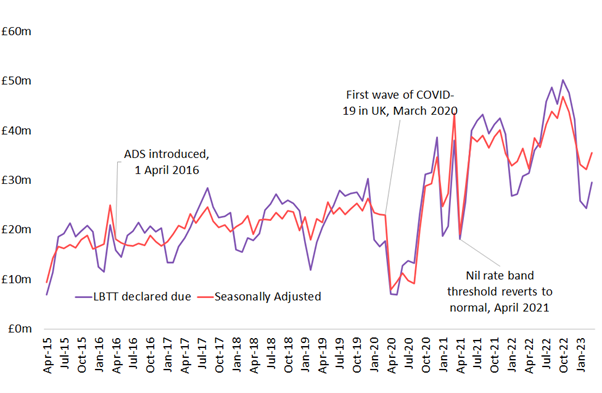

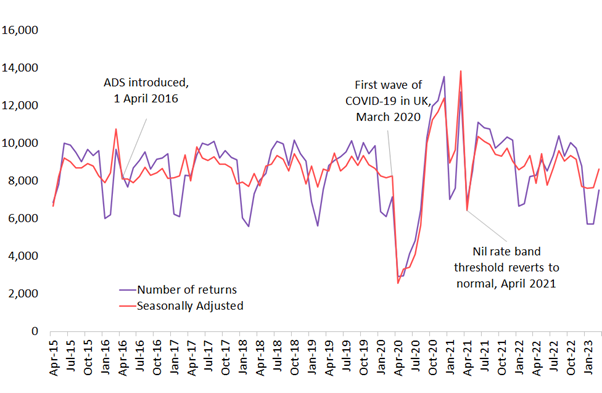

Figure 3: LBTT declared due excluding ADS, for residential conveyances received by month

Image

Both the number of residential LBTT returns and the revenue excluding ADS show consistent seasonal, monthly, and weekly patterns. Fewer returns in all of the LBTT bands are received in January and February, and these months are also associated with lower average house prices. This is due in part to the proportion of returns relating to properties in the two highest tax bands being lowest at this time of year.

After accounting1 for the known seasonal and calendar effects, the number of residential LBTT returns received remained relatively constant from 2015/16 to 2019/20. The effects of the COVID-19 pandemic on this trend can be seen from the end of March 2020 with the start of the first lockdown.

Between 15 July 2020 to 31 March 2021 the nil rate band threshold was temporarily increased from £145,000 to £250,000. This likely led to the unusually high number of returns seen in March 2021, and the large drop in April 2021 when the threshold reverted back to £145,000.

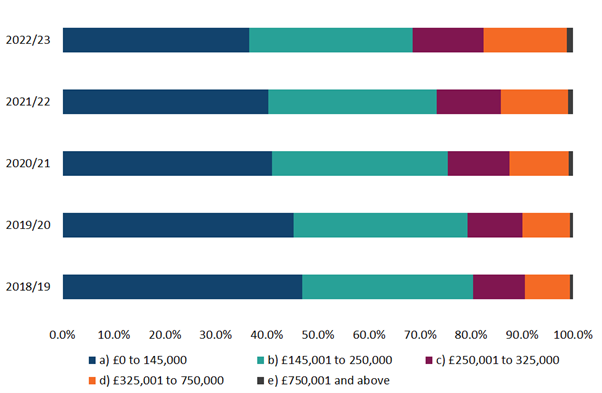

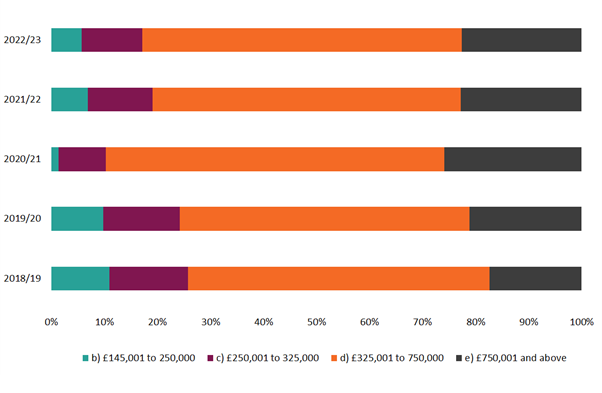

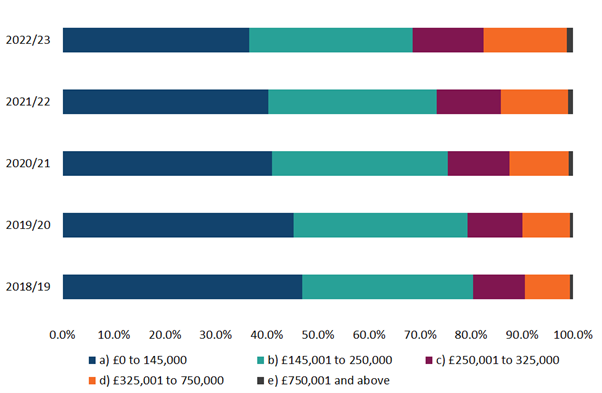

Figure 4: Distribution of residential conveyance returns received by residential LBTT band and year

[1] Seasonal adjustment performed using the X13-SEATS-ARIMA procedure, using a weighted count of weekdays in each month as a regression factor to adjust for calendar effects.

Image

Figure 4 shows that there has been a decreasing proportion of returns in the £0 to £145,000 band each year and increasing proportions of returns received in all higher bands for the last five years. This proportion shift is caused both by a decrease in the absolute number of returns in the bottom two tax bands and significant increase in the number of returns in the bands above £325,000. This is consistent with the increase in average residential property prices reported by Registers of Scotland.

37% of returns received in 2022/23 had a total consideration of less than or equal to £145,000 and, therefore, had zero tax liabilities2. This is the lowest proportion on record. However, Figure 5 shows LBTT revenue is dominated by the £325,000 to £750,000 band, which in 2022/23 contributed 60% of LBTT, while making up only 16% of returns. The highest band (£750,001 and above) accounts for 1% of returns received and 23% of tax.

[2] Residential conveyance transactions under £145,000 can incur tax liability if they are linked.

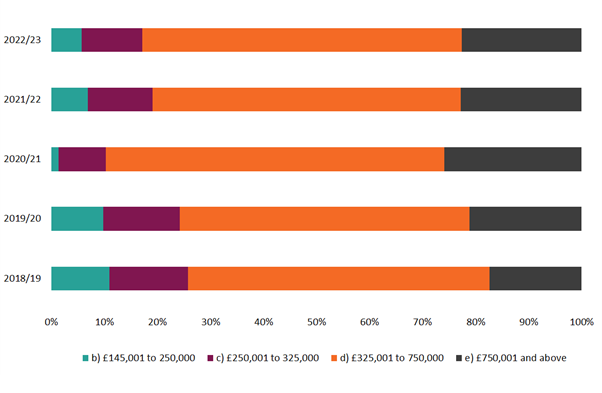

Figure 5: Distribution of residential LBTT revenue, excluding ADS, by residential LBTT band and year

Image

The share of revenue contributed by the top two tax bands increased in 2020/21 due to the temporary change to the nil rate threshold, effective from 15 June 2020 to 31 March 2021, which had the effect of reducing tax liabilities in the second-lowest residential tax band (consideration from £145,000 to £250,000) to zero, and reducing gross tax liabilities for all other residential transactions by £2,100.

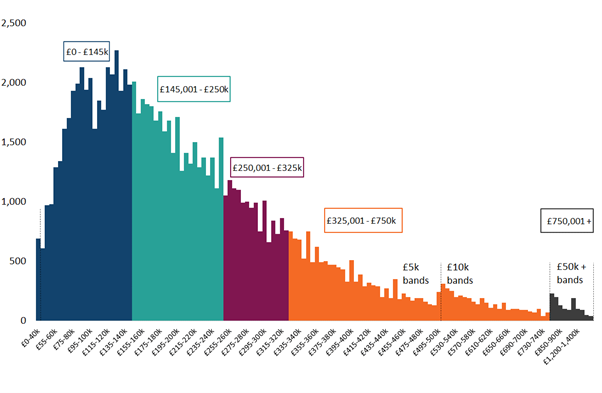

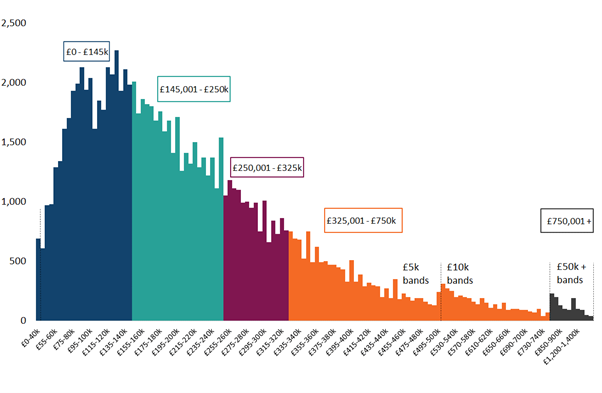

Figure 6: Distribution of numbers of residential conveyance transactions by total consideration and tax band 2022/23 (based on effective date)

Image

Figure 6 shows a more detailed breakdown of the number of residential conveyance transactions by total consideration (e.g. house price) for transactions that took place in 2022/23. The majority of transactions are towards the lower end of the scale (approximately two-thirds are less than or equal to £245k), with the distribution then extending to a long tail of higher value transactions. Due to the smaller numbers of transactions at the higher value end, the width of the total consideration categories is increased at the points indicated on the chart.

