Purpose of this guidance

This guidance will help you make an online Land and Buildings Transaction Tax (LBTT) lease return. Separate guidance is available on ‘How to pay LBTT’, including setting up Direct Debit and BACS payment arrangements.

This is not guidance to the tax itself. LBTT legislation guidance for taxpayers and agents is available separately on our website. Where we refer to further guidance, for example ‘see LBTT1001’, we mean references to that guidance.

It is the tenant’s responsibility to ensure the LBTT return is complete and accurate. If you are unsure about any matter relating to the LBTT return you should seek professional advice.

Her Majesty’s Revenue and Customs (HMRC) is responsible for the collection and management of Stamp Duty Land Tax (SDLT). All SDLT returns should continue to be sent to HMRC and we will reject any such returns that we receive.

All references in this guidance to:

- ‘tenant’ means the person who acquires the subject-matter of the land transaction;

- LBTT(S)A 2013 means The Land and Buildings Transaction Tax (Scotland) Act 2013;

- ‘landlord’ means the person who disposes of the subject-matter of the land transaction;

- ‘we’, ‘us’ or ‘our’ means Revenue Scotland; and

- ‘you’ means the person making the LBTT return (either as the tenant or the tenant’s agent).

Protection of information

We will protect and handle any information that you provide to us in your tax return with care. For further information please see our Privacy Policy and guidance on taxpayer information (Chapter 9 of The Revenue Scotland and Tax Powers Act 2014 legislation guidance).

The following information is guidance on completing specific sections of the LBTT lease return;

General Guidance

- 1. Creating a new LBTT return

-

Image

You can create a new LBTT return by selecting ‘Create LBTT return’ at the top of the dashboard.

Image

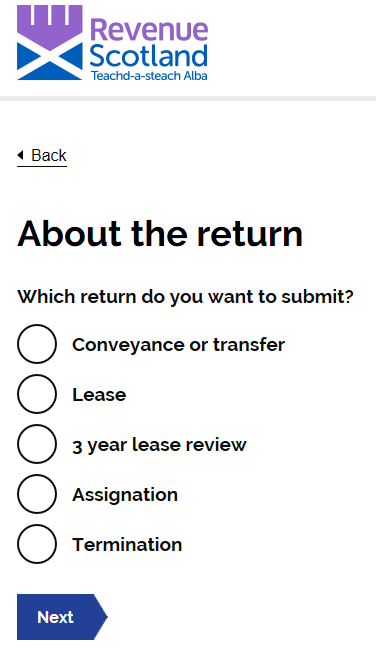

After selecting ‘Create LBTT return’ on the dashboard, you will be asked to select from five options. For a lease return select ‘Lease’.

- 2. Navigating the LBTT return

-

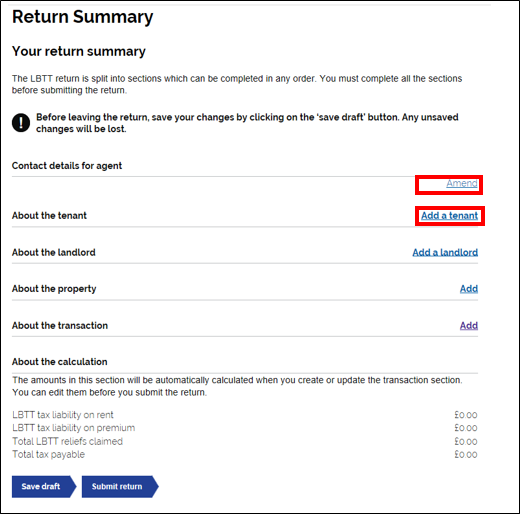

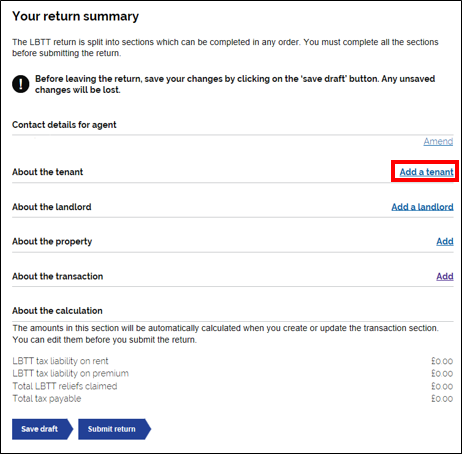

Image

The first section is the ‘contact details for agent’ section. These details are pulled through from the information you provided at sign up. However you can update the following details if you need to;

- Title

- First Name

- Last Name

- Agent Reference

- DX Number and exchange

- Telephone number

- Address

Once these fields are updated you can then go back to the Return Summary page.

The rest of the LBTT return is split into five sections, each of which can be completed in any order by selecting the ‘Add’ button on the right side of each section.

The ‘About the calculation’ will be editable once the ‘About the transaction’ section has been completed.

