LBTT4016 - Application to defer payment of LBTT

An application to defer payment of LBTT should be made by completing the Revenue Scotland Deferral Application Form.

The relevant legislation can be found at Section 41 LBTT(S)A and The Land and Buildings Transaction Tax (Administration) (Scotland) Regulations 2014 (legislation.gov.uk).

Overview

A buyer can make an application to Revenue Scotland to defer all or part of the LBTT payable on a land transaction.

An application to defer the LBTT payable on a transaction may be made by the buyer where the amount of tax payable:

- depends on chargeable consideration that is contingent or uncertain at the effective date of the transaction, and

- becomes payable or may become payable more than 6 months after the effective date of the transaction.

A deferral application does not affect the buyer’s obligations regarding the payment of tax on any consideration that has already been paid or provided when the application is made or is not contingent and whose amount is ascertained or ascertainable at the time the application is made.

You must calculate the tax liability using the total consideration. The amount to be paid on each return will then be calculated by reference to this total tax liability and an apportioned approach applied. The example at the bottom of this page shows how this works in practice.

Payment of LBTT in respect of deferred consideration cannot be postponed.

A deferral will not be available:

- where the consideration consists of rent,

- where the contingent or uncertain amount is payable within 6 months of the effective date,

- where consideration is ascertainable.

Where an application for deferral is approved, a buyer is still required to make a return to Revenue Scotland. A further return will be required when the amount deferred becomes due and payable.

Content of the Application to Defer Payment of Tax

The application must set out:

- the transaction reference number (if return submitted);

- the effective date of the transaction;

- the identity of the buyer;

- the buyer’s correspondence address;

- the location of the land involved;

- the certain chargeable consideration;

- the amount of consideration for which deferment is sought;

- a reasoned opinion as when this part of the consideration will cease to be contingent or can be ascertained;

- the total chargeable consideration;

- a calculation of the amount of LBTT due on the total chargeable consideration;

- a calculation of the LBTT payable in respect of which the application to defer payment refers. (Please see the example below for guidance on calculating deferred tax);

- the nature of the contingency/uncertain payment(s); and

- as much detail of the times of expected payments as it is possible to give.

Revenue Scotland may require further information to consider the application. If the information is not provided, Revenue Scotland may refuse the application.

Acceptance of an Application to Defer Payment of LBTT

If an application to defer payment of LBTT is accepted, the notice of acceptance will set out the terms of acceptance and specify, in particular:

- the amount of tax payable in accordance with the initial land transaction return; and

- the nature and dates of any relevant event (see below).

‘Relevant event’ in this context means an event on the occurrence of which the whole or any part of the consideration to which an application relates will either cease to be contingent or become certain.

Following acceptance of an application to defer payment of LBTT, you must include the deferral reference number on the LBTT return (and any future return in relation to the transaction). If a return has already been submitted, you must amend the return to include the reference number.

This is done on the following page of the return:

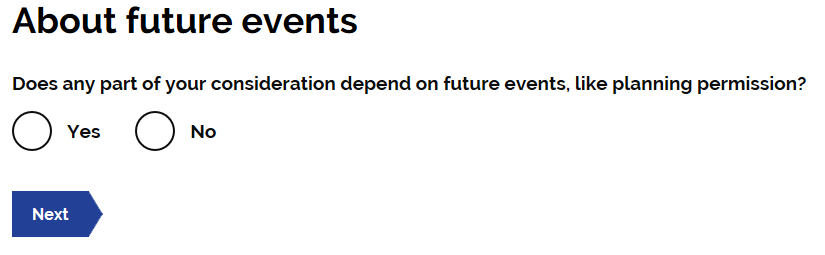

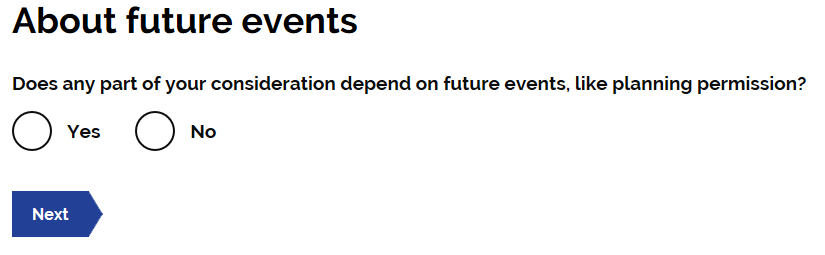

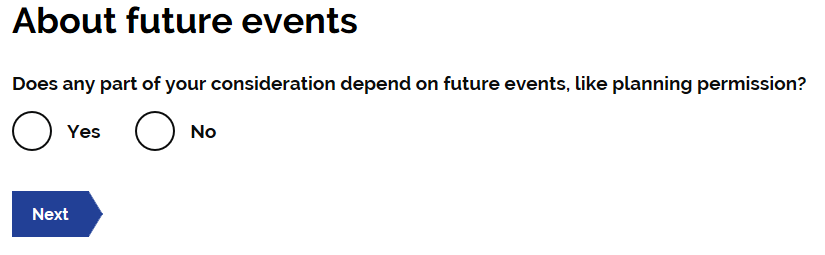

When asked ‘Does any part of your consideration depend on future events, like planning permission?’ please select ‘yes’. You will then be asked ‘Have you applied to pay on a deferred basis?’. Please select yes and input the deferral reference.

Any further return must be submitted within 30 days of any event becoming certain or known and tax paid at the same time.

Refusal of an Application to Defer Payment of LBTT

We may refuse an application for deferral of payment in the following circumstances:

- whole or some part of the chargeable consideration is not contingent or uncertain;

- the consideration is not payable more than 6 months after the effective date of the transaction;

- the application is not submitted in the correct form required, or does not contain the required information;

- the application, or information provided in connection with it, is incorrect;

- the application is missing relevant information and such information is not provided to the tax authority by a specified date as requested; or

- the transaction involves artificial tax avoidance arrangements as defined in Part 5 of the RSTPA 2014 – see RSTP8001).

If we refuse the application we must notify the buyer, setting out the grounds for the refusal and the amount of tax due in consequence of our refusal. The refusal notice is treated as an assessment of tax on which interest accrues from the date of issue of the notice until payment of the tax is made.

The buyer has a right to request a review of decision to refuse the application. The buyer also has a statutory right of appeal to The Scottish Tribunals which may be exercised if a review is not requested or you are not satisfied with the outcome of a review.

On appeal to the tribunal, the deferred tax is still due and payable but we will postpone the collection of the disputed deferral amount until the appeal is settled.