Additional Dwelling Supplement

If a taxpayer buys a new main residence before selling their previous main residence, or if they are buying a second home or buy-to-let property, they will have to pay Additional Dwelling Supplement (ADS). This payment can be reclaimed if the previous main residence is sold within 18 months, and the claim is made within 5 years of the submission date.

In 2022/23, ADS was charged at 4% until December 16 2022, at which point the rate was raised to 6%. Prior to January 25 2019 ADS had been charged at 3%.

Table 3: Gross ADS reclaimed and number of ADS repayments claimed for residential LBTT returns by year

| Year |

Gross ADS declared due (£Millions) |

ADS Reclaimed (£Millions) |

ADS Reclaimed (%) |

LBTT returns received with ADS declared due |

Repayments claimed |

Repayments claimed (%) |

| 2018/19 |

128.1 |

35.6 |

27.8% |

23,620 |

4,360 |

18.5% |

| 2019/20 |

163.5 |

44.1 |

27.0% |

23,230 |

4,100 |

17.7% |

| 2020/21 |

153.8 |

43.8 |

28.5% |

20,790 |

3,820 |

18.4% |

| 2021/22 |

188.5 |

44.2 |

23.5% |

25,140 |

3,730 |

14.8% |

| 2022/23 |

206.4 |

34.4 |

16.7% |

24,650 |

2,540 |

10.3% |

Roughly £206 million in gross ADS was declared due in 2022/23, an increase of approximately £18 million (9%) on the previous year.

The fact that a record high figure for ADS declared due was recorded in 2022/23 despite the number of returns with ADS declared due being down slightly on the previous year reflects the increase in the rate of ADS from 4% to 6% towards the end of Q3 of the financial year. The sharp increase in ADS declared due from 2018/19 to 2019/20 was due largely to the increase in the ADS rate from 3% to 4% in January 2019.

Around 10% of taxpayers who submitted LBTT returns with ADS declared due in 2022/23 have since claimed repayment of ADS, accounting for 17% of the gross ADS declared due.

The ADS reclaim rate for 2022/23 appears lower than previous years. This is to be expected as taxpayers have had less time to submit a repayment claim on more recent transactions, and the figure is likely to increase over time as more claims for repayment are made. Only minimal revisions are expected to repayment claims relating to returns made up to 2020/21.

Though taxpayers have 18 months from the effective date of the transaction to sell their previous main residence and reclaim ADS, the majority of claims for repayment are received much sooner. Taxpayers can submit repayment claim up to five years after selling their previous residence.

Table 4: Percentage of Gross ADS reclaimed and number of claims for ADS repayment received, by number of weeks following initial LBTT return

| Weeks from initial return submission to repayment claim |

% of Gross ADS reclaimed |

% of Repayment claims received |

| < 4 |

9.7% |

9.0% |

| < 8 |

24.1% |

22.9% |

| < 12 |

36.2% |

34.4% |

| < 16 |

45.8% |

44.1% |

| < 20 |

53.7% |

52.3% |

| < 24 |

59.9% |

58.7% |

| < 28 |

65.0% |

64.0% |

| < 32 |

69.7% |

68.8% |

| < 36 |

73.5% |

72.5% |

| < 40 |

76.8% |

75.9% |

| < 44 |

79.7% |

79.0% |

| < 48 |

82.3% |

81.8% |

| < 52 |

84.9% |

84.4% |

| < 56 |

86.9% |

86.5% |

| < 60 |

88.5% |

88.1% |

| < 64 |

90.0% |

89.8% |

| < 68 |

91.5% |

91.3% |

| < 72 |

93.2% |

93.1% |

| < 76 |

95.1% |

95.0% |

| < 80 |

96.7% |

96.7% |

| 80 or more |

100.0% |

100.0% |

|

Notes:

1. The data reflects claims for repayment of ADS received up to and including 31 May 2023 and will be revised over time as more claims for repayment of ADS are received, primarily for returns received in 2021/22 and 2022/23.

|

Approximately 9% of ADS repayment claims are received within four weeks of the initial tax return being submitted. More than half of all claims are received within 20 weeks and approximately 84% of all claims are received within a year. The percentages are very similar for gross ADS reclaimed, as claims received and gross ADS reclaimed follow a near identical distribution.

Table 5: Number of LBTT returns received with ADS declared due and the proportion with a subsequent claim for repayment, by year and stated intention to reclaim

| |

LBTT returns received with ADS declared due |

Proportion with a subsequent claim for repayment |

| Financial Year |

Yes, intend to reclaim ADS |

No intention to reclaim ADS |

Total |

Yes, intend to reclaim ADS |

No intention to reclaim ADS |

All |

| 2018/19 |

5,830 |

17,790 |

23,620 |

67.9% |

2.3% |

18.5% |

| 2019/20 |

4,870 |

18,360 |

23,230 |

70.4% |

4.5% |

18.3% |

| 2020/21 |

4,240 |

16,550 |

20,790 |

72.6% |

4.5% |

18.4% |

| 2021/22 |

4,130 |

21,000 |

25,140 |

71.3% |

3.7% |

14.8% |

| 2022/23 |

3,940 |

20,710 |

24,650 |

52.8% |

2.2% |

10.3% |

| Notes: |

|

|

|

|

|

|

| 1. The data reflects claims for repayment of ADS received up to and including 31 May 2023 and will be revised over time as more claims for repayment of ADS are received, primarily for returns received in 2021/22 and 2022/23. |

For LBTT returns submitted with ADS declared due in 2022/23, around 84% of taxpayers stated they did not intend to reclaim ADS. This is the highest percentage on record, though only slightly higher than in 2021/22.

In 2020/21 around 73% of taxpayers who stated that they intended to reclaim ADS went on to do so, the highest proportion so far. In 2021/22 this figure remained high at 71%. The proportion of taxpayers who stated no intention to reclaim ADS but subsequently went on to file a reclaim has never been higher than 4.5%.

These figures indicate that a substantial proportion (around 27% at its lowest in 2020/21) of taxpayers who stated that they intended to reclaim ADS did not subsequently do so. However, when a taxpayer had stated that they did not intend to reclaim ADS then it was very unlikely that they would go on to submit a reclaim.

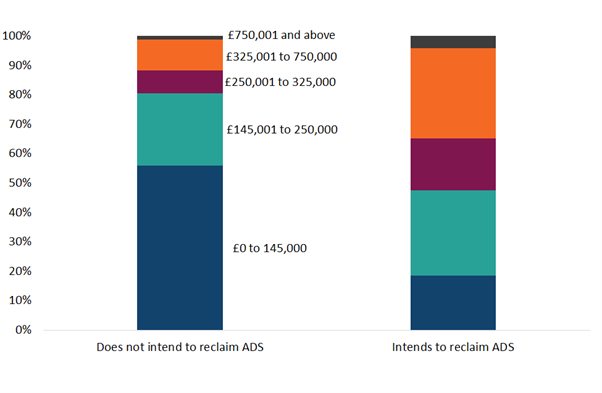

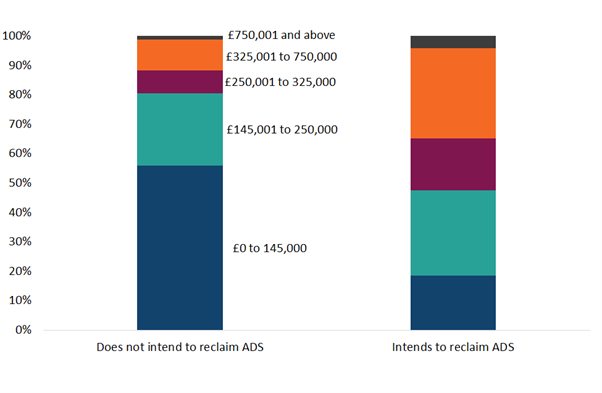

Figure 7: Distribution of residential conveyances by type of transaction (ADS declared due and intends/does not intend to reclaim ADS) and residential LBTT band, 2022/23

Image

Figure 7 shows that the proportion of conveyances in the lowest tax band is three times as high for returns where the taxpayer does not intend to reclaim ADS, compared to returns where they do intend to reclaim. This likely reflects the fact that these transactions will include buy-to-let properties and second homes. Higher value transactions make up a much higher proportion of returns where the taxpayer intends to reclaim ADS. This is likely to reflect a number of factors including the fact that these transactions will include taxpayers who may be moving up the property ladder as they intend to replace their previous main residence.