- 3. Draft LBTT return - Creating, searching, saving, editing and deleting

-

Creating and saving a draft

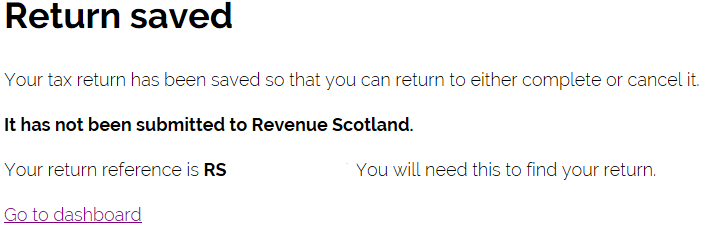

Image

To save a draft, select the ‘save draft’ button at the bottom of the return. This will then take you to a screen which will confirm the return has been saved. This screen will also create a reference number for the return.

If at any point you need to exit the return and come back to it later, select the ‘save draft’ button at the bottom of the return again.

Searching for a draft return

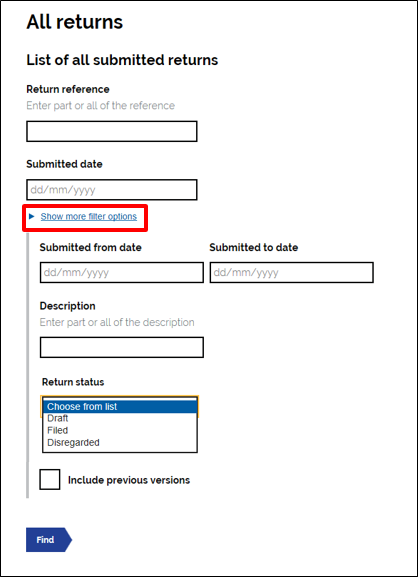

Image

Selecting the ‘all returns’ button on the dashboard, will bring you to the ‘all returns’ page. Here you can search for any draft (or submitted) returns.

Selecting the ‘Show more filter options’ will show all search options. You can search for a return by;

- Return Reference – The reference Revenue Scotland assign to the return

- Submitted date – If the return has been submitted

- Submitted from and submitted to date

- Description – The description of the return is populated with the tenants name and address

- Return status – Draft, Filed or Disregarded. If searching for a draft you would select draft here.

There is also the option of checking the ‘include previous versions’ box. This will include already submitted returns in your search.

Editing a draft return

As long as you have saved a draft of the online LBTT return, you can edit it at any time before making the final return to us by finding the return from the ‘Draft Returns’ section on the Dashboard and selecting the ‘continue’ button

This will then take you into the draft LBTT return where you can begin making the necessary changes. Once you have finished, you can either:

- submit the amended return to us by selecting the ‘Submit’ option at the bottom of the return; or

- if you are still not yet ready to submit it, select the ‘Save Draft’ option.

Deleting a draft return

There is currently no option to delete a draft return on our new system. This is temporary and will be fixed as soon as possible. We will update this guidance once this has been completed.

- 4. Amending an LBTT return once it has been submitted

-

Once an LBTT return has been made to us, subject to a small number of exceptions you can amend any details in the return up to 12 months after the filing date (see LBTT1000). No amendment to an LBTT return can be made after this date.

For further guidance, including the exceptions to this rule, see the ‘How to amend an LBTT return’ guidance available on our website.

Note: If the ‘Status’ description for the return says ‘Amendment not allowed’ this is because we have restricted online amendments for this return. Please contact us if you wish to make an amendment to this return.

- 5. Reviewing the LBTT Return

-

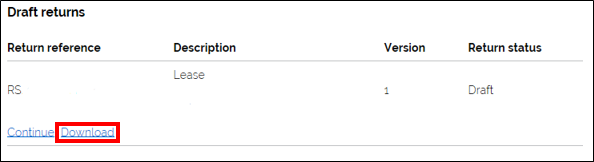

Draft returns

Image

On the dashboard under the ‘Draft returns’ heading you will see the daft return. There will be an option to ‘download’ the return. This will produce a PDF version of the return.

You can then use this to preview the content of the LBTT return at any point before submitting the return. This can be saved and/or printed.

Submitted returns

Image

On the dashboard you can access all submitted returns by selecting the ‘All returns’ button. Once selected you will be able to view all submitted returns. Once you have found the return you wish to view, under the return reference there will be the option of selecting ‘Download’. Selecting this button will created a PDF version of the return. You can then use this to view the PDF, save and or print.

Note: We will not accept a print-out of an online LBTT return sent to us in the post. If you wish to make a paper LBTT return you must use the paper return available to download and print from our website.

- 6. Post-submission Return Acknowledgement

-

Image

Please note you will no longer be able to view a copy of the tax return acknowledgment. When the tax return is submitted, there is an option to print the confirmation there and then. If you need a copy of the confirmation, you must print it then.