Initial Return

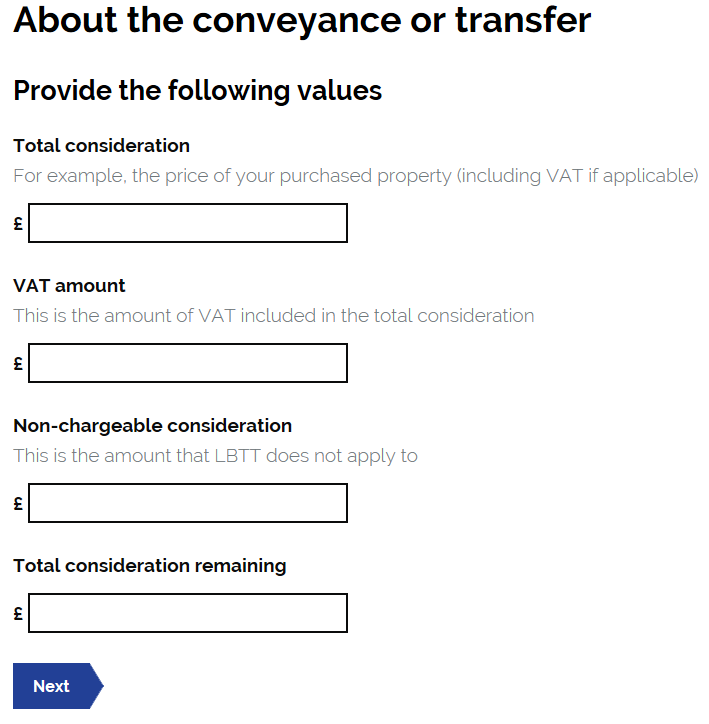

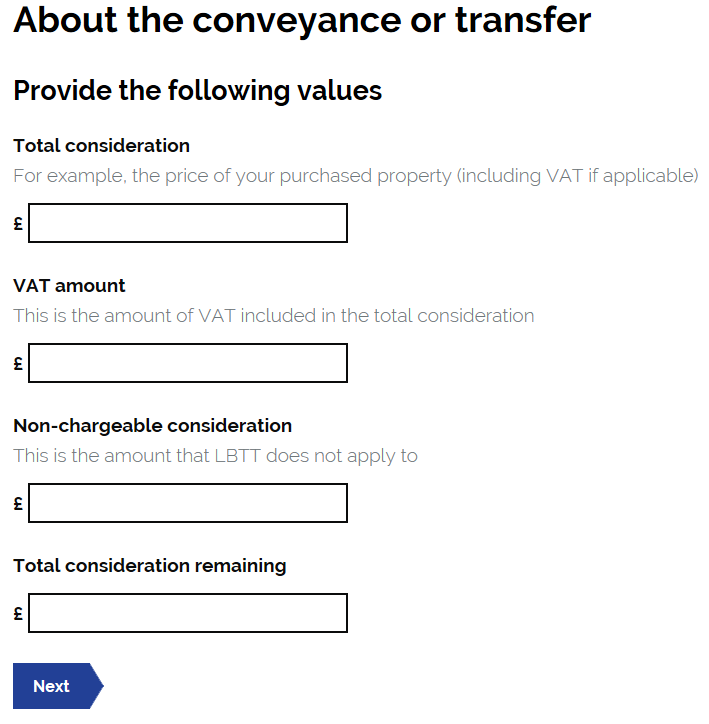

On the initial return, the ‘total consideration’ should include both the contingent and non-contingent elements, regardless of whether part of this consideration is subject to a deferral.

When asked ‘Does any part of your consideration depend on future events, like planning permission?’ please select ‘yes’. You will then be asked ‘Have you applied to pay on a deferred basis?’. Please select yes and input the deferral reference if you have one.

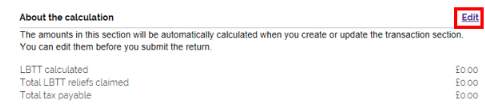

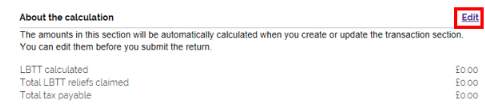

You must then amend the ‘total tax payable’ under the ‘About the calculation’ section of the return to include only the amount to be paid now and not to include the deferred amount of tax.

Further Returns

When the consideration ceases to be contingent or can be ascertained and the deferred amount of tax becomes due and payable, a further return is required.

In this further return, the ‘total consideration’ should still reflect the total consideration from the initial return, which includes all consideration.

When asked if there are any linked transactions, you must click ‘yes’ and include the return reference for the original return, alongside the consideration shown in that return. Guidance on linked transactions can be found at LBTT2008.

You must then amend the ‘total tax payable’ under the ‘About the calculation’ section of the return to include only the amount to be paid now (the deferred amount of tax).

Example:

- A developer purchases land for an initial consideration of £350,000.

- The buyer and seller agree additional consideration of £50,000 for each set of 50 houses for which planning permission is granted within the 2 years following the effective date.

- The buyer expects to obtain permission for 200 houses.

- The contingent consideration in the transaction is £200,000 (4 x £50,000). This is contingent on planning permission for the 200 houses being granted. This can remain contingent for a period of 2 years.

- A deferral application can be made for this transaction.

- LBTT is due on the initial consideration of £350,000. The normal rules apply to the initial consideration. An LBTT return and payment of tax is required no later than 30 days after the effective date of the transaction. However, on this return, the total consideration of £550,000 (£350,000 + £200,000) should be shown on the return in the ‘total consideration’ field.

- The amount of tax to pay should be based on this total consideration of £550,000 and then applying a fraction to this amount. A breakdown is provided below. The tax liability should not be calculated separately for each amount as this will result in a lower amount of tax to pay and penalties may apply.

- The total tax payable should then be amended to show only the tax payable on the initial consideration of £350,000.

- Following acceptance of an application to defer payment of LBTT, you must include the deferral reference number on the LBTT return (and any future return in relation to the transaction). If a return has already been submitted, you must amend the return to include the reference number.

- The buyer subsequently obtains planning permission for 200 houses, 1 year after the effective date. The buyer must then make a further LBTT return within 30 days of the consideration ceasing to be contingent.

- This return should show the total consideration of £550,000 (£350,000 + £200,000) in the ‘total consideration’ field, as the first return did. The total tax payable in the 'about the calculation' section should then be amended to show only the tax payable on the additional consideration of £200,000.

- This return should be linked to the first return as a linked transaction.

Non-Contingent (i.e. certain) Consideration - £350,000

Contingent Consideration - £200,000

Total Consideration (Non-Contingent + Contingent Consideration) = £550,000

Tax on Total Consideration (calculated using the relevant tax rates and bands for non-residential transactions in force at the effective date of the transaction) - £16,000

LBTT on Non-Contingent Consideration

(Certain Consideration / Total Consideration) x Tax on Total Consideration

(350,000 / 550,000) x 16,000 = £10,182

LBTT on Contingent Consideration

(Contingent Consideration / Total Consideration) x Tax on Total Consideration

(200,000 / 550,000) x 16,000 = £5,818

These are the amounts that should be used on each respective return.