Non-residential conveyances

Non-residential rates and bands for transactions on or after 25 January 2019:

| Purchase price |

LBTT rate |

| Up to £150,000 |

0% |

| £150,001 to £250,000 |

1% |

| Above £250,000 |

5% |

Table 6: Non-residential LBTT, excluding ADS, declared due and number of returns received by year

| Year |

LBTT declared due (£ millions) |

Annual percentage change in LBTT declared due |

LBTT returns received |

Annual percentage change in LBTT returns received |

LBTT declared due per return received (Nearest £100) |

| 2018/19 |

167.4 |

-5.0% |

7,160 |

4.1% |

23,400 |

| 2019/20 |

170.5 |

1.9% |

6,440 |

-10.0% |

26,500 |

| 2020/21 |

122.9 |

-27.9% |

5,930 |

-7.9% |

20,700 |

| 2021/22 |

223.7 |

82.0% |

7,080 |

19.3% |

31,600 |

| 2022/23 |

187.3 |

-16.3% |

7,040 |

-0.5% |

26,600 |

LBTT from non-residential conveyances, including ADS, was £187 million in 2022/23, a decrease of £36 million (16%) on the previous year, but the number of LBTT returns received only dropped slightly to 7,040 from 7,080 last year. The LBTT figure in 2021/22 was unusually high due to built up demand from the previous year which was impacted by the COVID 19 pandemic. Despite non-residential LBTT falling in 2022/23, the figure is still high compared to all years prior to 2021/22.

Despite only making up 6% of LBTT returns received, non-residential conveyances accounted for approximately 22% of total LBTT declared due in 2022/23. The average LBTT declared due per return fell by approximately 16% on the previous year to £26,600.

Total revenue from non-residential LBTT returns is disproportionately impacted by tax reliefs when compared to residential LBTT. This is partly responsible for the large difference between total residential LBTT revenue and non-residential LBTT revenue each year.

Compared to residential LBTT, the value of LBTT declared from non-residential conveyances can change substantially year to year, due to fluctuations in the small number of very high value transactions seen in each year.

Figure 8: Number of non-residential LBTT returns received by month and year

Image

The distribution of non-residential LBTT returns received throughout the year is typically uniform from month to month, but with notable peaks at the end of both the calendar year and financial year. 2022/23 held true to this pattern.

Table 7: LBTT excluding ADS declared due by month and year for non-residential conveyances (£Millions)

| Month |

2018/19 |

2019/20 |

2020/21 |

2021/22 |

2022/23 |

| Apr |

12.6 |

13.4 |

2.6 |

11.6 |

18.9 |

| May |

12 |

12.8 |

6.3 |

12.9 |

17.7 |

| Jun |

19.8 |

13.5 |

5.5 |

22.6 |

16.7 |

| Jul |

13.5 |

19.7 |

11.5 |

17.3 |

15.4 |

| Aug |

17.2 |

15.3 |

9.7 |

19.3 |

13.1 |

| Sep |

9 |

14.4 |

9.9 |

13 |

15.2 |

| Oct |

10.6 |

13.5 |

14.7 |

20 |

13.8 |

| Nov |

15.6 |

8.5 |

12.1 |

15.5 |

19.1 |

| Dec |

17.7 |

17 |

20 |

31.6 |

20 |

| Jan |

13.7 |

17.8 |

8.4 |

17.3 |

10.8 |

| Feb |

9.9 |

15.6 |

9 |

21.7 |

9.6 |

| Mar |

15.7 |

9.1 |

13.3 |

21 |

17 |

Non-residential LBTT declared due is more variable than the number of LBTT returns received, because a small number of high-value transactions can have a significant impact on the overall tax. There is typically a peak in December, though the size of the peak varies from year to year. In 2022/23, non-residential LBTT was higher in November and December than in other months, but the typical December peak was not as pronounced as usual. Unlike the previous year, there was no secondary peak in June in 2022/23 as numbers steadily fell throughout the summer months.