- 7. About the Tenant

-

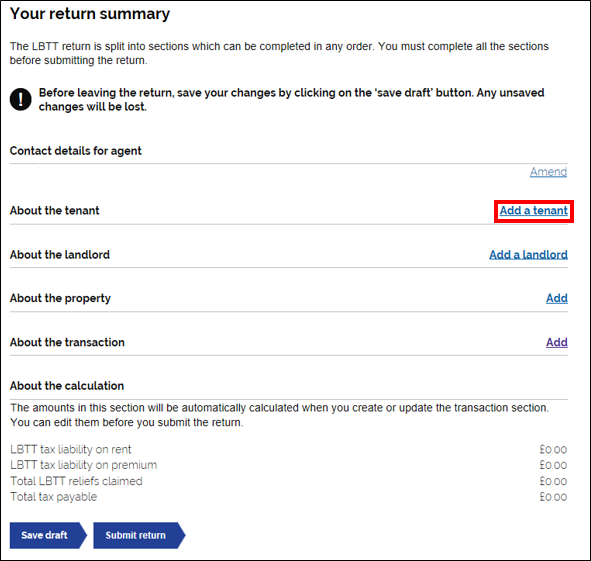

Image

You can add a tenant by selecting the ‘add a tenant’ button on the right had side of the ‘About the tenant’ section.

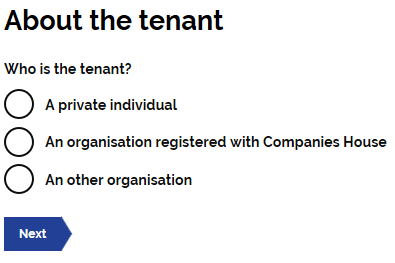

Image

Who is the Tenant

Select the option which is most relevant to the tenant.

Note: For these purposes, ‘An other organisation’ includes the option of Partnership, Trust, Charity, Club, Other and Company (Not registered with Companies house).

Depending on the type of tenant you chose, you will be asked for different information.

Tenant type - Private IndividualTenant details

You will be asked to complete the following details for the tenant;

- Title

- First name

- Last name

- Telephone number

- National Insurance number (NINO) /Other form of ID if no NINO

- Address

Note: All these fields, except Title, are mandatory.

Tenant’s contact address

You will be asked ‘should we use a different address for future correspondence in relation to this return?’. Please use the radio buttons to select either ‘Yes’ or ‘No’.

Where ‘Yes’ is selected, please provide the tenants contact address.

Tenant type - Organisation registered with companies house

Registered company details

You will be asked to enter the registered company number. This will populate the Company Name and Address. These can be edited if necessary.

Contact details

You will be asked to complete the following details for the company contact;

- First name

- Last name

- Job title or position

- Address

- Contact phone number

Tenant type – An other organisation

Type of organisation

Here you can select which type of organisation the tenant is.

Note: When ‘other’ is selected, a box will appear to prompt an explanation of the type of organisation the tenant is. If ‘charity’ is selected then you will be asked to provide the charity number.

When you have selected the organisation type you will then be asked to provide the following information;

- Name of the organisation

- Address of the organisation

- The country’s law which governs the organisation i.e. where the organisation is registered

Once this information is completed you will be asked to enter the following details for the organisations point of contact;

- First name

- Last name

- Job title or position

- Address

- Contact phone number

Tenant Details

Under Tenant details you will be asked the following questions;

Is the Tenant connected to the Landlord?

Enter ‘Yes’ if the tenant and landlord are connected persons as defined under section 58 of the LBTT(S)A 2013.

Is the tenant acting as a trustee or representative partner for tax purposes?

Select either ‘yes’ or ‘no’.

Note: Once complete, you can add additional tenants if necessary. This is done by selecting the ‘Add a tenant’ button.

- 8. About the Landlord

-

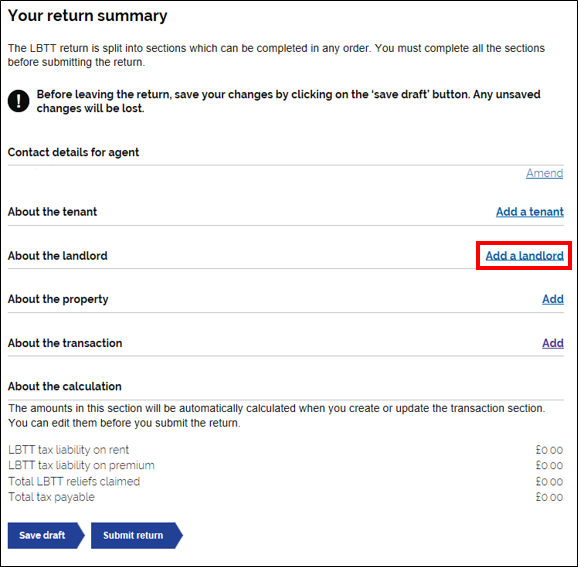

Image

You can add a landlord by selecting the ‘add a landlord’ button on the right hand side of the ‘About the landlord’ section.