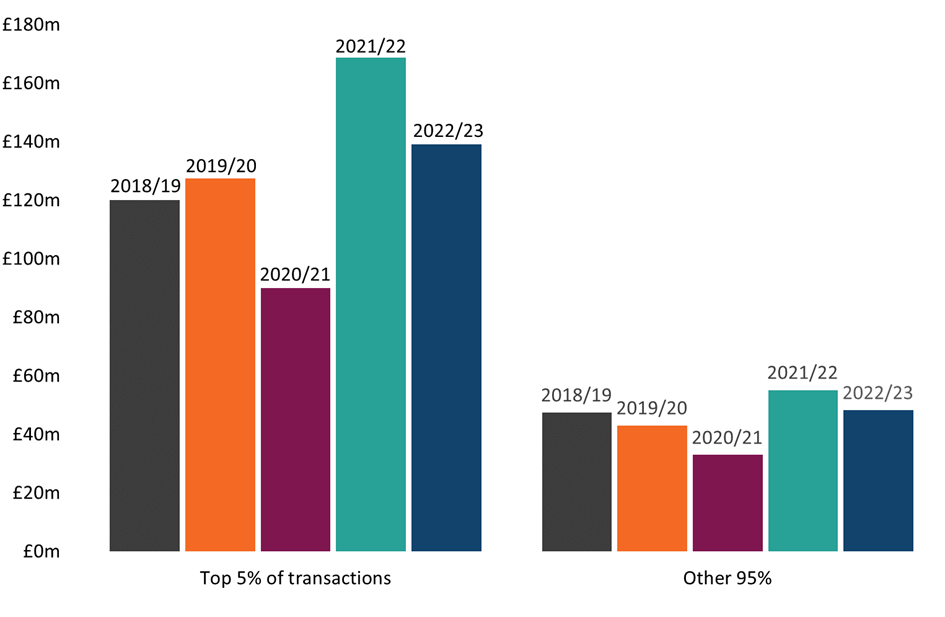

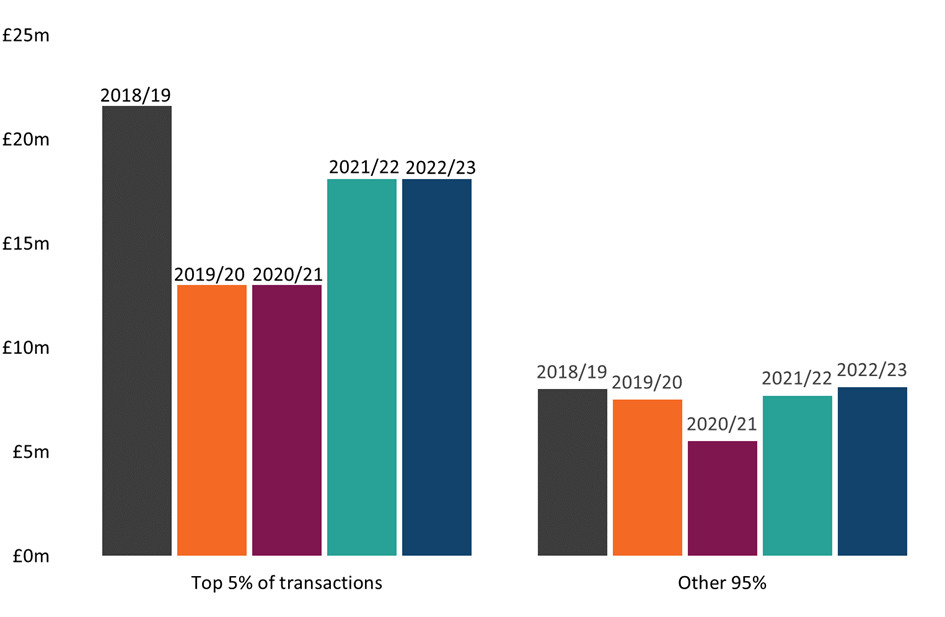

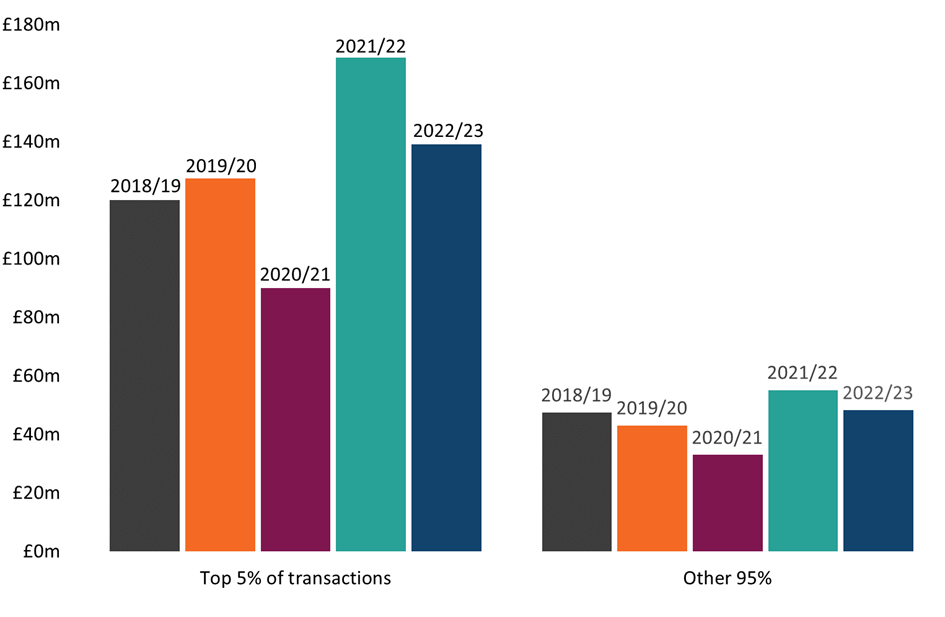

Figure 9: Non-residential LBTT, excluding ADS declared, for the top 5% of transactions by value, per year

Image

Figure 9 shows that when ranked from highest to lowest transaction value (purchase price), the top 5% of non-residential returns account for the vast majority of LBTT due. In 2022/23 the top 5% most valuable transactions made up 74% of non-residential LBTT due. Total non-residential LBTT is generally highly dependent on higher value transactions, with 96% of LBTT coming from the top 20% most valuable non–residential transactions in 2022/23. In fact, the entire lower half of non-residential LBTT returns ranked by value, accounted for less than 0.1% of the total non-residential LBTT declared due.

LBTT declared due for the top 5% most valuable non-residential transactions varies from year to year, with these variations accounting for the majority of the change in non-residential LBTT declared due. LBTT declared due for the top 5% of transactions decreased by 17% in 2022/23 compared to the previous year, corresponding to a 16% decrease in total non-residential LBTT.

1.5 Leases

A non-residential lease that is granted, or is treated as having been granted, for the first time on or after 1 April 2015 is potentially chargeable to Land and Building Transactions Tax.

99% of leases are non-residential, but analysis in this section includes a small number of leases which taxpayers have classified as residential, perhaps mistakenly. However, the overall tax position remains correct as the LBTT due for a lease is the same whether it is residential or non-residential.

Table 8: LBTT declared due and number of LBTT returns received by year for leases

| Year |

LBTT declared due

(£ millions)

|

Annual percentage change in LBTT declared due |

LBTT returns received |

Annual percentage change in LBTT returns received |

LBTT declared due per return received (Nearest £100) |

| 2018/19 |

29.4 |

16.8% |

5,130 |

-7.9% |

5,700 |

| 2019/20 |

20.4 |

-30.5% |

4,920 |

-4.1% |

4,100 |

| 2020/21 |

18.5 |

-9.2% |

3,500 |

-28.9% |

5,300 |

| 2021/22 |

25.8 |

40.1% |

4,540 |

30.3% |

5,700 |

| 2022/23 |

26.2 |

1.2% |

4,620 |

1.7% |

5,700 |

£26 million in LBTT was declared due for leases in 2022/23, accounting for 3% of total LBTT declared. Both the number of lease returns received and the total LBTT due from leases remained fairly steady in comparison to 2021/22, with both figures increasing only slightly. The mean amount of LBTT due per lease return also remained consistent, the figure being roughly £5,700 for both 2022/23 and 2021/22.

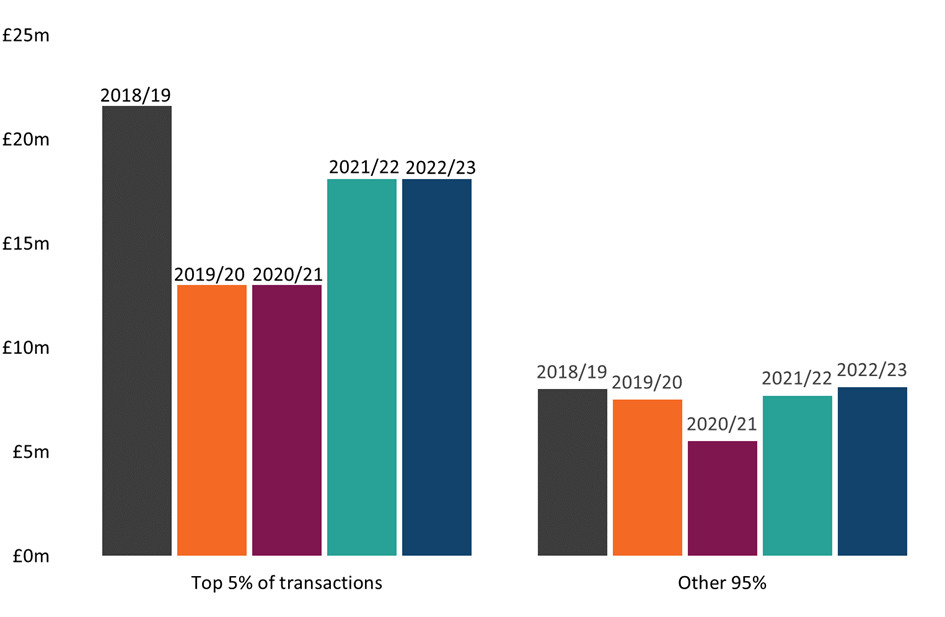

Figure 10: LBTT declared due for top 5% of lease transactions by value, per year

Image

When lease returns received in 2022/23 were ranked in order from highest to lowest total consideration (cost of the lease), the top 5% of leases made up 69% of the total LBTT declared due on leases. Like non-residential conveyances, the distribution of LBTT from leases in general is heavily skewed towards the most valuable transactions, with 91% of total lease LBTT coming from the top 20% of transactions.

LBTT for leases may be due on the net present value of rent, as well as payment of a premium to secure the lease. 95% of all LBTT declared due on leases in 2022/23 was due to rent, with the remaining 5% due to premiums. LBTT due on premiums is dominated by a small number of large premiums over £350,000. LBTT due on the rental value of leases is more widespread, with 59% of lease returns declaring some amount of LBTT due on rent in 2022/23.

Reviews of a lease include:

- Three-yearly reviews, which inform Revenue Scotland of any changes which have occurred since the effective date or previous review date. Tax chargeable on the lease is reviewed and the new Net Present Value is calculated when the review is submitted.

- Assignations: when a lease is assigned to a new tenant, the outgoing tenant must submit a review within 30 days of the lease being signed, including an assessment of the amount of tax chargeable reflecting any changes since the last return was submitted.

- Terminations: When a lease is terminated, the tenant at the point of termination must submit a return to Revenue Scotland, including an assessment of the amount of tax chargeable reflecting any changes since the last return was submitted.

The first six-year reviews became due from 1 April 2021 and make up part of the three-year review figures for this year.