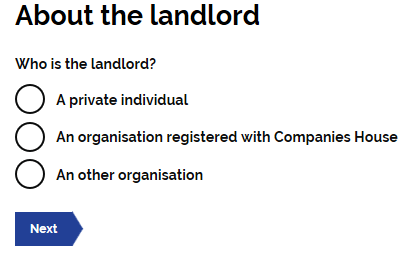

Image

Who is the landlord

Select the option which is most relevant to the landlord.

Note: For these purposes, ‘An other organistaion’ includes the option of Partnership, Trust, Charity, Club, Other and Company (Not registered with Companies house).

Depending on the type of landlord you chose, you will be asked for different information.

Landlord type – Private Individual

You will be asked to complete the following details for the landlord;

- Title

- First name

- Last name

- Address

Note: All these fields, except Title, are mandatory.

Landlord type - Organisation registered with companies house

Registered company details

You will be asked to enter the registered company number. This will populate the Company Name and Address. These can be edited if necessary.

Landlord type – An other organisation

Type of organisation

Here you can select which type of organisation the landlord is.

Note: When ‘other’ is selected, a box will appear to prompt an explanation of the type of organisation the landlord is. If ‘charity’ is selected then you will be asked to provide the charity number.

When you have selected the organisation type you will then be asked to provide the following information;

- Name of the organisation

- Address of the organisation

- The country’s law which governs the organisation i.e. where the organisation is registered

Note: Once complete, you can add additional landlords if necessary. This is done by selecting the ‘Add a landlord’ button.

- 9. About the Property

-

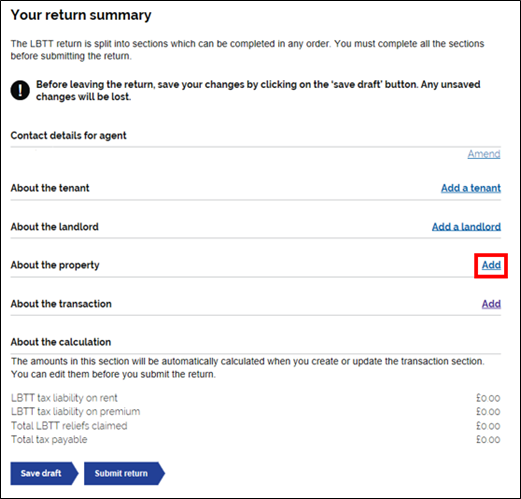

Image

You can add a property by selecting ‘Add’ on the right hand side of the ‘about the property’ section.

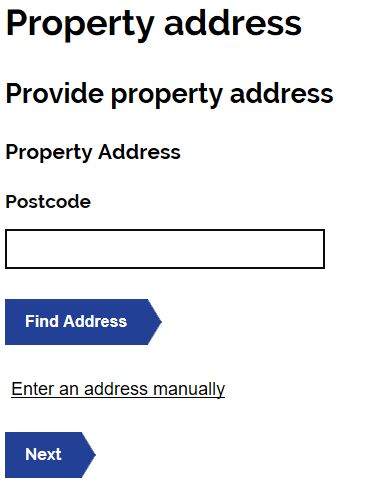

Provide Property Details

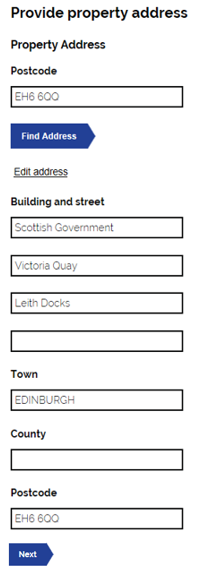

Image

Using the postcode lookup, enter the property postcode and select ‘Find address’. The postcode finder will find all properties that belong to that postcode. Select the appropriate address.

Note: You can select the ‘enter an address manually’ link if the property doesn’t have a postcode/you don’t know the postcode.

Image

The postcode finder will then populate the address details. These can be edited if necessary.

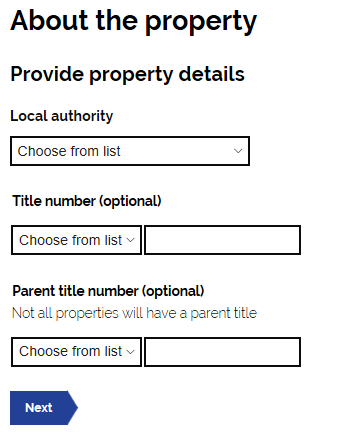

Image

You will then be asked to complete the following details;

Local Authority

From the drop-down list select the local authority in which the property is situated. If a property straddles a local authority boundary enter the code for the local authority in which most of the property falls.

Title Number

1. From the drop-down list select the appropriate county code for the property’s title number e.g. for Aberdeen select ‘ABN’.

2. In the free-text field to the right of the county code enter the property’s title number (if known). Only complete these fields if you know the full numbers.

Parent Title Number

If you do not know the title number of the property it is possible that it forms part of a larger area.

1. From the drop-down list the appropriate county code for the property’s parent title number e.g. for Aberdeen select ‘ABN’.

2. In the free-text field to the right of the county code enter the parent title number(s) to which the property relates.

Note: Please only complete these parts if you know the full number.

- 10. About the Transaction

-

Image

You can add details about the transaction by selecting the ‘add’ button on the right hand side of the ‘About the transaction’ section.

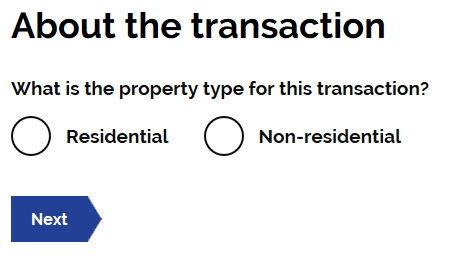

About the transaction

Image

You will then be asked ‘what is the property type for this transaction?’. Use the radio buttons to select the appropriate answer.

Image

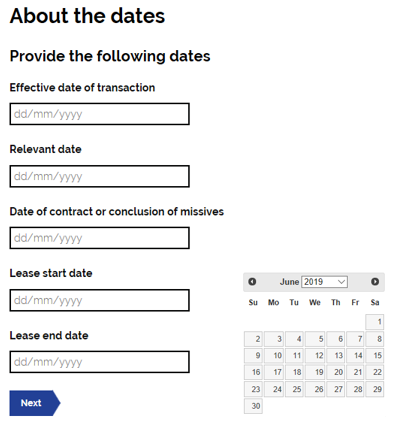

You will be asked to complete the following dates;

- Effective date of transaction

- Relevant date

- Date of contract of conclusion of missives

- Lease start date

- Lease end date

Clicking on the box will produce a calendar. You can use this to select the appropriate dates. You can also type into the box, without having to use the calendar.

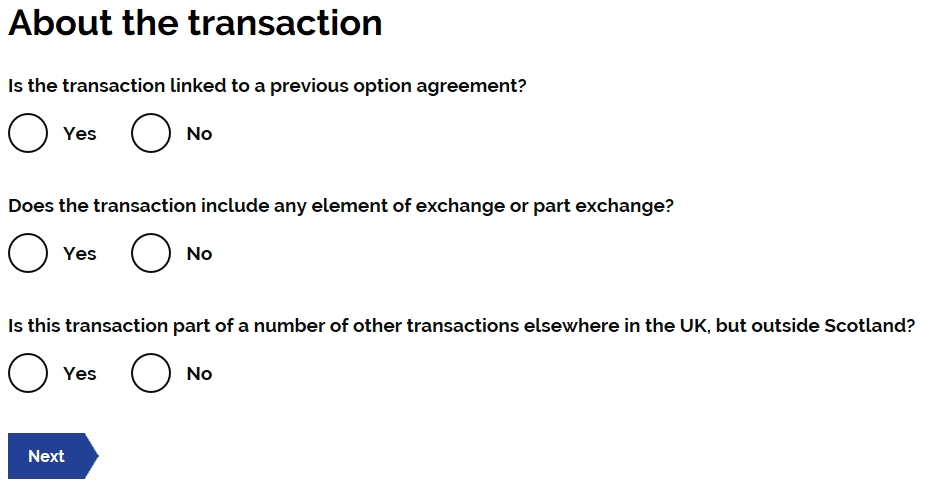

Image

You will be asked the following questions;

- Is the transaction linked to a previous option agreement?

- Does the transaction include any element of exchange or part exchange?

- Is this transaction part of a number of other transactions elsewhere in the UK, but outside Scotland?

Use the radio buttons to choose the appropriate answer to each question.

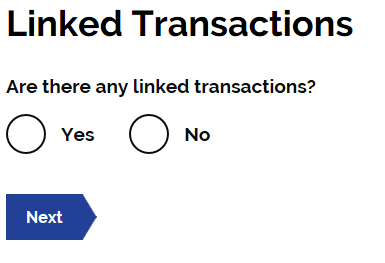

Linked Transactions

Image

You will be asked if this transaction is linked to any other transactions. Guidance on linked transactions can be found at LBTT2008.

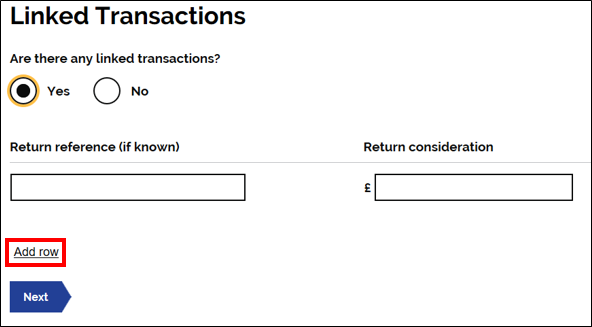

Image

If you answer ‘yes’ to ‘Are there any linked transactions?’ a further field will be populated. Here you will asked to complete the ‘Return reference (if known)’ and the ‘Return consideration’ of the linked transaction.

There is the option to ‘Add row’ if there are multiple linked transactions.