Table 9: LBTT declared due and number of returns received for reviews, by year

| Year |

Lease Reviews declaring an Increase in LBTT due |

LBTT declared due on Lease Reviews (£Millions) |

Lease Reviews declaring a decrease in LBTT due |

Repayments to taxpayer declared due on Lease Reviews (£Millions) |

Lease Reviews declaring no change in LBTT due |

Total Lease Reviews received |

Net LBTT due on Lease Reviews (£Millions) |

| 2018/19 |

450 |

1.0 |

310 |

-1.0 |

3,460 |

4,220 |

0.0 |

| 2019/20 |

630 |

1.3 |

350 |

-0.8 |

3,580 |

4,570 |

0.6 |

| 2020/21 |

440 |

0.9 |

320 |

-0.8 |

2,130 |

2,900 |

0.0 |

| 2021/22 |

890 |

1.9 |

600 |

-1.4 |

3,090 |

4,580 |

0.5 |

| 2022/23 |

890 |

2.6 |

560 |

-1.6 |

3,270 |

4,720 |

1.0 |

Reviews of a lease accounted for approximately £1m of LBTT declared due in 2022/23. This makes up roughly 0.1% of total LBTT for the year.

Approximately 4,720 reviews of a lease were received in 2022/23, of which 69% declared no change in the LBTT due from the original lease return (meaning LBTT declared due on review was £0). 19% declared further LBTT due and 12% claimed a repayment of LBTT.

In 2018/19, 11% of lease reviews declared further LBTT due to be paid. This percentage rose each year until it reached 19% in 2021/22, then stayed at this level in 2022/23. Likewise, the percentage of lease reviews declaring a repayment of LBTT due to the taxpayer rose each year from 7% in 2018/19 to 13% in 2021/22, then dropping slightly to 12% in the past year.

In the past year, almost one in three reviews of a lease resulted in a change to the amount of LBTT due on the lease. In 2018/19, fewer than one in five reviews resulted in any change to the LBTT due.

1.7 Sub-Scotland

This section contains breakdowns of LBTT data at local authority level, as well as by ITL 2 (International Territorial Level). The figures here are referred to as estimates, due to the fact that location data for a proportion of LBTT returns has been imputed. This is necessary as we use the postcode stated on LBTT returns to assign them to higher geographies and not all LBTT returns are submitted with a valid postcode, primarily non-residential returns.

In 2022/23, 98% of residential LBTT returns and 69% of non-residential returns contained a valid postcode.

In order to improve the completeness of our address data, we match records without a valid postcode to data provided by Registers of Scotland and link on the postcode recorded alongside the title registration. If we cannot find a postcode using this method, we find a “donor” record which is similar to our incomplete “recipient” record, based on information on the LBTT return, and use this to impute geographical information.

This method provides robust estimates for residential and non-residential conveyances. The estimates for residential conveyances are more reliable because residential conveyance returns are more likely to include a valid postcode and more likely to match to a title registered with Registers of Scotland.

For the estimates presented here of returns submitted in 2022/23, location was imputed using the donor method for less than 1% of residential returns and 13% of non-residential returns.

1.7.1 Sub-Scotland: Residential LBTT

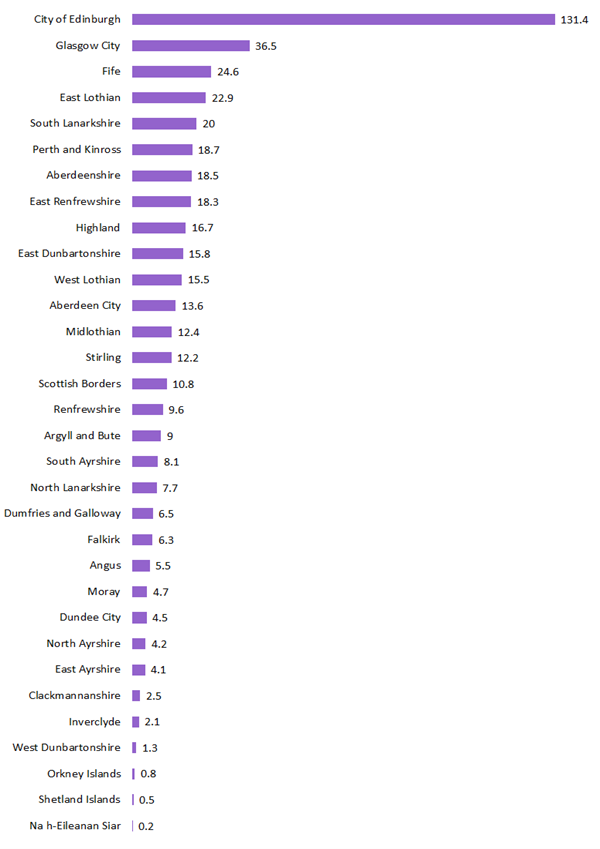

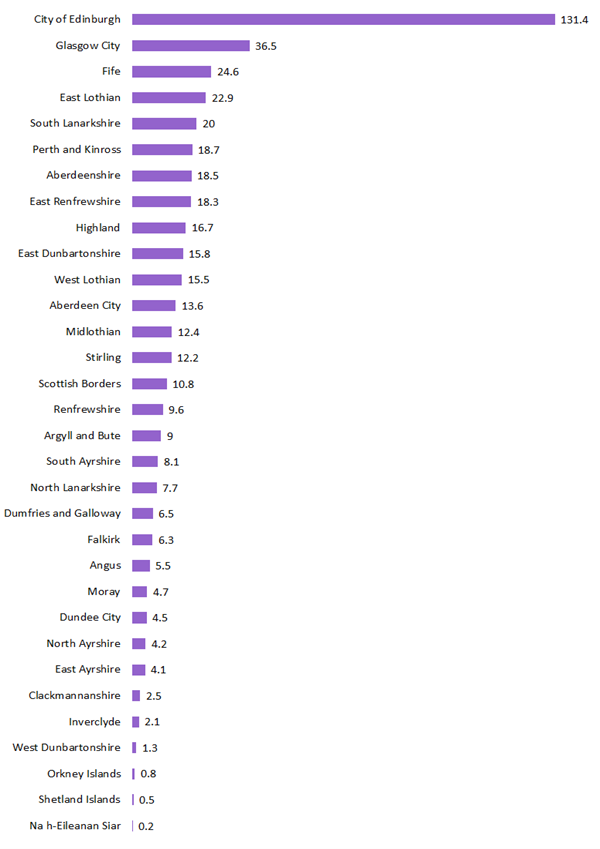

Figure 11: Estimates of LBTT declared due, excluding ADS, for residential conveyances by local authority, 2022/23 (£Millions)

Image

In 2022/23, City of Edinburgh accounted for £131.4 million (28%) of residential LBTT declared due, excluding ADS, by far the biggest contribution from a single council area. Next highest was Glasgow City, making up 8% of total residential LBTT at £36.5 million. City of Edinburgh has accounted for 30% to 34% of LBTT revenue, excluding ADS, each year since 2015/16. No other local authority has ever accounted for more than 9%.

The 3 local authorities with the highest mean LBTT declared due per transaction for residential returns were:

- City of Edinburgh at £11,500

- East Renfrewshire at £9,900 and

- East Lothian at £9,700.

The lowest averages were for:

- Na h-Eileanan Siar at around £800

- West Dunbartonshire at £1,000 and

- North Lanarkshire at £1,400.

From 2021/22 to 2022/23, LBTT revenues increased in 26 of the 32 local authorities. City of Edinburgh saw the largest absolute increase with a rise of £7 million (5%), while the largest percentage increase occurred in Shetland Islands where residential LBTT was up 47% (from approximately £0.35 million to £0.5 million). The largest percentage decrease on the previous year was in Na h-Eileanan Siar, which saw 34% less residential LBTT declared than in 2021/22.

Figure 12: Estimated number of residential conveyance returns received by local authority

Image

Glasgow City had the most residential conveyance returns received in 2022/23 with 11,740 returns (11% of the total), just ahead of City of Edinburgh with 11,390 returns (11%).

Numbers of residential conveyances decreased in 29 of 32 local authorities from 2021/22 to 2022/23, with only three local authorities seeing more residential LBTT returns received than last year.

The council areas which saw an increase in residential returns were:

- East Lothian with an increase of 3%

- Stirling with an increase of 2%

- East Dunbartonshire with an increase of 1%.

The council areas with the largest percentage decrease in number of returns on the previous year were:

- Na h-Eileanan Siar with a decrease of 31%

- Orkney Islands with a decrease of 20%

- Angus with a decrease of 19%.