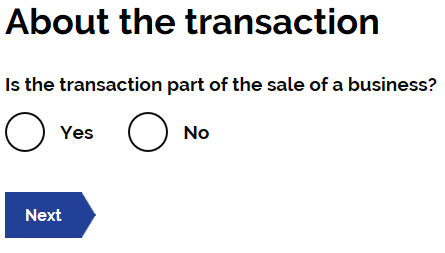

Sale of a business

Image

You will be asked ‘is the transaction part of the sale of a business?’. Use the radio buttons to select the appropriate answer.

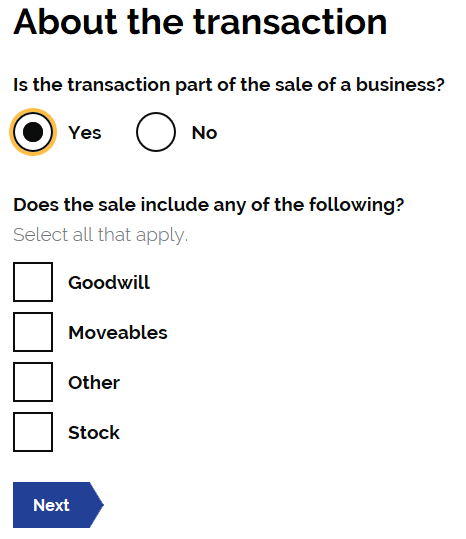

Image

If you select ‘yes’ to ‘Is the transaction part of the sale of a business?’ a further field will be populated. You will be asked if the sale includes any of the following;

- Goodwill

- Moveables

- Other

- Stock

Used the check boxes to select the which is applicable.

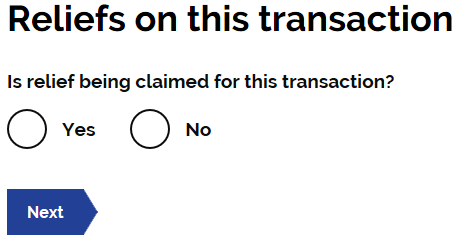

Reliefs

Image

You will be asked ‘Is relief are being claimed for this transaction?’. Use the radio buttons to choose the appropriate answer.

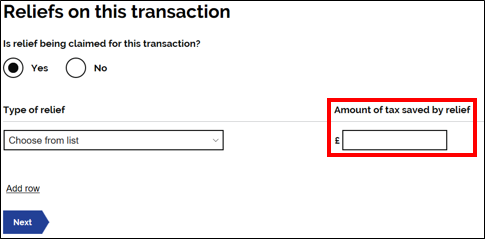

Image

If ‘yes’ is selected a relief is being claimed, a further field will be populated. You will be asked to select, from the drop down, which relief you are claiming. You will also be asked to complete the box detailing the ‘amount of tax saved by the relief’.

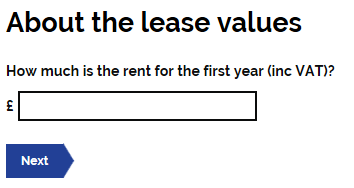

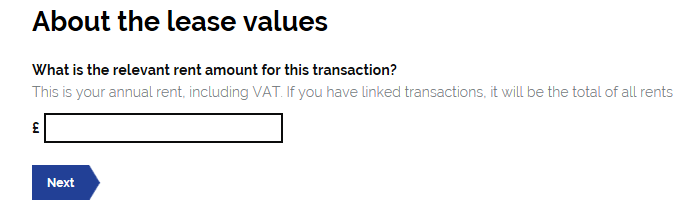

About the lease values

Image

You will be asked ‘How much is the rent for the first year (inc VAT)?. Use the box to enter the amount.

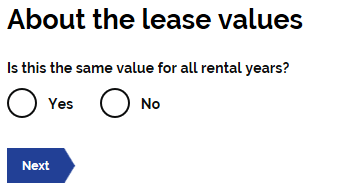

Image

You will then be asked to confirm if the rental amount for the first years rent, is the same amount for all rental years. Use the radio buttons to choose the relevant answer.

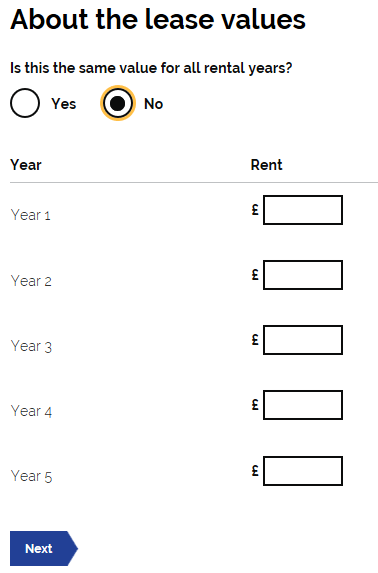

Image

If you select ‘no’, a further field will populate. This allows you to enter the rental value for each year of the lease.

Note: Please ensure you complete these boxes correctly as the system uses these figures to calculate the NPV figure.

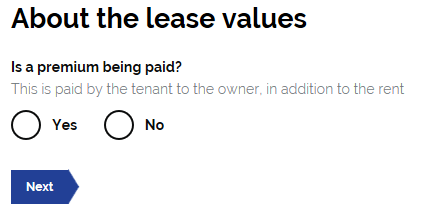

Image

You will be asked if a premium is being paid on the lease. Use the radio buttons to select the relevant answer.

If you select ‘yes’, a further field will populate. This will ask you to enter the ‘Premium amount (inc VAT)’.

Image

You will be asked ‘What is the relevant rent amount for the transaction?’. Use the box provided to enter the appropriate amount.

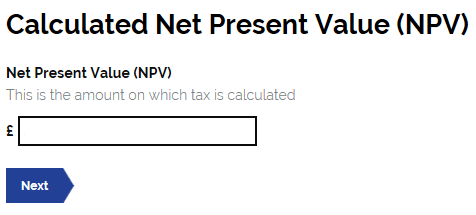

Image

The system will then calculate the Net Present Value (NPV) based on the figures entered earlier in the ‘About the transaction’ section.

Once these fields have been completed, the figures will be pulled through to the ‘About the calculation’ section. The ‘About the calculation’ section can then be edited if necessary.

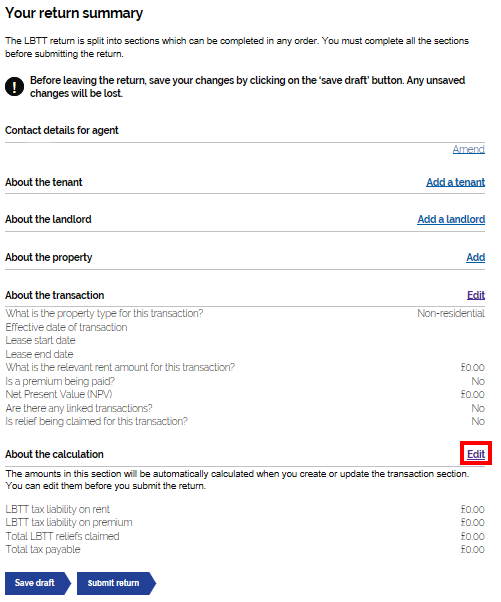

- 11. About the Calculation

-

The ‘About the calculation’ section will only become editable once the ‘About the transaction’ section has been completed.

Guidance on how to complete the ‘About the transaction’ section can be found in the previous section, ‘About the transaction’.

Image

To edit, select the ‘edit’ button on the right of the ‘About the Calculation’ section. You will then be able to edit the following fields;

- LBTT tax liability on rent

- LBTT tax liability on premium

- Total LBTT reliefs claimed

- Total tax payable

Some of these fields may not be applicable to your transaction and will not need to be amended.

Note: These fields should not include any penalties and interest that may be due in relation to the transaction – these are administered separately by us.

Once you have amended the necessary fields, select next to update the changes. These will then be reflected on the Return summary area.

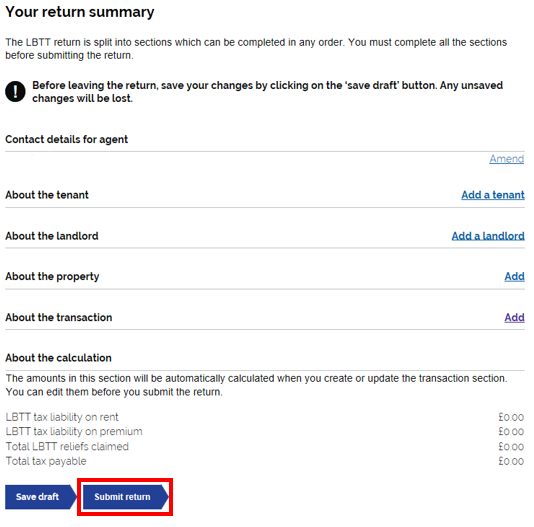

- 12. Submitting a Return

-

Submit Return Button

Image

When you have completed the LBTT return and are ready to submit it, select ‘Submit return’ at the very bottom of the return summary page.

Note: If you select ‘Submit return’ and an error dialogue box appears, you must correct any relevant errors before you can successfully submit the return.