1.7.2 Sub-Scotland: Additional Dwelling Supplement

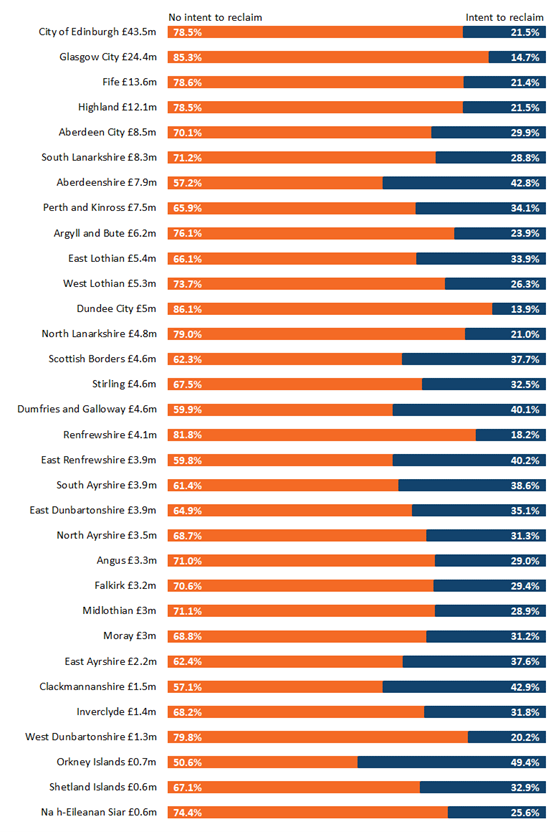

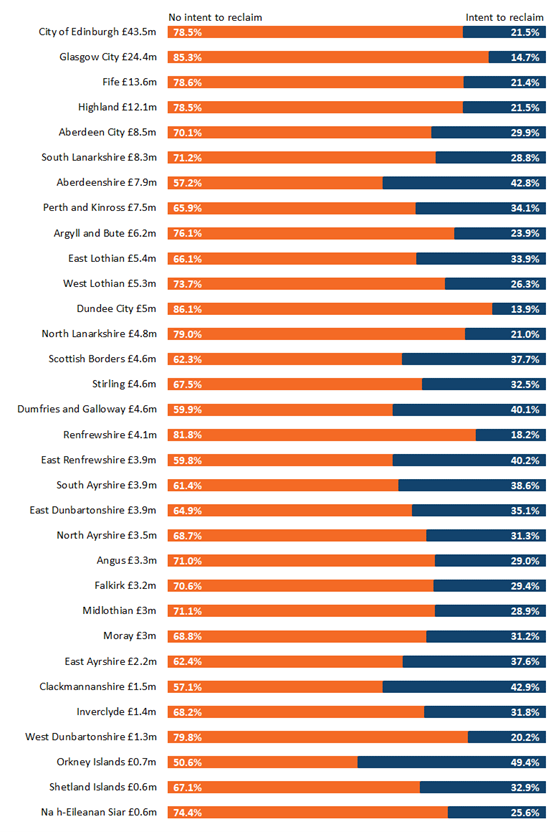

Figure 13: Estimates of gross residential ADS declared due (£Millions) by local authority and percentage which is intended to be reclaimed by taxpayer, 2022/23

Image

City of Edinburgh accounted for 21% of gross ADS declared due in 2022/23 with around £43 million, an increase of £2 million on the previous year. Glasgow City accounted for the second-largest share of ADS, making up 12% of the total with £24 million. Edinburgh tends to dominate LBTT excluding ADS (28% of total) more than gross ADS. This is because the ADS rate is flat whereas the LBTT rate is progressive, meaning the effective tax rate increases with total consideration.

The council area with the highest proportion of gross ADS coming from taxpayers who don’t intend to reclaim it was Dundee City at 86%. This figure was lowest in Orkney Islands at 51%.

The council areas with the greatest number of returns with ADS declared due were:

- Glasgow City with 3,360

- City of Edinburgh with 3,110

- Fife with 1,600.

At 93%, Dundee City also had the highest proportion of returns where the stated intention was to not reclaim ADS. The lowest figure was for Orkney Islands, where 54% of returns stated no intention to reclaim ADS.

1.7.3 Sub-Scotland: Residential conveyances not replacing a main residence

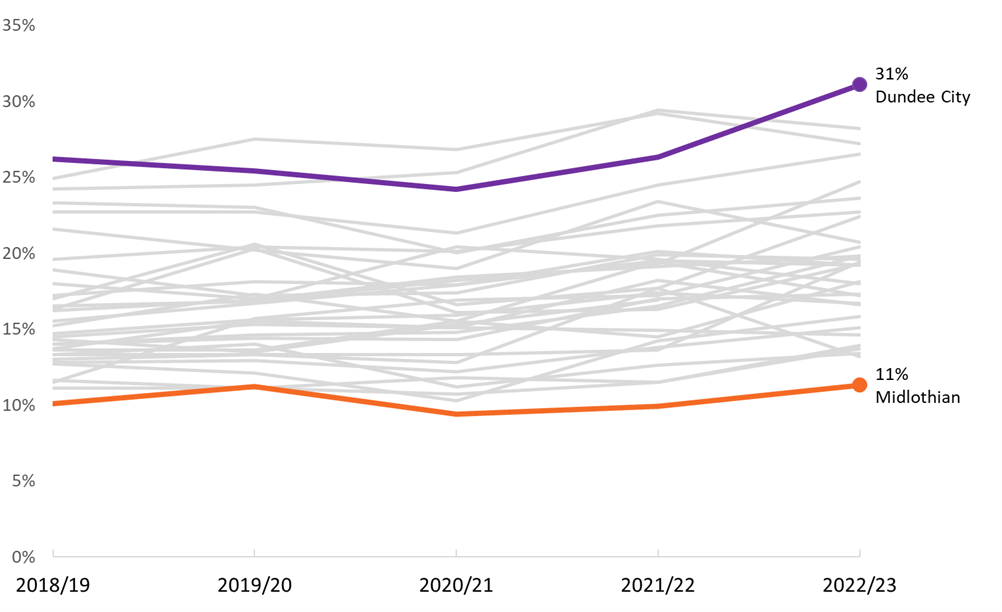

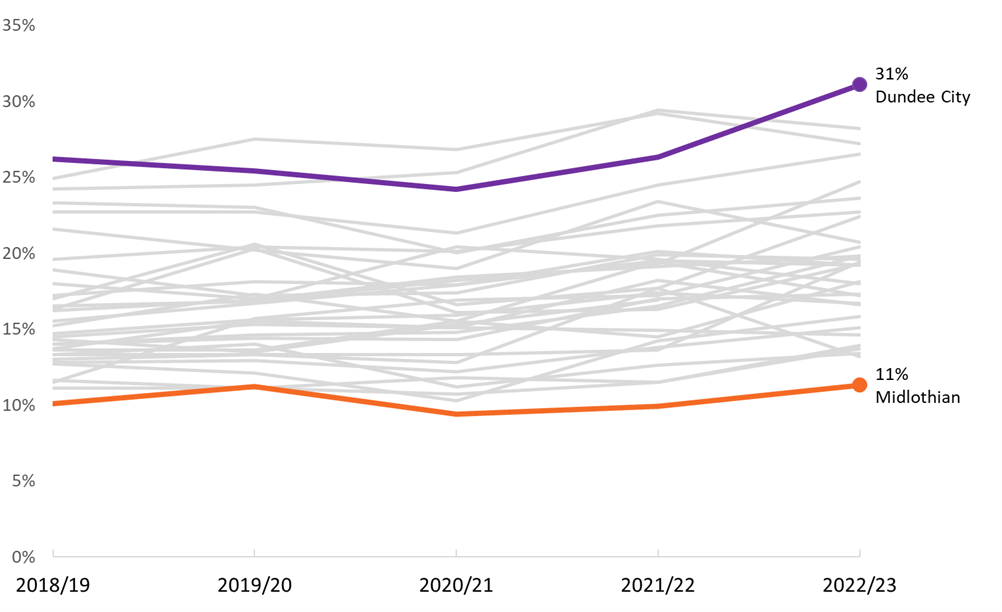

Figure 14: Estimates of the percentage (%) of all residential conveyance returns received where the taxpayer did not intend to reclaim ADS declared due, by local authority and year

Image

The data shown in Figure 14 is an indicative measure of the percentage of all residential conveyances where the taxpayer is purchasing an additional property (e.g. buy-to-let dwelling or a second home) rather than replacing their main residence. In 2022/23 this was highest in Dundee City at 31.1%.

The lowest figure was in Midlothian, where only 11% of residential LBTT returns declared ADS due, which the taxpayer did not intend to reclaim. Midlothian has been lowest in four of the past five years.

For the council areas with the highest numbers of residential returns, the figures were:

- Glasgow City: 27%

- City of Edinburgh: 24%

- Fife: 20%

1.7.4 Sub-Scotland: Residential tax bands

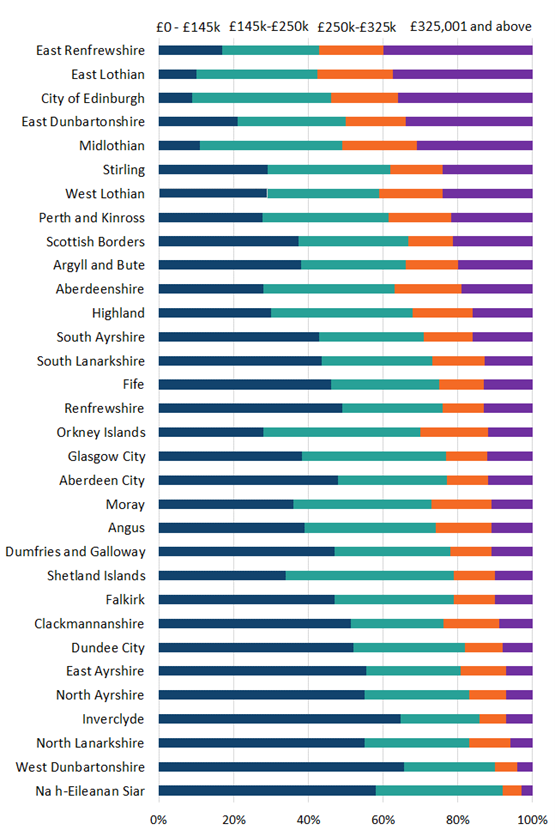

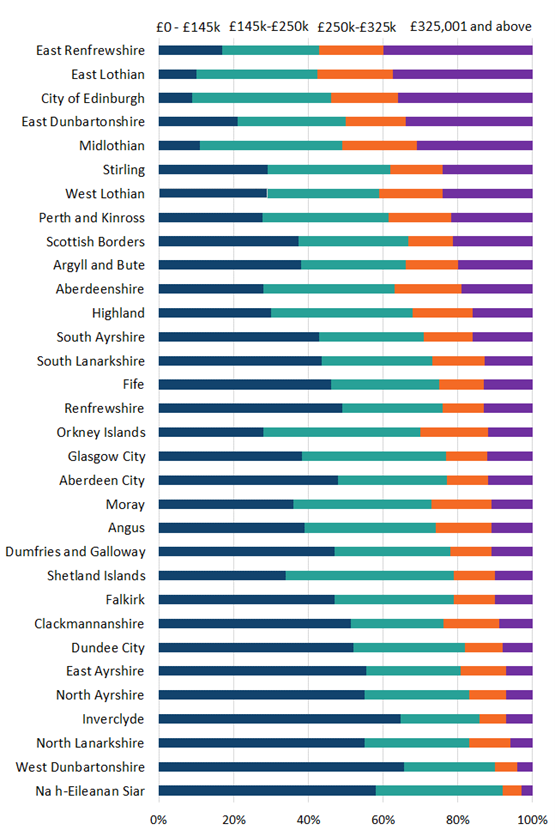

Figure 15: Distributions of residential LBTT returns by local authority and tax band, 2022/23

Image

Figure 15 shows the distribution of residential transactions by tax band, with the top two bands (£325,000 to £750,000 and £750,000 and above) combined to protect taxpayer confidentiality.

The council areas with the highest proportion of returns in the top grouped (£325k +) band were:

- East Renfrewshire at 40%

- East Lothian at 37%

- City of Edinburgh at 36%

One in 20 residential returns in City of Edinburgh fell into the highest underlying tax band (£750k+). These 580 returns accounted for nearly half of the 1,240 total returns within the £750k+ tax band in Scotland. East Lothian had the lowest proportion of residential returns in the bottom two tax bands combined (42%).

West Dunbartonshire had the highest proportion (65%) of transactions in the nil rate tax band (£0-145k). For 8 of the 32 local authorities, more than half of transactions fell into the nil-rate tax band. This is down from 11 in the previous year. A total of 37% of all residential transactions in Scotland fell into the nil-rate band, with 17% falling into the combined top two bands (£325k+).

1.7.5 Sub-Scotland: Non-residential conveyances

Sub-Scotland LBTT data is analysed by ITL 2 areas instead of local authorities for non residential returns, to minimise the risk of disclosing protected taxpayer information.

ITL stands for International Territorial Levels which are geographical areas used in UK statistics. These areas are currently identical to the Europen Nomenclature of Units for Territorial Statistics which were used in previous versions of this publication.

Scotland is divided into five of these units, mainly by grouping together Council Areas. These five areas are: Highlands and Islands, North Eastern Scotland, Eastern Scotland, West Central Scotland, and Southern Scotland.

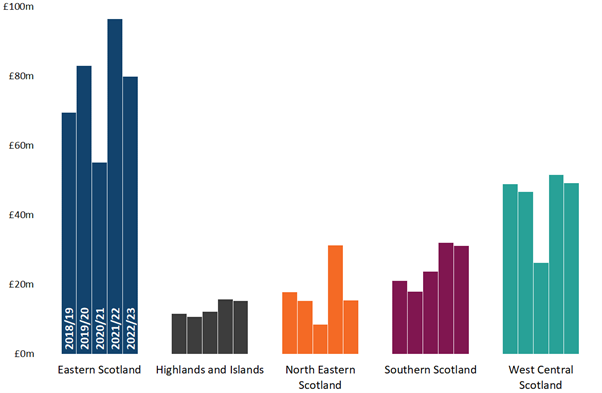

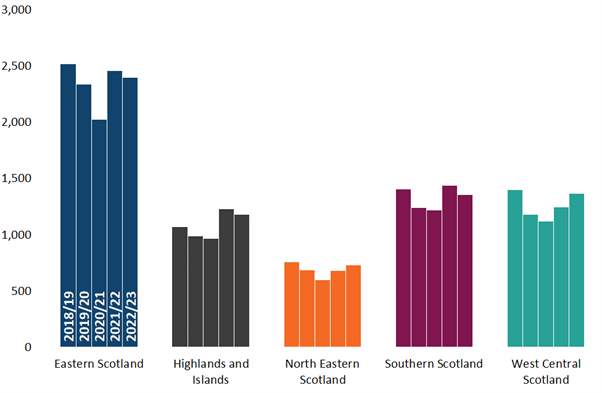

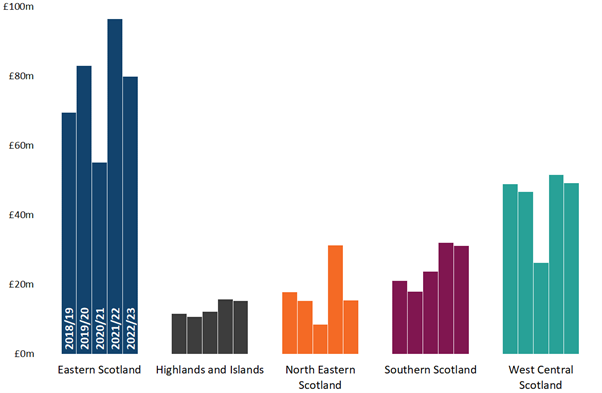

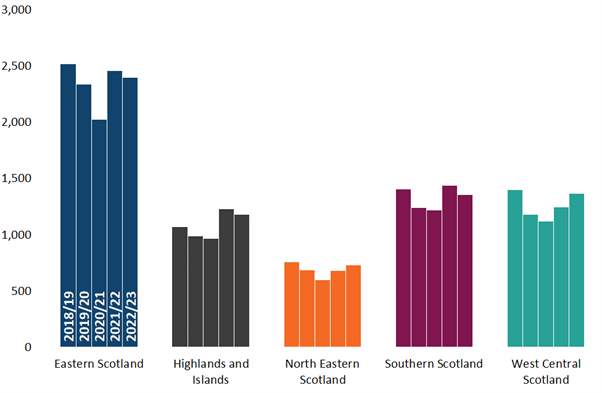

Figure 16: Estimates of non-residential LBTT declared due by ITL 2 area and year

Image

Eastern Scotland consistently makes up the largest share of non-residential LBTT declared due, accounting for £80 million (42%) in 2022/23. The highest number of returns also comes from Eastern Scotland at 2,400 (34%).