Payment Method

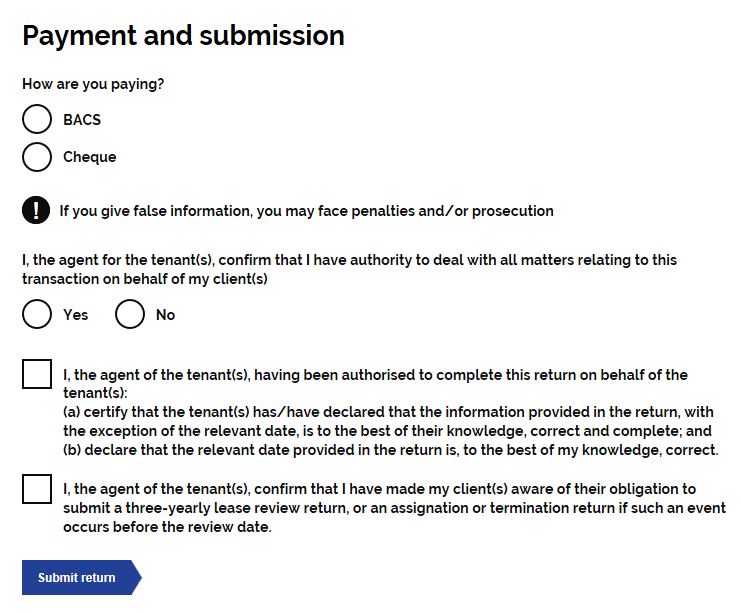

Image

After selecting ‘Submit return’ you will be asked if you are paying by BACS or Cheque. If you have signed up for Direct Debit, this will also show as an option. Use the check box to select your chosen payment method.

Declaration Statements

Under the payment check boxes you will see three declaration statements. The first declaration asks you to confirm, by checking the box, that you, as the agent, have the authority to deal with all matter relating to the transaction on behalf of your client(s).

Use the radio button to select either ‘yes’ or ‘no’.

The second declaration asks you to confirm that;

I, the agent of the tenant(s), having been authorised to complete this return on behalf of the tenant(s);

(a) certify that the tenant(s) has/have declared that the information provided in the return, with the exception of the relevant date, is to the best of their knowledge, correct and complete; and

(b) declare the relevant date provided in the return is, to the best of my knowledge, correct.

The third declaration relates to the requirement to complete a three-year lease review as well as an assignation/termination return. This declaration ask you to confirm that;

I, the agent of the tenant(s), confirm that I have made my client(s) aware of their obligation to submit a three-yearly lease review return, or an assignation or termination return if such an event occurs before the review date.

Note: You must check the box to confirm you agree with the declaration in order to submit the return.

Submission Confirmation

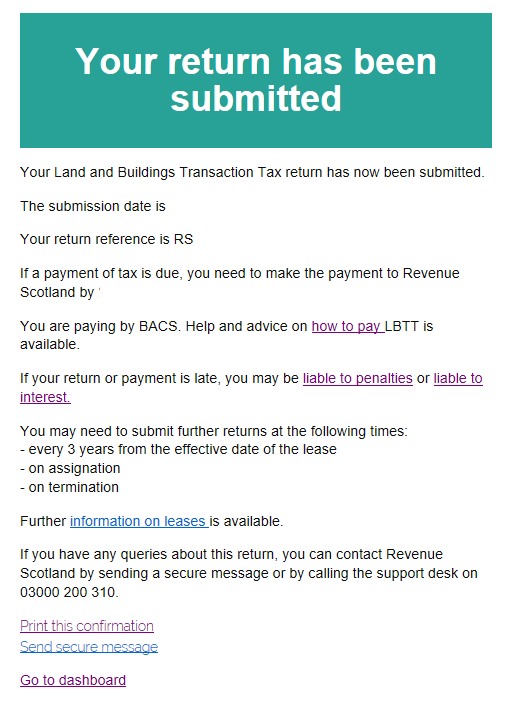

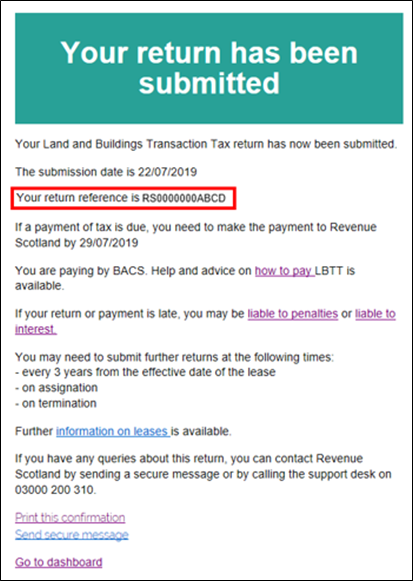

Image

The return will then be submitted to us and given a 13 digit unique transaction reference (RSXXXXXXXABCD) which will be displayed to you on this screen. This number must be quoted when making payments in relation to the transaction or when contacting us about the transaction.

The submission screen will confirm when payment must reach us by. A link to our How to pay guidance is provided. There is also a link to our penalties and interest guidance. Further information on leases is also linked on the submission page.

Note: Any tax due is treated as paid on time if arrangements satisfactory to us are made at the same time as the LBTT return and the full payment is received no later than the return filing date.

This submission notice can be printed by selecting the ‘Print this confirmation’ link at the bottom of the page. You can also send a secure message from the submission page. Clicking the ‘send secure message’ button will create a secure message and automatically populate the return reference.

You can then select ‘Go back to dashboard’ to go back to your dashboard.

A summary of the return details will be displayed on your dashboard. At any time you will be able to view or download and print a copy of the return. You will also be able to amend the return if within 12 months of the filing date see General guidance about the LBTT return for further information.