All ITL 2 areas saw decreases in non-residential LBTT in 2022/23 compared with the previous year. West Central Scotland, Southern Scotland and Highlands and Islands saw fairly small reductions in comparison to North Eastern Scotland which saw a 51% drop, and Eastern Scotland which fell by 17%.

The number of non-residential returns received overall was very similar to last year, with a figure of 7,040 this year, compared to 7,050 last year. Western Scotland saw 9% fewer returns compared with 2021/22 and North Eastern Scotland saw a drop of 7%, while the other ITL 2 areas saw slight increases.

Southern Scotland and Highlands and Islands saw more gradual increases and did not experience the dip in 2020/21.

The significant drop in LBTT in North Eastern Scotland and Eastern Scotland despite relatively stable numbers of returns compared with the previous year reflects the fact that for non-residential LBTT, a small number of very high value transactions can greatly affect the total LBTT due. For this reason, care should be taken when interpreting annual trends in non-residential LBTT by ITL 2 area.

Figure 17: Estimated number of non-residential returns by ITL 2 area and year

Image

1.8 LBTT Reliefs

There are a number of tax reliefs which provide whole or partial relief from LBTT. Common reliefs include:

- First-Time Buyer relief, which currently relieves LBTT on the first £175,000 of the consideration payable for first time buyers, subject to conditions.

- Charities relief, where the buyer in a land transaction is a charity and certain conditions are met.

- Group relief, where at the effective date of a land transaction the seller and buyer are both companies in the same group.

Table 10: Estimated LBTT revenue forgone to reliefs and number of LBTT returns received in which some LBTT revenue has been forgone to reliefs, by year (combined Residential and Non-Residential)

| Year |

LBTT revenue excluding ADS forgone (£Millions) |

ADS revenue forgone (£Millions) |

All revenue forgone (£Millions) |

Returns in which some LBTT excluding ADS was forgone to relief |

Returns in which some ADS revenue was forgone to relief |

All returns in which some revenue was forgone to relief* |

| 2018/19 |

122.4 |

4.3 |

126.7 |

9,940 |

310 |

10,020 |

| 2019/20 |

106.2 |

5.7 |

111.9 |

15,390 |

410 |

15,530 |

| 2020/21 |

100.8 |

3.6 |

104.4 |

3,020 |

240 |

3,030 |

| 2021/22 |

127.0 |

5.3 |

132.3 |

17,680 |

310 |

17,710 |

| 2022/23 |

102.1 |

13.2 |

115.3 |

17,600 |

870 |

17,850 |

*This column is not the sum of the two preceding columns. Some returns may have relief on the LBTT and ADS, so they are only counted once in this column.

Due to known data quality issues with reliefs information collected from LBTT returns, figures in this section are presented as estimates. These issues only impact a small number of returns and the total figure for LBTT foregone to reliefs is not affected. Further information is available in Appendix C.

It is estimated that £115 million of LBTT revenue was forgone to reliefs in 2022/23, which represents a £17 million (13%) decrease on the previous year. In the same period, total LBTT declared increased 5% and the total number of returns received was down by 6% (see Overview Section of this publication). The number of returns received where some LBTT was foregone to reliefs increased by just 1%.

Roughly 15% of all LBTT returns had some LBTT revenue foregone to reliefs in 2022/23, up from 14% in 2021/22. This continues the upward trend year on year for the percentage of LBTT returns with some LBTT foregone to reliefs, excluding 2020/21 when there was a temporary pause on First Time Buyer Relief.

ADS foregone to relief rose by almost £8 million (149%) in 2022/23, while the number of returns in which some ADS was foregone to relief increased by 181%. The three reliefs which account for the majority of both of these increases are:

- Relief for certain acquisitions of residential property

- Charities relief

- Relief for certain acquisitions by registered social landlords.

Detailed explanations of these reliefs are available on the relief section of the Revenue Scotland website.

It is important to note that a small number of very high value reliefs can have a significant impact on the overall total figure, and cause year to year fluctuations.

First-time buyer relief was introduced in 2018, and largely accounts for the sharp increase in the number of returns with LBTT foregone to relief between 2018/19 and 2019/20. The steep decline in 2020/21 can be mostly attributed to the temporary increase in the nil-rate tax band. During this period, a large number of transactions which normally would have qualified for first time buyers relief, simply had no LBTT due, making the relief temporarily redundant.

Table 11: Estimated LBTT revenue forgone to reliefs and number of LBTT returns received in which some LBTT revenue has been forgone to reliefs by type of property and year

| Year |

LBTT forgone (£ millions) |

Number of LBTT returns in which some LBTT revenue has been forgone to reliefs |

|

| |

| Residential |

Non-residential |

All |

Residential |

Non-residential |

All |

|

| 2018/19 |

15.9 |

110.8 |

126.7 |

9,180 |

840 |

10,020 |

|

| 2019/20 |

17.3 |

94.6 |

111.9 |

14,740 |

790 |

15,530 |

|

| 2020/21 |

16.2 |

88.2 |

104.4 |

2,310 |

730 |

3,030 |

|

| 2021/22 |

35.5 |

96.8 |

132.3 |

16,950 |

760 |

17,710 |

|

| 2022/23 |

24.4 |

90.9 |

115.3 |

17,010 |

840 |

17,850 |

|

Approximately 17% of residential returns in 2022/23 had some LBTT foregone to reliefs and 12% of non-residential returns claimed some form of relief.

Residential returns made up 95% of returns in which some LBTT was forgone to reliefs in 2022/23. However, non-residential returns made up the majority of the total value of LBTT forgone to reliefs (79%).

First-Time Buyer Relief

First-Time Buyer Relief accounted for 91% of returns received in which some LBTT revenue was forgone to relief in 2022/23. Every year since its introduction, aside from in 2020/21, when there was a temporary increase to the nil-rate tax band, First-Time Buyer Relief has made up the majority of claims for relief. Despite accounting for the vast majority of claims for relief, Figure 19 shows that First-Time Buyer relief accounts for only a small portion of the estimated LBTT revenue foregone to reliefs. This is because First-Time Buyer relief provides a maximum of £600 relief from LBTT per transaction, as it only applies to the first £175,000 of the consideration. This is unlike other relief types which can relieve the entire tax liability of potentially much larger transactions.

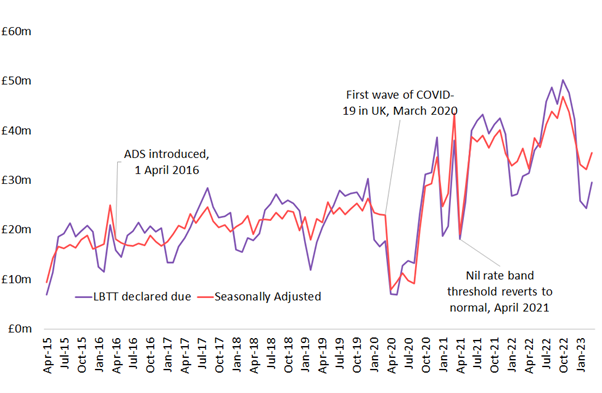

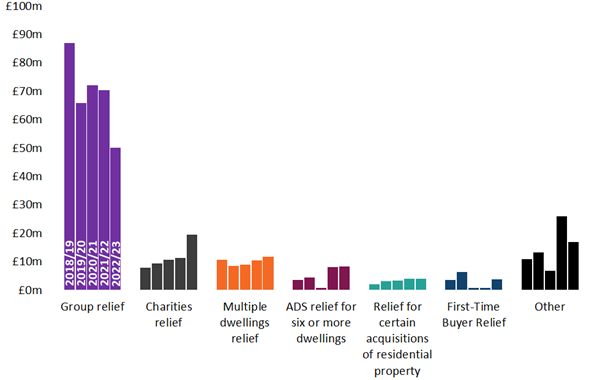

Figure 18: Estimated LBTT revenue forgone to reliefs by type of relief and year

Image

Group relief typically makes up the majority of LBTT forgone to reliefs, accounting for 44% in 2022/23. Changes in the total reliefs are largely driven by changes in group relief. Group relief provides relief from LBTT where the seller and buyer are both companies in the same group. Where certain rules are met, this allows companies to move property within a corporate group structure without a liability for LBTT being incurred.

The second highest proportion of LBTT forgone to relief (17%) came from Charities relief. The third highest proportion (15%) came from Other reliefs, which groups together all reliefs outside the six biggest single contributors. More information about these reliefs can be found on the Revenue Scotland website. As with residential reliefs, a small number of high value transactions can have a significant impact on the total in this category.